Reopening Issues Remain A Big Factor Driving Inflation In November – OpEd

By Dean Baker

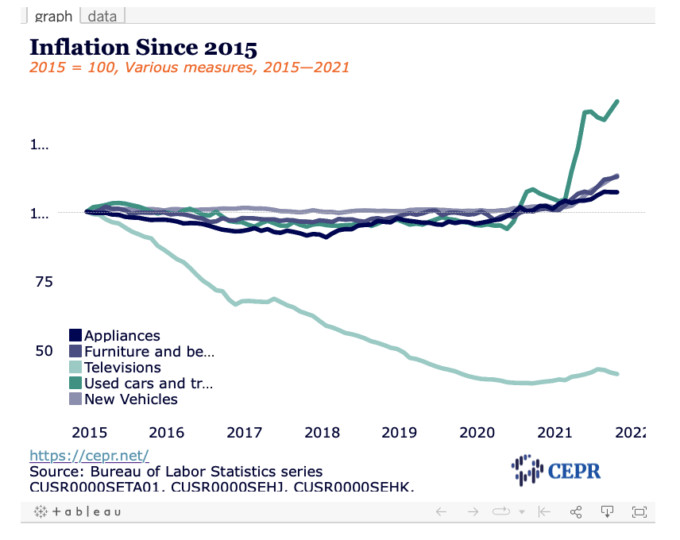

Overall, reopening issues are still a big factor in inflation. Energy prices in the CPI are lagging world prices, and are almost certain to be sharply negative (lowering inflation) in December.

Cars are still a huge factor driving inflation. Factories are getting back up to speed, but it may be a few more months before this pushes prices back down.

Supply chain issues may persist, but demand is likely to wane for big ticket items which people don’t buy every month. TV prices have fallen sharply in the last three months, appliance prices (which do not include TVs) are down slightly in the last two months. It seems likely that monthly inflation (not year-over-year) will be sharply lower in December and future months.

+ The overall Consumer Price Index (CPI) was up 0.8 percent in November, the core was up 0.5 percent. The overall was up 6.8 percent year-over-year, and the core up 4.9 percent.

+ Gas prices were up 6.1 percent in November, 58.1 percent year-over-year. Prices are not yet reflecting recent declines in world oil prices.

+ New car prices went up another 1.1 percent in November, and 11.1 percent year-over-year. Used car prices were up 2.5 percent, and 31.4 percent year-over-year.

+ The increase in new car prices added 0.04 percentage points to the overall inflation rate in November, and 0.05 percentage points to the core rate. The rise in used car prices added 0.08 percentage points to overall inflation and 0.11 percentage points to core inflation.

+ Food at home prices were up 0.8 percent in November and 6.4 percent year-over-year. Restaurant prices were up 0.6 percent in November and 5.8 percent year-over-year. Clearly, higher pay in restaurants is not driving prices.

+ Rent and owners equivalent rent were both up 0.4 percent in November, and up 3.0 percent and 3.5 percent year-over-year, respectively. This is roughly the pre-pandemic rate of inflation.

+ Rents continue to diverge with high-priced areas showing lower growth and low-priced areas seeing rapid rises. In NYC, rents are down 0.1 percent year-over-year, and in San Francisco 0.5 percent. In Boston, rents are up 1.1 percent, and in DC 0.2 percent. By contrast, Detroit rents were up 5.8 percent, along with Atlanta at 7.5 percent, and St. Louis at 4.8 percent.

+ The medical care index was up 0.2 percent in November, and 1.7 percent year-over-year.

+ The education index was up 0.2 percent in November, and up 2.1percent year-over-year.

+ Toy prices rose 1.4 percent in November, but up just 1.2 percent year-over-year. (Happy Holidays)

+ Television prices fell 1.4 percent in November for the third straight month of rapid decline after rising rapidly from March to August.

+ Airfares were up 4.7 percent in November, but still down 3.7 percent year-over-year.

+ It is worth noting the 5.0 percent year-over-year rise in apparel prices reverses a 5.1 percent year-over-year decline from November 2019 to November 2020.

This first appeared on Dean Baker’s Beat the Press blog.