Latin America’s Inflation Challenge – Analysis

Inflation has surged in the largest economies of Latin America, prompting large central banks in the region to raise interest rates before economic activity has fully recovered.

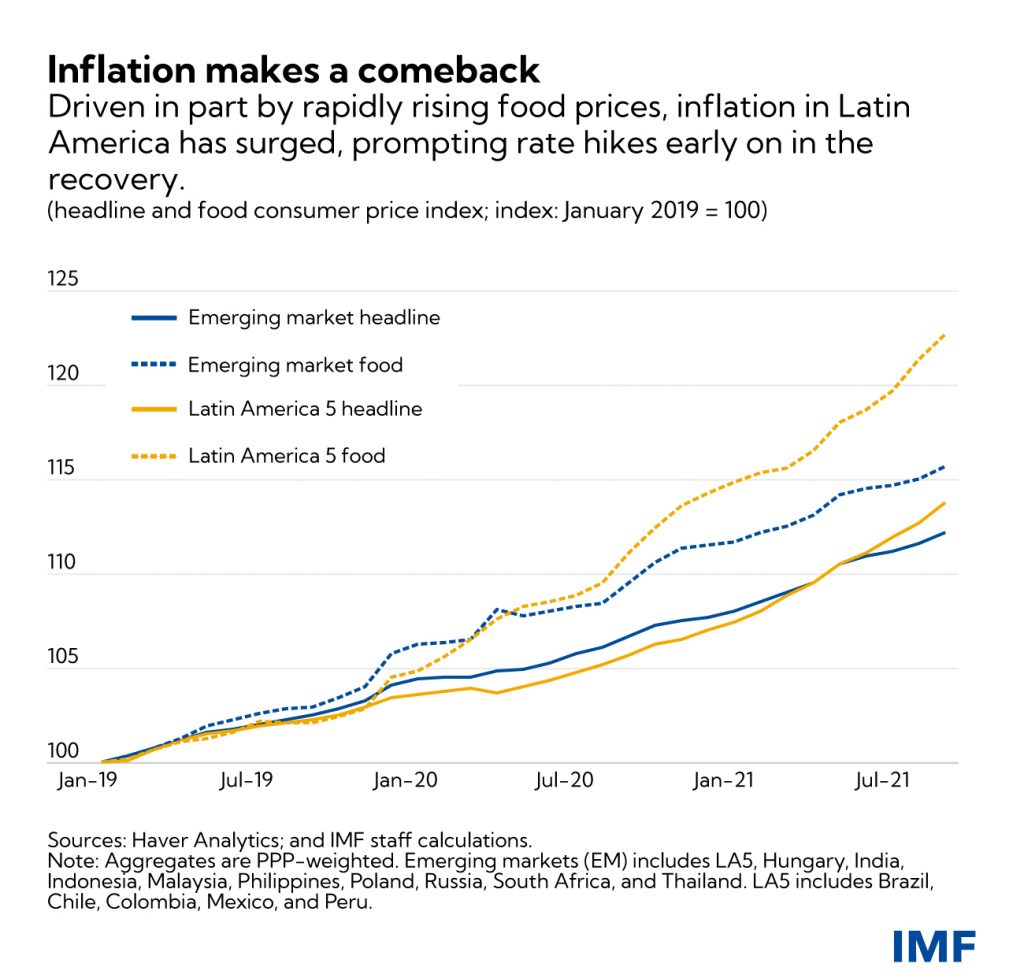

Our latest Regional Economic Outlook shows how rapidly inflation is rising. In the first year of the pandemic, average inflation in Brazil, Chile, Colombia, Mexico, and Peru—the LA5—was below the average for other emerging market economies. It’s now higher, averaging 8 percent year-on-year in October and in the case of Brazil, surpassing 10.5 percent.

Soaring food prices are partly driving the surge. They started increasing even before the pandemic and have risen more than 18 percent on average in LA5 countries since January 2020.

In Latin America, food prices make up about a quarter of the average consumption basket. For households still reeling from the coronavirus crisis, higher food bills leave less to spend on other goods. In a region with the highest levels of income inequality, the burden is highest for low-income households who spend a larger share of their income on food.

Even core inflation, which excludes food and energy prices, has exceeded the pre-pandemic trend this year, reaching an average of 5.9 percent year-on-year in October.

Inflationary pressures should be temporary and medium-term inflation will likely revert to central bank targets. But there is a lot of uncertainty. The shock from the pandemic is unique and its impact on commodity prices, supply bottlenecks, and rising shipping costs is hard to pin down.

The region is also battling a long history of high and unstable inflation—a challenge for central banks that have only recently established their credibility. This history may have led to indexation practices (contracts that adjust their terms automatically with inflation) that could accelerate prices further.

There is also the risk that international financial conditions tighten rapidly and unexpectedly in response to inflation developments in advanced economies, leading to capital outflows. This potential shock could jeopardize financial stability and depreciate currencies in Latin America, adding to inflationary pressures.

Managing expectations, through statements or rate hikes, is a key factor in heading off an inflationary spiral, which is why central banks in the region are moving fast to preserve their hard-won credibility in an uncertain environment. All LA5 countries have already hiked policy rates and their monetary authorities have shifted up forward guidance.

Despite the recent rate hikes, monetary policy stances generally remain accommodative and continue to support the ongoing recovery. The region nevertheless faces difficult trade-offs and needs to balance an uncertain inflation outlook with employment still substantially below pre-pandemic levels and an uneven recovery in Latin America’s jobs market.

*About the author:

- Maximiliano Appendino is an economist at the Regional Studies Division of the IMF’s Western Hemisphere Department. He joined the IMF as part of the Economist Program in 2014 and worked for the Strategy, Policy and Review Department and the Middle East and Central Asia Department. Maximiliano holds a Ph.D. in Economics from Yale University, and bachelor’s and master’s degrees in economics from Universidad de San Andrés in Argentina.

Source: This article was published by IMF Blog