War-Fueled Surge In Food Prices To Hit Poorer Nations Hardest – Analysis

By Christian Bogmans, Jeff Kearns, Andrea Pescatori and Ervin Prifti

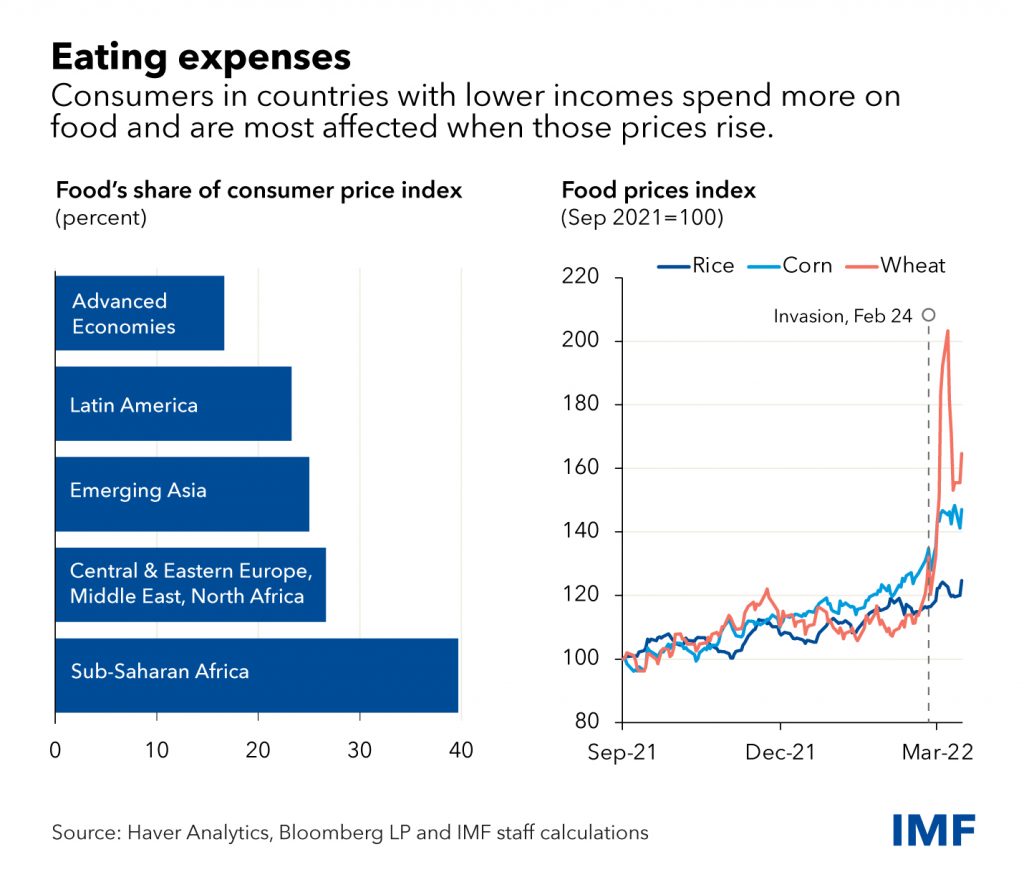

Global food prices are poised to keep climbing even after jumping to a record in February, placing the heaviest burden on vulnerable populations while adding to headwinds for the global economic recovery.

Food commodity prices rose 23.1 percent last year, the fastest pace in more than a decade, according to inflation-adjusted figures from the United Nations Food and Agriculture Organization. February’s reading was the highest since 1961 for the gauge tracking prices for meat, dairy, cereals, oils, and sugar.

Now, the war in Ukraine and sanctions on Russia are upending shipments and possibly production for two of the world’s largest agricultural producers. The two countries account for nearly 30 percent of world wheat exports and 18 percent of corn, most of which is shipped through Black Sea ports that are now closed. Wheat futures traded in Chicago, the global benchmark, recently rose to a record.

The Chart of the Week shows how price shocks will have worldwide impact, especially on poor households for whom food is a higher share of expenses. Food costs account for 17 percent of consumer spending in advanced economies, but 40 percent in sub-Saharan Africa. Though this region is highly import-dependent for wheat, the grain constitutes only a minor share of the total caloric needs.

Differences in diet are also significant. In Europe, where bread is deeply embedded in many aspects of its culture, wheat makes up about a quarter of diets. In Southeast Asia, wheat accounts for only 7 percent versus 42 percent for rice, for which price increases so far have been relatively contained. Country-level averages, however, mask substantial differences within nations as poor households tend to eat more cereals but less meat, vegetables, and fruits compared with middle-income households.

Finally, disruption may be even greater for countries with close trade links to Russia and Ukraine, including in Eastern Europe, the Caucasus, and Central Asia. High wheat prices will weigh even more on economies in the Middle East and North Africa, such as Egypt, which are especially reliant on Russian exports.

Looking forward, reduced fertilizer supplies and higher oil prices will increase costs for harvesting, transporting and processing food. Policymakers must prevent those pressures from fueling food insecurity by avoiding protectionism and increasing social assistance for the poorest.

The world may also call upon the two largest economies if the situation worsens. In the United States, where about 40 percent of corn production goes to ethanol, policymakers could reassess that use. And China, which holds more than half of global wheat and corn reserves, could consider releasing supplies to lower prices.

*About the authors:

- Christian Bogmans is an economist in the IMF’s Research Department (Commodities Unit). His main research interests are in the fields of environmental and energy economics and international trade, with an emphasis on the relationship between trade, natural resources, and the environment.

- Jeff Kearns is a senior communications officer in the IMF policy communications division and managing editor of IMF Blog. He joined the Fund from Bloomberg News, where he was an economics editor in Beijing and Washington, a Federal Reserve reporter in Washington, and a US stock market reporter in New York

- Andrea Pescatori is Chief of the Commodities Unit in the IMF Research Department and associate editor of the Journal of Money, Credit and Banking. He has written extensively on a variety of macroeconomic topics, including monetary and fiscal policy, and published in peer-reviewed journals

- Ervin Prifti is a Senior Economist with the Research Department of the International Monetary Fund working on issues of food security and agricultural commodity markets.

Source: This article was published by IMF Blog