Oman Energy Profile: Largest Non-OPEC Oil And Natural Gas Producer In Middle East – Analysis

By EIA

Located on the Arabian Peninsula, Oman’s proximity to the Arabian Sea, Gulf of Oman, and Persian Gulf grants it access to some of the most important energy corridors in the world, enhancing Oman’s position in the global energy supply chain (Figure 1). Oman plans to capitalize on this strategic location by constructing a world-class oil refining and storage complex near Duqm, Oman, which lies outside the Strait of Hormuz (an important oil transit chokepoint).

Like many countries in the Middle East, Oman is highly dependent on its hydrocarbons sector. In 2014, Oman’s hydrocarbons sector accounted for 84% of government revenues and 47% of Oman’s gross domestic product, according to the Central Bank of Oman.1 Oman’s fiscal breakeven price for oil in 2014 was $108 per barrel, according to the International Monetary Fund (IMF).2 The IMF projected a fiscal deficit for Oman of almost 15% in 2015 and urged Oman to begin fiscal reforms to mitigate the financial stress on the country.

Petroleum and other liquid fuels

Oman’s petroleum and other liquids production exceeded 1 million barrels per day in June 2015 for the first time since December 2000.

Sector organization

The Ministry of Oil and Gas coordinates the government’s role in the Omani hydrocarbon sectors. Final approval on policy and investment; however, rests with the Sultan of Oman. Petroleum Development Oman (PDO) holds most of Oman’s oil reserves and is responsible for more than 70% of its crude oil production, according to PDO.3 In addition to the government’s 60% ownership stake in PDO, Shell (34%), Total (4%), and Portugal’s Partex (2%) also own stakes in PDO.4 The Oman Oil Company (OOC) is responsible for energy investments both inside and outside Oman and is fully owned by the government. The Oman Oil Refineries and Petroleum Industries Company (ORPIC) controls the country’s refining sector and owns both of Oman’s operating refineries.

Reserves

According to the Oil & Gas Journal, Oman had 5.3 billion barrels of estimated proved oil reserves as of January 2016, ranking Oman as the 7th largest proved oil reserve holder in the Middle East and the 22nd largest in the world.5 A report published by the U.S. Geological Survey in 2012 stated that the estimated mean undiscovered energy resources in the South Oman Salt Basin—located in the southern part of the country—totaled more than 370 million barrels of oil, 315 billion cubic feet (Bcf) of natural gas, and more than 40 million barrels of natural gas liquids (NGL).6 With rising production levels, a growing petrochemical sector—which relies on liquefied petroleum gases (LPG) and NGL—and additional potential resources, the country is unlikely to significantly alter its dependence on hydrocarbons in the short term.

Exploration and production

Enhanced oil recovery techniques helped Oman’s oil production rebound from a multi-year decline in the early 2000s.

Occidental Petroleum has the largest presence of any foreign firm in Oman. Other major players with interests in Oman include Shell, Total, Partex, BP, CNPC, KoGas, and Repsol.7 By the end of 2013, there were exploration and production activities in all 31 of Oman’s exploration blocks, according to the Ministry of Oil and Gas.8 Nearly all of Oman’s oil production comes from the Oman Basin, which spans most of the country (Figure 2).

