Credit Shrinkage Of Residents And Private Enterprises Further Curbs Demand In China – Analysis

By Anbound

By Wei Hongxu*

The latest data released by the People’s Bank of China (PBoC) shows that at the end of October, the balance of broad money (M2) was RMB 261.29 trillion, an increase of 11.8% year-on-year. The growth rate was 0.3 percentage points lower than the end of the previous month and 3.1 percentage points higher than the same period of the previous year.

The balance of narrow money (M1) was RMB 66.21 trillion, a year-on-year increase of 5.8%. The growth rate was 0.6 percentage points lower than the end of the previous month and 3 percentage points higher than the same period of the previous year. The data also shows that the stock of social financing scale at the end of October 2022 was RMB 341.42 trillion, a year-on-year increase of 10.3%, a drop from September. Both monetary and social financing growth rates have declined, and that is not exactly good news for stable growth. According to the researchers at ANBOUND, the decline in the growth rate of social finance and currency further signifies that the credit contraction of household consumption and private enterprises has led to increasingly prominent problems on the demand side in China.

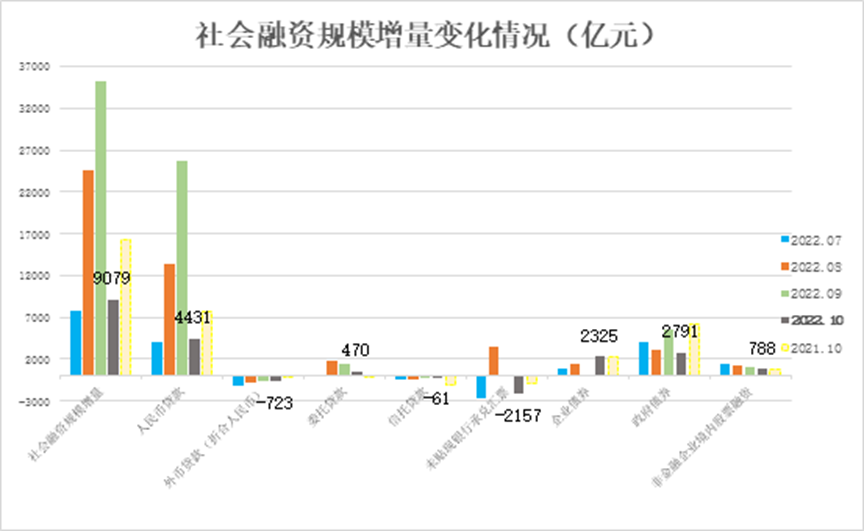

Figure: Incremental Changes in Social Financing Scale (in RMB 100 million)

Judging from the growth rate of social financing and M2, the difference between the year-on-year growth rate of these two at the end of October remained at 1.5 percentage points, which was consistent with the previous period, indicating that the expansion rate of social financing was still weaker than that of monetary expansion. This also signifies that there is a persistent misalignment of credit demand and monetary easing while there are still obstacles from monetary to credit expansions. In the process of gradually reducing interest rates, this gap not only reflects the distortion of the transmission mechanism such as the idling of funds in the financial market but also shows the credit contraction caused by the sluggish financing demand.

In terms of new credit, renminbi loans increased by RMB 615.2 billion in October, a year-on-year decrease of RMB 211 billion. This was affected by factors such as the high base last year. On the other hand, the sluggish growth of loans to the household sector obviously dragged down credit growth. From the perspective of the residential sector, short-term loans decreased by RMB 51.2 billion, and residents’ willingness to consume continued to be weak. Medium and long-term loans increased by only RMB 33.2 billion, a sharp decrease of RMB 388.9 billion year-on-year, which means that the consumption and real estate markets that affect demand remain weak. In terms of loans to enterprises and institutions, the medium and long-term loans amounted to RMB 462.3 billion, an increase of RMB 243.3 billion year-on-year, indicating that the credit structure of enterprises and institutions continued to improve. The increase in medium and long-term loans is mainly due to the successive implementation of policies to stabilize the economy. Since the beginning of this year, the seasonal effect of the scale of new credit has been obvious, which also shows the effect of policy stimulus. This has offset the impact of private enterprise credit contraction to a certain extent and has overdrawn the potential of future credit growth.

