Biden’s Visit To Saudi Arabia: Late Or Early? – OpEd

By Arab News

By Wael Mahdi*

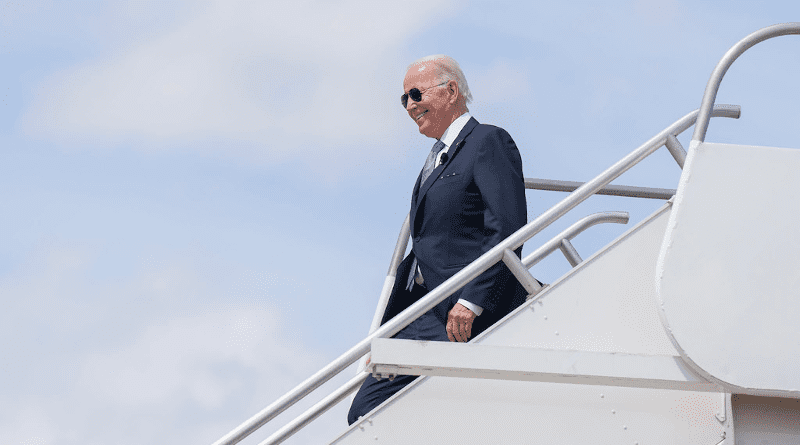

From a market point of view, what signals can we get from the news that US President Joe Biden has finally decided to visit Saudi Arabia?

The easy answer is more oil supplies.

Yet, I believe that this would signal a mixed energy policy for an administration that is halfway through its term.

If this visit shows anything, it shows that the US does not have a sound energy policy in place; and if there is any, then it is most likely a very reactive one.

Setting long-term targets without addressing or focusing on the short-term needs won’t help a country like the US.

The current energy crisis has shown that gasoline prices are at the heart of the US policies — no matter how much its officials claim that they care less about fossil fuel.

We are in 2022 and the success of any US president still hinges on what the citizens feel about prices at the gas station.

However, it took the current US administration a long time to signal that it finally got it right and will do its best to ensure that the US taxpayers won’t suffer when they go to fuel their vehicles.

Frankly speaking, the White House went a little bit far when it called on the refiners to lower gasoline prices out of sympathy for the consumers.

It is a “patriotic duty” now to lower prices and not to respond to the laws of supply and demand after gasoline hit the historical level of $5 per gallon.

So again it’s not clear what energy policy or what economic thinking is at work when market actions are influenced by political motives.

For President Biden’s visit to become successful, it must be part of a bigger agenda or a grandiose energy scheme.

It must signal that the US is committed to reasonable policies when it comes to energy transitions and it must signal that working with the Organization of the Petroleum Exporting Countries is and will always be a priority for any US administration.

The US cannot afford to avoid OPEC because it’s the only force that can stabilize the market along with OPEC+, the supreme being that is now responsible for almost half of the world’s oil production.

This trip can’t be more than a start toward a better and more clear global energy policy as the US needs that.

From releasing strategic petroleum reserves to calling on refiners to increase production and forgo profit, the US administration did everything to avoid working closely with the OPEC. It took it to see the price of a gallon soar to $5 to understand that they needed a turn.

So, is it late or early for President Biden to make this trip to Saudi Arabia?

I believe it’s late if we consider the situation with gasoline prices, but it can be early if we start thinking about the future.

The future isn’t green or renewable, the future is affordable.

When gasoline prices are at $2 a gallon, it’s easy to turn your back to fossil fuel and think about an ideal world with no OPEC and no carbon emissions.

But when gasoline is at $5 a gallon and economic pain is all that people feel every day, people won’t care about carbon emission and they will think about working with any party to ease the pain even if it is OPEC.

I’m not sure if the US is ready to embrace new thinking, but I’m hopeful that the $5 per gallon will be an eye-opener for Americans.

The world needs more collaboration to ensure that our citizens don’t feel economic pain.

The present and the future of our economies will require all sources of energy.

The energy transition is a journey that we need to make together and we need to make sure that we all move at the same pace or at least without leaving anyone behind.

And last but not the least, the US needs OPEC and OPEC needs a US administration with a clear energy policy.

• Wael Mahdi is an independent energy commentator specializing on OPEC and a co-author of “OPEC in a Shale Oil World: Where to Next?”