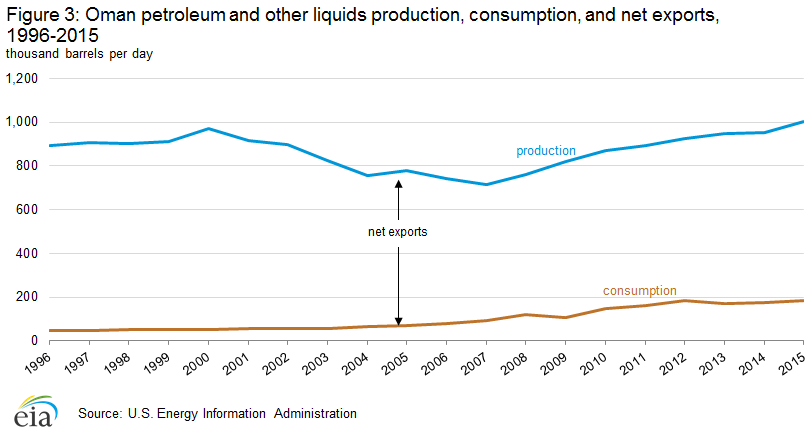

Oman’s petroleum and other liquids (total oil) production ranks 7th in the Middle East and ranks among the top 25 oil producers in the world. Oman is the largest oil producer in the Middle East that is not a member of the Organization of the Petroleum Exporting Countries (OPEC). Oman’s annual petroleum and other liquids production peaked at 972,000 barrels per day (b/d) in 2000, but dropped to 715,000 b/d by 2007. Oman successfully reversed that decline, and total oil production rose each year, averaging 1,002,000 b/d in 2015 (Figure 3). Enhanced Oil Recovery (EOR) techniques helped drive this production turnaround, although the country also experienced some additional production gains as a result of new discoveries. Oman’s government aims to keep production near its current level for at least the next five years by continuing to apply EOR techniques and the cost management associated with it.9

Several recent developments could contribute to future oil production growth in Oman. Some of the notable new developments include Circle Oil’s announcement of Block 52 (offshore) with its 7 billion barrels of oil in place and Occidental Petroleum’s Block 53, located at the Mukhaizna field, which could produce roughly 44 million of barrels of oil each year.10 Occidental Petroleum implemented one of the world’s largest steam flood projects in Oman in 2005.

Enhanced oil recovery (EOR)

Oman’s ability to increase its oil and natural gas production relies heavily on extraction technologies. Several EOR techniques are already used in Oman, including polymer, miscible, and steam injection techniques.11 Because of the relatively high cost of production in the country, Oman’s government offers incentives to international oil companies (IOCs) for exploration and development activities in the country’s difficult-to-recover hydrocarbons. The government enlists foreign companies in new exploration and production projects, offering generous terms for developing fields that require the sophisticated technology and expertise of the private sector. Given the technical difficulties involved in oil production, the contract terms for IOCs have become more favorable in Oman than in other countries in the region, some allowing significant equity stakes in certain projects.12

To increase oil production, EOR techniques, such as steam injection and miscible injection, have been the key driver of Oman’s oil production growth. Block 6, operated by PDO, is the center of current EOR operations, with the Marmul field (polymer), Harweel field (miscible), Qarn Alam field (steam), and Amal-West (solar), using all four of the EOR techniques within the same block.13 Solar EOR at Alam-West in southern Oman is the first solar EOR project in the Middle East, completed by GlassPoint Solar in 2012 and commissioned in early 2013. Backed by a US $53 million equity investment, including funding from Oman’s State General Reserve Fund (SGRF), GlassPoint Solar’s project involves the production of emissions-free steam that feeds directly into the thermal EOR operations currently in existence. This process reduces the need to use natural gas in EOR projects.14 This project serves as an operational starting point for larger steam-powered EOR projects in the future.

Consumption and refining

Oman is not a major refined petroleum product exporter, although there are plans to expand the country’s refining capabilities in the next few years. Oman aims to capitalize on its strategic location on the Arabian Peninsula by expanding its refining and storage sectors. A major bunkering and storage terminal near Sohar is scheduled to be completed in 2017, and the facility’s location outside the Strait of Hormuz could make it an attractive option for international crude oil shippers.15