Meanwhile, the increase in social financing scale in October was RMB 907.9 billion, which was RMB 709.7 billion less than the same period last year. Among them, loans issued to the real economy increased by RMB 443.1 billion, a decrease of RMB 332.1 billion year-on-year. This is not only a decrease from the same period last year but also a sharp drop from the RMB 3.5 trillion increase in September this year, similar to the great drop that happened in July. This seasonal fluctuation clearly demonstrates the role of policy stimulus in promoting social financing and credit growth in Q3. The sharp decline in social financing increment in October means that the endogenous financing demand of market players is still weak, and the overall economic recovery remains unstable, causing insufficient impetus for economic growth. The growth of social financing reflects more of the growth of government infrastructure investment and state-owned enterprise investment, as well as the effect of macro policies. The situation of small and medium-sized enterprises and private enterprises shows that their credit demand has not yet fully recovered.

The problem of insufficient recovery of residents’ consumption and limited credit expansion has already appeared in Q3. The Q3 leverage ratio report for the year 2022 recently released by the National Institute of Finance and Development (NIFD) shows that in the Q3 of 2022, China’s macro leverage ratio ended the trend of rapid growth, rising by 9.3 percentage points in the first half of the year. rose only 0.8 percentage points. Among them, changes in residents’ leverage can still indicate the reality of insufficient growth in overall demand. The Q3 leverage ratio of residents increased slightly from 62.3% at the end of Q2 to 62.4%. This fluctuated slightly at the level of 62% for nine consecutive quarters, The total increase in the first three quarters was 0.2 percentage points. However, deducting operating loans according to the principle of substantiveness, the resident leverage ratio at the end of Q3 should be 46.9%, which has declined for seven consecutive quarters starting from the first quarter of 2021. The report pointed out that at the end of Q3, the growth rate of residential loans fell from 8.1% in Q2 to 7.2%, the lowest value since the beginning of this century. The stock growth of short-term consumer loans and housing loans was only 2.1% and 5.0% respectively. From 38% at the end of 2016 to 5% in 2022, the decline in the growth rate of housing loans is the main reason for dragging down the leverage ratio of residents. Among all investments, non-state-owned enterprises suffered the most serious downturn. In the first three quarters, the year-on-year growth rate of private enterprise investment was only 3.4%, and the year-on-year growth rate of investment by other limited liability enterprises was only 4.3%, which was far lower than that of state-owned enterprises.

Researchers at ANBOUND pointed out that the slowdown in the growth of residents’ income and the increase in uncertainties brought about by the COVID-19 outbreaks have led to a continuous decline in the growth rate of consumer demand. The continuous decline of personal credit has also caused an insufficient increase in social financing. For private enterprises, various uncertain factors such as the pandemic have made corporate investment increasingly conservative and reduced financing needs. It should be pointed out that both the residential sector and the private enterprise sector have begun to take the initiative to “shrink the balance sheet”. The Q3 leverage ratio report showed that in the past two years, there have been signs of “balance sheet recession” in both the residential and non-financial corporate sectors. Although the cost of financing has dropped, the willingness to actively raise funds is not strong. Therefore, whether it is consumption or investment, stabilizing the demand will be the main challenge for China in the coming period.

Final analysis conclusion:

Actual changes in October indicate that the sharp decline in China’s monetary and social financing increments reflects that after the implementation of various policies, the credit contraction of residents and private enterprises caused by unstable expectations is still obvious. Inadequate overall demand leads to insufficient endogenous drivers for economic growth, and these are the main contradictions that the country needs to resolve to maintain steady growth.

Wei Hongxu is a researcher at ANBOUND