The US Reliance On Other Countries For Essential Medical Equipment – Analysis

By VoxEU.org

The COVID-19 pandemic is creating a massive shortage of medical equipment. To face the health crisis, the US needs to increase its supply of protective equipment, and equipment needed to treat infected patients. This column studies the extent to which the US relies on other countries to supply its demand for critical medical goods. Given its heavy reliance on other countries also affected by COVID-19, the US might need to urgently design policies to boost its production of these goods.

By Fernando Leibovici, Ana Maria Santacreu and Makenzie Peake*

The ongoing COVID-19 pandemic is leading to a massive shortage of key medical equipment in the US. The surge in the number of infections that require hospitalisation is leading to an excess demand for protective personal equipment—such as masks, gowns and gloves—necessary to protect medical personnel from contagion.

Moreover, the increasing number of COVID-19 patients requiring intensive care has significantly increased the demand for respirators and other equipment used to treat infected patients in critical conditions. As a result, the US urgently needs to increase its supply of such key medical equipment to combat the COVID-19 pandemic. In this article, we study the extent to which the US typically relies on other countries to supply its demand for these critical medical goods.

Relying on other countries for the supply of these goods might be good, insofar as the US can purchase them in large amounts, but it may be a problem when these countries are also currently affected by COVID-19 and thus without excess capacity to produce and ship these goods.

We document that the US relies heavily on other countries also affected by COVID-19 to fulfil its supply of key medical equipment required to combat the pandemic. This suggests that the US might need to urgently design policies to boost its production of these goods.

US dependence on foreign medical equipment

We start by collecting data on US imports and exports of medical products needed to treat COVID-19 from UN COMTRADE for years 2012 to 2018.1 Each product is reported as a six-digit code using the Harmonized System (HS) classification of 2012.

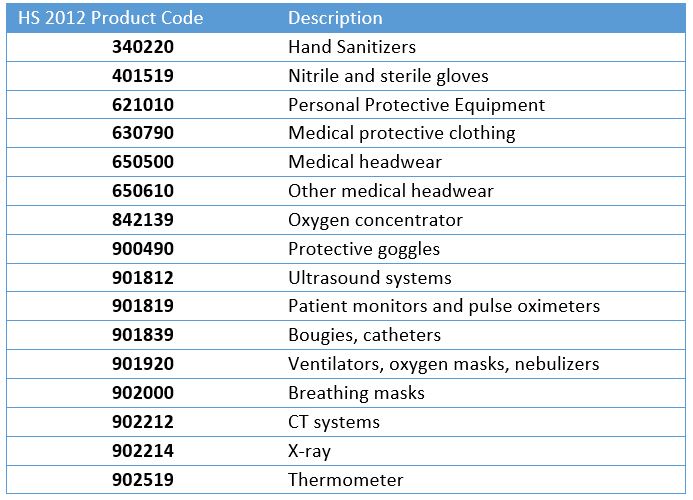

Table 1 reports the list of medical product codes that we focus on, and their description. These products include protective medical equipment—such as sterile gloves, medical protective clothing, protective goggles and masks—as well as equipment needed to treat infected patients such as ventilators, oxygen masks and breathing masks.

Table 1 Medical product codes

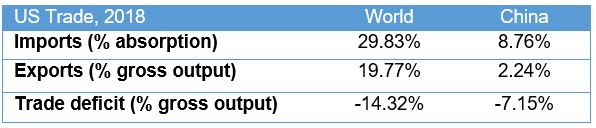

In table 2, we show that US imports of medical equipment represent roughly 30% of total domestic demand (i.e., absorption) for these products. Exports, in turn, are only 20% of total gross output.