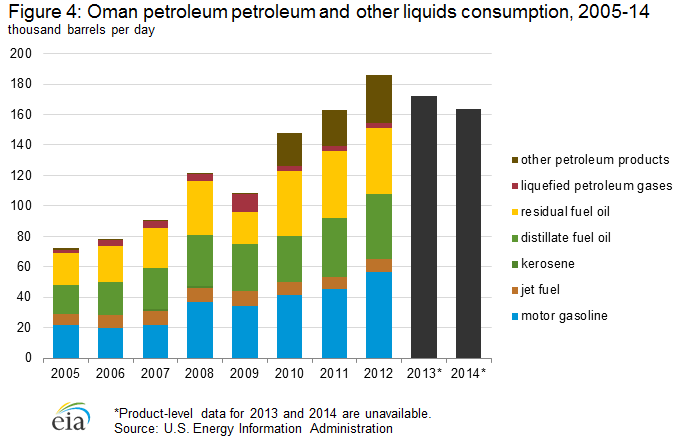

Oman has two operating refineries, Mina al Fahal and Sohar, with a combined nameplate capacity of 222,000 b/d and plans to add an additional 81,000 b/d of capacity by 2018.16 The average refinery utilization rate in Oman was estimated at 96% in 2014, according to IHS Energy.17 Preliminary estimates show that Oman consumed 164,000 b/d of petroleum and other liquids in 2014 (Figure 4), most of which was petroleum products refined at Oman’s refineries and a small amount that was imported. Oman also exports a small amount of petroleum products on the international market.

Steps are underway to upgrade the facility at Sohar as part of the ORPIC-led Sohar Refinery Improvement Project (SRIP). Sohar’s capacity is expected to expand to 197,000 b/d from 116,000 b/d by the fourth quarter of 2016.18 Oman aims to construct a refinery near Duqm with a capacity of 230,000 b/d by 2019, as well as a 200 million barrel crude oil storage terminal at Ras Markaz.19 The storage terminal, opening in 2018, will be one of the world’s largest crude oil storage facilities.

Oman does not have any international oil pipelines, although there are plans to expand the country’s domestic pipeline infrastructure. Plans include the Muscat Sohar Pipeline Project (MSPP), scheduled to be completed in 2017, which is a 174-mile refined product pipeline that will connect the Mina al-Fahal and Sohar refineries and reduce tanker traffic between the two coastal facilities.20 The project’s later phases include plans to construct new storage facilities with the goal of enabling Oman to hold up to 30 days of oil reserves.21

Imports and exports

Oman is an important oil exporter, particularly to Asian markets. In 2014, virtually all of the country’s oil exports went to countries in Asia, of which 72% went to China

Oman’s only export crude stream is the Oman blend, which is a medium-light and sour (high sulfur) crude. Oman is an important crude oil exporter, particularly to Asian markets. In 2014, Oman exported an estimated 800,000 b/d of crude oil and condensate, of which 72% went to China (Table 1).22

| Country | Amount (thousand bbl/d) |

|---|---|

| China | 579 |

| Taiwan | 93 |

| Thailand | 39 |

| Japan | 36 |

| South Korea | 17 |

| India | 16 |

| Singapore | 9 |

| Other | 12 |

| Total | 801 |

| Source: Oman Ministry of Oil and Gas | |

Natural gas

In 2013, Oman combined the Oman LNG and Qalhat LNG companies to streamline the country’s LNG sector.

PDO has an even greater presence in the natural gas sector than it does in the oil sector, accounting for nearly all of Oman’s natural gas supply along with smaller contributions from Occidental Petroleum, Oman’s largest independent oil producer, and Thailand’s PTTEP. The Oman Gas Company (OGC) directs the country’s natural gas transmission and distribution systems. The OGC is a joint venture between the Omani Ministry of Oil and Gas (80%) and OOC (20%). Oman Liquefied Natural Gas (OLNG)—owned by a consortium including the government, Shell, and Total—operates all liquefied natural gas (LNG) activities in Oman through its three liquefaction trains in Qalhat near Sur.23

Exploration and production

Oman’s potential for natural gas production growth may be substantial, supported by promising developments in several new projects.

Oman held 24.3 trillion cubic feet (Tcf) of proved natural gas reserves as of January 2016, according to the Oil & Gas Journal.24 Oman’s gross natural gas production grew to more than 1.13 Tcf in 2013, but it dropped slightly to 1.09 Tcf in 2014. Nearly 81% of the country’s gross natural gas production in 2014 came from nonassociated natural gas fields, according to government figures.25

