US Semiconductor Export Curb On China Is Bearing Fruit – Analysis

By Observer Research Foundation

By Seema Sirohi

As the US-China competition gets sharper, President Joe Biden’s decision to impose sweeping controls on the sale of semiconductors to China has brought the first taste of success—the world’s largest microchip manufacturer is raising its investment to US$40 billion in the United States (US).

The Taiwan Semiconductor Manufacturing Company (TSMC) announced last week that it was upping its investment in Arizona from US$12 billion to US$40 billion and building a second chip plant in the state. Biden was in Phoenix to relish the moment. “American manufacturing is back, folks,” he exulted.

The US was a major semiconductor producer in the 1990s, making 37 percent of the world’s chips but today its share is only about 12 percent. TSMC’s move to more than triple its investment in the US will go a long way to satisfy US domestic demand in both the civilian and military sectors while building a strong supply chain which is less dependent on unreliable foreign partners.

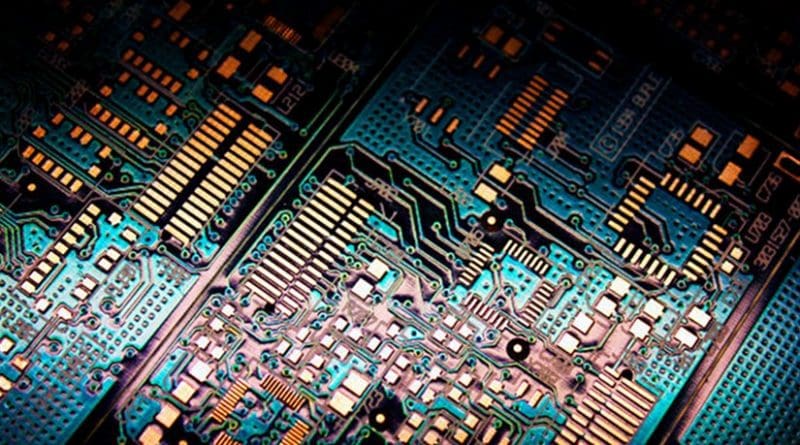

Semiconductors are critical in an array of products ranging from cars, medical equipment, and consumer electronics to weapon systems. Expensive to make, they are some of the most intricate pieces of technology requiring pristine conditions.

Chip shortages in the US sparked by supply-chain disruptions caused by the pandemic highlighted a dependence on foreign chip makers that US officials saw as a major national security issue. The White House’s brain trust of China experts grew even more determined to institute policies to reduce that dependence.

The new TSMC fabrication plant is expected to start the production of 4-nanometer chips by 2024 and 3-nanometer chips by 2026. Apple CEO, Tim Cook—often accused of using cheap Chinese labour to make his high-end products—was with Biden to show support for the larger policy shift underway.

Biden framed his comments in the context of “allies and partners” who are “building alongside us as well”. The US is determinedly decoupling from China, and at the same time, attempting to contain it. Things came out of the closet the moment Washington announced its broad new measures against China in October.

The time between the announcement and TSMC’s enthusiastic response was barely two months. Under the Commerce Department’s new rules, China can’t ‘buy American’ in a manner of speaking. Top-end semiconductors, the machines to build them and the US talent to use them were all put out of China’s reach.

Aimed at strangling China’s high-tech industry, the new controls also made clear that access and denial of high technology would be the defining element of geopolitics for the foreseeable future. And there is no dispute between Democrats and Republicans on hobbling China’s rise even if they agree on little else these days.

One might say it took a while for Washington to understand that its technological edge was slipping away as China made substantial progress in artificial intelligence, chip manufacturing, and quantum computing by investing in R&D, luring talent from abroad and by forcing US corporations to share technology as a price of operating in China.

But like all good things, it is coming to an end with the American political class waking up to the harsh reality. Whether other key global players join the US remains a question but for now, Washington has made its intentions clear—foundational technologies are a matter of national security.

Putting muscle into the idea, Biden’s signed the landmark CHIPS and Science Act of 2022 into law in August which mandates spending US$52.7 billion over the next five years in grants, loans, tax credits for capital expenditure, and other incentives to encourage semiconductor manufacturing.

Between the Commerce Department’s stringent restrictions and the CHIPS Act, the Biden administration wants to freeze China’s capabilities in place—14-nanometer chips which Beijing currently is capable of producing—by forbidding the export of equipment capable of making anything smaller.

As National Security Advisor Jake Sullivan stated clearly in a speech in September, the US was reassessing its old philosophy of staying only a couple of generations ahead. “This is not the strategic environment we are in today. Given the foundational nature of certain technologies, such as advanced logic and memory chips, we must maintain as large of a lead as possible.”

The lead will materialise in the shape of 3-nanometer chips as TSMC rolls them out at its new Arizona plant. For those watching the US-China tech war play out, it’s clear who is in the lead in near and medium term.