Table 2 US trade of medical equipment

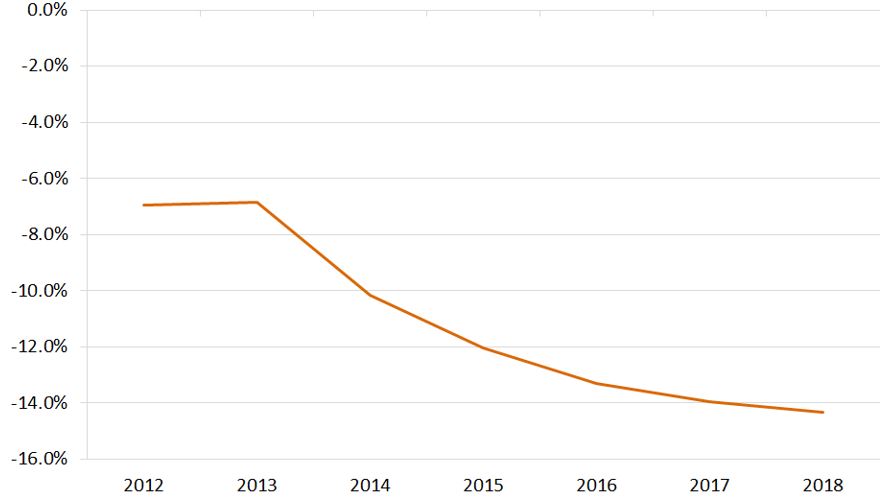

Figure 1 shows that the reliance on foreign countries to supply medical equipment, computed as net exports over gross output, has been increasing over time: in 2012, the U.S. trade deficit of medical equipment was roughly 7%, by 2018, it had increased to approximately 14%.

This increased reliance is proving to be a challenge for the US, as it is in the middle of a global pandemic and other countries might currently be reluctant or even unable to export equipment that they need to fight COVID-19 domestically.

Figure 1 US trade deficit in medical equipment, percentage of gross output

Primary foreign suppliers of US medical equipment

In 2018, the US imported over $29 billion in medical equipment. The main source of these goods was China, which supplied about 28% of those products. The second most important source was the European Union, accounting for 18% of total imports.

Countries in the European Union are in the midst of fighting COVID-19, thus likely preventing the US from relying on this source to boost its imports of medical goods. Indeed, as the Peterson Institute has documented, the European Union has imposed export restrictions on key medical equipment (Bown 2020).

China has mostly recovered and has indeed started to export these products again, but its supply is still limited. The US is also competing for China’s products with other countries facing the COVID-19 crisis.

Conclusion

These findings show that the US relies heavily on other countries to supply its demand for medical equipment that is crucial to fight COVID-19. Boosting imports of these goods might not be feasible since the key sources—China and the European Union—are either in the midst of fighting their own outbreaks of COVID-19 (European Union) or already overstretched supplying these goods to other countries (China). Therefore, policies aimed at increasing domestic production of medical equipment in the US are of critical importance to fight COVID-19.

This column originally appeared April 8 on the St. Louis Fed’s On the Economy blog: How Much Does the U.S. Rely on Other Countries for Essential Medical Equipment?

*About the authors:

- Fernando Leibovici,Economist, Federal Reserve Bank of St Louis

- Ana Maria Santacreu, Senior Economist, Federal Reserve Bank of St Louis

- Makenzie Peake, Research Associate, Federal Reserve Bank of St Louis

References

Bown, C (2020), “EU limits on medical gear exports put poor countries and Europeans at risk,” Peterson Institute for International Economics Trade and Investment Policy Watch, 19 March 2020.

Pierce, J and P Schott (2009), “A Concordance Between Ten-Digit U.S. Harmonized System Codes and SIC/NAICS Product Classes and Industries,” NBER Working Paper No. 15548, November 2009

Endnotes

1 Domestic demand is computed using data from the Bureau of Economic Analysis for domestic production of medical equipment. Industries representing medical equipment are classified according to NAICS and correspond to industries 339112 and 339113, which contain “Surgical and Medical Instrument Manufacturing.” Even though these industries are very aggregated, we can use them as a good approximation for medical equipment captured in the HS-six-digit products we use for trade. (See Pierce and Schott (2009) for the concordance between NAICS industries and HS products.) Domestic absorption is calculated as gross output minus exports plus imports.