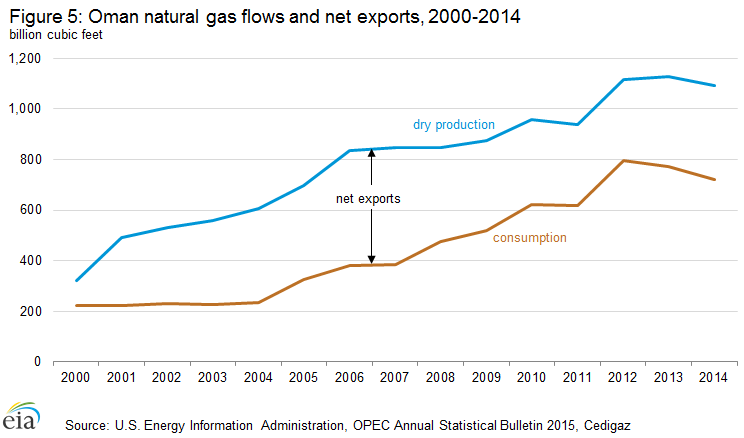

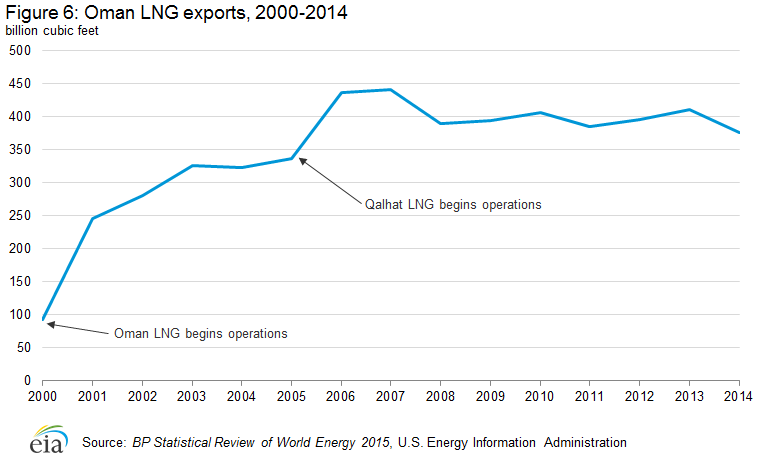

Oman’s natural gas sector grew in importance over the past two decades, largely the result of the opening of the country’s two LNG facilities in 2000 and 2005.26 The opening of the Oman LNG facility in 2000 helped spur Oman’s dry natural gas production, which grew from 322 Bcf in 2000 to 1,091 Bcf in 2014.

The greatest growth potential for Oman’s natural gas production is in the Khazzan-Makarem field in BP’s Block 61. The field is a tight gas formation, and BP suggests the field has between 15 Tcf and 20 Tcf of recoverable natural gas resources, and up to 100 Tcf of natural gas in place.27 In November 2014, Oman brought on stream the Abu Tabul gas field in Block 60, as well as a number of other projects to help meet short-term demand in the country. Abu Tabul is targeting production of 90 million cubic feet of natural gas per day and 6,000 b/d of condensates.28

Imports

Oman currently exports LNG from two liquefaction facilities, although rising domestic demand for natural gas could limit the volumes available for export in the future.

Oman has just one international natural gas pipeline—the Dolphin Pipeline—that runs from Qatar to Oman through the United Arab Emirates. Oman is not a major importer of natural gas, although the country imported approximately 73 Bcf of natural gas in 2014 from Qatar through the Dolphin Pipeline.29 The imports through the Dolphin Pipeline are necessary to meet the rising level of domestic natural gas consumption, which rose from 236 Bcf in 2004 to 721 Bcf in 2014 (Figure 5). Rising natural gas consumption prompted the Oman LNG company to announce that it would divert all its currently exported volumes of natural gas away from foreign markets and toward domestic consumers by 2024.30

In March 2014, Oman signed a memorandum of understanding with Iran on a natural gas import contract. The deal is worth $60 billion over 25 years beginning in 2017 and will deliver 10 billion cubic meters of natural gas per year through a pipeline under the Gulf of Oman.31

Exports

Oman is a member of the Gas Exporting Countries Forum (GECF) and exports natural gas as LNG through its two liquefaction facilities near Sur, in the Gulf of Oman. In 2014, Oman exported 375 Bcf of natural gas (Figure 6).32 Nearly all of Oman’s natural gas exports go to South Korea and Japan, accounting for 93% of exports in 2014.33

In 2013, Oman LNG and Qalhat LNG began the process of integration into a single entity under the Oman LNG banner.34 The companies operate as one entity, but their accounts are kept separate because of different contracts. Combining these companies gave Oman LNG control of all three of the country’s LNG trains, with a combined capacity of 10.4 million tons per year (approximately 500 Bcf).35

Electricity

Oman’s electricity sector relies heavily on the country’s domestic natural gas resources to fuel electricity generation in Oman.

