Booming US Growth In Question – Analysis

Economists warn that the US tax cuts, heavy spending along with an aging population and infrastructure pose recession risks.

By David Dapice*

According to US President Donald Trump, the second quarter US GDP growth figure of 4.1 percent rising from the previous quarter’s 2.2 percent is just the beginning of good times. From now on the US economy can only improve. However, the reality is more sobering, suggest most economists, including those of the non-partisan US Congressional Budget Office.

Most estimates put the nation’s 2018 GDP growth at about 3 percent, reflecting tax cuts and spending increases of the Republican-controlled government. The tax cut will raise debt by $1.9 trillion in 2018-2028 after taking account of the economic growth caused by large and permanent corporate tax cuts and smaller and temporary personal tax cuts. Separately, US federal spending increased by more than $200 billion. Most projections suggest this stimulus effect fades in 2019 with long-run GDP growth trending just under 2 percent per year. However, Trump suggested that 4 percent growth was more of a floor than a ceiling, and his supporters insist 3 percent growth is sustainable over time.

A deeper dive into the numbers suggest a combination of slower population growth, limited immigration, sparse unused capacity and full employment will produce a declining trend, even without a trade war’s negative impacts.

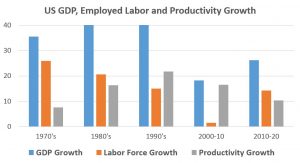

GDP growth can come from more workers or more productivity per worker. Since 1970, the rate of the US employed labor force growth for each decade up to 2010 has slowed as the post–World War II baby boom ran its course. The employed labor force grew 25 percent in the 1970s, accounting for most of that decade’s 35 percent growth. In the 1980s and 1990s, labor force growth slowed to 15 to 20 percent per decade while GDP growth grew 40 percent each decade. Assuming 3 percent GDP growth in fiscal years 2018-19 and 2019-20, and employment gains similar to the past year, the current decade would have 26 percent growth in GDP and 14.5 percent growth in employment.

Productivity growth since 1970 was normally 10 to 20 percent per decade. If productivity grew 20 percent over the next decade, a very favorable guess, and employment grew 5 percent, the rate of adult population growth, average GDP growth would be about 2.5 percent per year.

The prospect of more labor than currently expected is unlikely. The participation rate is the share of the working age population that is working. This ratio changed slowly from 60 percent to as high as 67 percent from 1970 to 2018. US labor participation is currently 63 percent and might increase if real wages rise, government benefits like Social Security or Medicare are cut, or if child care becomes less expensive and easier to get. With real wages falling under Trump, the participation rate may not rise.

It is common for GDP to grow strongly coming out of a recession with high unemployment and lots of unused capacity in factories. It is rare for GDP to sustain rapid growth from full employment – around 4 percent unemployment, which is where the US economy is now. In fact, since 1970, there has never been a sustained period of full employment at all. Those projecting a sustained period of full unemployment and strong growth have no historical peacetime basis for their expectations.

The US economy can expect many productivity-impeding problems. Infrastructure gets a D+ from the American Society of Civil Engineers, and the Congress has a demonstrated preference for tax cuts rather than fixing roads and bridges. Better qualified workers are one source of productivity, but students are not pursuing more education as student debt soars. Healthy workers are also more productive, and attempts to destroy the Affordable Care Act and make health insurance unaffordable or cheap due to paltry coverage for tens of millions of workers is not a pro-growth policy. Trade has historically allowed economies of scale and higher productivity, but a trade war would run this in reverse, raising prices for many inputs and stranding trillions of dollars in capital assets made under the assumption of a stable trade policy. Investments raise productivity, but this requires macroeconomic stability.

Expansionary fiscal policy at full employment is madness – and will lead to the Federal Reserve raising interest rates, a strengthening dollar and reduction of exports in the most productive sectors. In short, the current macroeconomic policy mix is anti-growth in most significant ways. Arguments that giving corporations and wealthy individuals an even greater share of the after-tax pie will boost US growth are unpersuasive. Income inequality is causing political instability, not leading to increased investment.

The one policy that might help GDP growth, at some cost, is deregulation. Trump administration economists argue that deregulation will add 0.8 percent a year to GDP. This estimate, on the high side of reasonable estimates, conflicts with analysis suggesting that deregulation thus far has had little impact, and ignores health and safety concerns.

The non-partisan Congressional Budget Office projects GDP growth of about 3 percent this year and next, 2 percent in 2020 and 1.5 percent to 1.8 percent on out to 2028. The labor force grows only 5 percent a decade, much less than the 15 to 20 percent of the 1980s and 1990s. Notable in these projections is the lack of any recession, even though the current expansion started in 2009, interest rates are rising, and the federal deficit is high and growing. A recession would further reduce tax revenues and could result in spending cutbacks exactly when the government should try to invest to stabilize the economy. That fiscal space has been used up by tax cuts, curtailing the ability of future governments to respond to economic weakness. This would cause GDP growth to be more stop-and-go, making it harder to invest for the long term. In short, there is a conservative critique that the Congressional Budget Office has taken a plausible “median” projection rather than try to anticipate the real risks that current policy has created. Of course, the Congressional Budget Office has been under attack for not being optimistic, so the current projections may reflect a desire to avoid worst-case scenarios. Indeed, with the UK, China, Russia, Turkey, Japan and other economies facing challenges, a US recession could help trigger a larger international downturn.

For the economy to sustain 3 percent GDP growth with slow workforce growth is not just unlikely – it is unprecedented. Productivity would have to grow much more quickly than it has during the past half century. Of course, new energy or artificial intelligence technologies might allow this, but current budget priorities and pro-coal policies work against these possibilities as tax cuts leave little for R&D or training. Higher levels of migration are unlikely, though that could increase both skills and workforce growth. Trade barriers will reduce economies of scale. Higher interest rates will depress investment. Budget stringency will mean inferior infrastructure. Expensive child care will continue to depress birthrates below replacement – a typical mother now has two or fewer children. Unless or until policies support rather than retard growth, a recession and growth below 2 percent a year are much more likely than the US economy approaching, much less exceeding, 3 percent a year over any extended period.

More generally, the US fiscal outlook before the tax cuts and spending increases was already poor due to an aging population. Both Social Security and Medicare, as well as other transfer programs, require bipartisan attention. The partisan fiscal policy has diminished Democrats’ willingness to cooperate and solve problems that now loom even larger and will be harder to solve. With rising interest rates, high corporate debt, possible trade wars and Washington gridlock, a recession becomes more likely, notwithstanding boastful tweets by the president.

*David Dapice is the economist of the Vietnam and Myanmar Program at Harvard University’s Kennedy School of Government.