The Authority for Electricity Regulation Oman regulates the country’s electricity and associated water sectors. Its primary functions include implementing general policy from the state; licensing; compliance; and coordination between the various ministries, organizations, and stakeholders in the sector. The Oman Power and Water Procurement Company is the planning body for power supplies in Oman, and the Oman Electricity Transmission Company is in charge of the country’s transmission networks.

Oman’s electricity sector has two major networks—the Main Interconnected System (MIS) and the Salalah system. The MIS, the larger of the two, covers most of the northern area of Oman. The Salalah portion of Oman’s grid covers areas in the south. Areas outside both networks get electricity from the Rural Areas Electricity Company (RAECO), primarily through the use of diesel generators.36 According to International Energy Agency (IEA) data, roughly 98% of the country has access to electricity.37

Oman’s electrification generation more than doubled between 2004 and 2013, from 11 billion kilowatthours (kWh) to 26 billion kWh. Electricity consumption over the same period grew at a similar rate, rising from 9 billion kWh to 23 billion kWh. Oman generates electricity primarily from natural gas, although there is some diesel/distillate generation as well.

Oman is a part of the Gulf Cooperation Council’s (GCC) grid interconnection system, which allows for electricity transfers between the six connected countries (Kuwait, Saudi Arabia, Qatar, Bahrain, the United Arab Emirates, and Oman). Oman and the United Arab Emirates established their connection in October 2011.38

Oman has a nascent renewable energy sector, with several projects making progress. Oman’s Rural Areas Electricity Company (RAECO) plans to install 90 megawatts of renewable capacity by 2020.39 In its 2014 Annual Report, RAECO detailed three renewable electricity pilot projects underway, of which one is solar and two are wind.40 In addition, RAECO anticipates five new solar projects with a combined capacity of 7,000 kW.41 Although Oman does not currently have a nuclear energy program, the country joined the International Atomic Energy Agency in 2009. Currently, there are no plans to construct any nuclear generating facilities.

Notes:

- Data presented in the text are the most recent available as of January 15, 2016.

- Data are EIA estimates unless otherwise noted.

Endnotes:

1Central Bank of Oman, “Annual Report 2014,” (June 2015), page 38.

2International Monetary Fund, “IMF Executive Board Concludes 2015 Article IV Consultation with Oman“, Press Release No.15/189, (May 5, 2015).

3Petroleum Development Oman (Accessed November 16, 2015)

4Petroleum Development Oman (Accessed November 16, 2015)

Oil & Gas Journal, “Worldwide Look at Reserves and Production” (January 1, 2016).

6U.S. Geological Survey, “Assessment of Undiscovered Conventional Oil and Gas Resources of the Arabian Peninsula and Zagros Fold Belt, 2012,” (September 2012), page 3.

7Petroleum Development Oman (Accessed November 16, 2015)

Note: Occidental Petroleum Oman’s operations are located primarily at the Mukhaizna Field in south-central Oman, and blocks 9,27, and 62 in northern Oman. Oxy has been working in Oman for over 30 years and has increased the country’s production and reserves greatly. In 2013, the average gross daily oil production at Mukhaiza was 123,000 bbl/d, over 15 times higher than production levels in 2005, when Oxy assumed operation of the field.

8Oman Ministry of Oil and Gas, “Annual Report 2013: Energy for Oman Today & Tomorrow,” (2013), page 9.

9Oman Ministry of Oil and Gas Note: For more details on block level production

10Oil & Gas News, “Sultanate places its bet on a successful exploration plan,”; Mubadala, “Mukhaizna” (Accessed September 18, 2014)

11Petroleum Development Oman (Accessed November 16, 2015)

12IMF, “GCC Countries: From Oil Dependence to Diversification,” (2003).

13Middle East Economic Survey, “Oman Taps Shell for 30,000 B/D Crude Output Boost” (September 5, 2014), page 7 Middle East Economic Survey, “Oman Targeting Steady Crude Output Through 2018” (March 7, 2014), page 4.

14GlassPoint Solar, “Petroleum Development Oman and GlassPoint Commission the Middle East’s First Solar EOR Project” (May 21, 2013).

15Middle East Economic Survey, “Oman Eyes 2018 Completion of Linked Downstream Projects, but Liwa Cost Rising” (September 11, 2015)

16Middle East Economic Survey, “Orpic Seals $0.9bn Financing For $7bn Projects Program” (May 22, 2015)

17IHS Energy Annual Long-Term Strategic Workbook

18Middle East Economic Survey, “Oman Eyes 2018 Completion of Linked Downstream Projects, but Liwa Cost Rising” (September 11, 2015)

19Middle East Economic Survey, “Oman Eyes 2018 Completion of Linked Downstream Projects, but Liwa Cost Rising” (September 11, 2015); Middle East Economic Survey, “Oman Awards Ras Markaz Crude Terminal FEED” (January 30, 2015)

20Middle East Economic Survey, “Oman Advances Downstream Projects” (December 19, 2014)

21Middle East Economic Survey, “Oman Plans Muscat-Sohar Pipeline” (February 22, 2013)

22Oman Ministry of Oil and Gas (Accessed November 16, 2015)

23Oman LNG (Accessed November 16, 2015)

24Oil & Gas Journal, “Worldwide Look at Reserves and Production” (January 1, 2016).

25Oman Ministry of Oil and Gas (Accessed November 16, 2015)

26Oman Ministry of Oil and Gas (Accessed November 16, 2015)

Note: Oman’s LNG liquefaction plant is located on the coast at Qalhat near Sur and its head office is in Muscat. Oman LNG’s claims its activities contribute to helping the Omani government diversify the economy.

27Middle East Economic Survey, “Oman, BP Sign Final Khazzan Tight Gas Deal” (December 20, 2013)

28Middle East Economic Survey, “Abu Tabul Commissioning to Kick Start Oman Gas Boost” (August 1, 2014)

29Middle East Economic Survey, “Dolphin Splashes on Debt, Stranded by Gas Impasse” (December 11, 2015)

30Middle East Economic Survey, “Oman’s LNG Strategy Hinges On New Supplies, Production” (April 24, 2015)

31Middle East Economic Survey, “Iran, Oman Edge Closer To Gas Supply Deal” (March 14, 2014)

32BP Statistical Review of World Energy, 2015 (Accessed November 16, 2015)

33BP Statistical Review of World Energy, 2015 (Accessed November 16, 2015)

34Middle East Economic Survey, “LNG: Omani State Producers Join Forces; Yemen Looks To Price Hike” (September 6, 2013)

35Middle East Economic Survey, “LNG: Omani State Producers Join Forces; Yemen Looks To Price Hike” (September 6, 2013)

Note: The Dolphin gas pipeline was conceived in 1999 to produce, process and transport to Qatar to the UAE and Oman. This pipeline is the largest energy-related venture ever taken in the region, and is the first of its kind for the Gulf Cooperation Council (GCC) countries.

36Oman Power and Water Procurement Company (Accessed November 16, 2015)

37International Energy Agency (Accessed November 16, 2015)

38Cigre, “GCC Interconnection Grid: Operational Studies for the GCC Interconnection with United Arab Emirates (UAE)” (2012), page 1.

39Middle East Economic Survey, “Oman Turns To Wind To Cut Rural Generating Costs” (October 17, 2014)

40Rural Areas Electricity Company, “Delivering Electricity to Rural Oman: Annual Report 2014” p35

41Rural Areas Electricity Company, “Delivering Electricity to Rural Oman: Annual Report 2014” p35