Examining Moral Basis Of Pope Francis’ Pleas For Financial Regulation And Morality Of ‘Speculation’ – OpEd

At the most elemental level, any reflection on speculation’s moral dimension should begin with recognition that all economic activity contains an element of speculation. Everyone needs to make choices about how they spend and invest their income within a context of uncertainty and based upon imperfect knowledge of the future.

By Samuel Gregg*

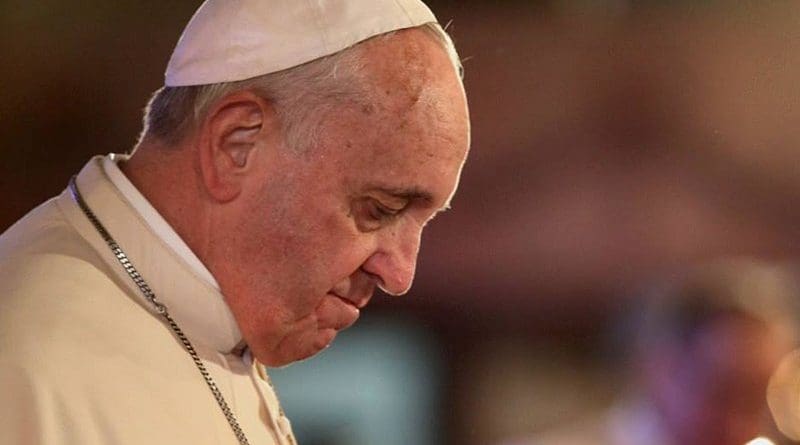

In his Prayer Intentions for May 2021, Pope Francis is asking that Catholics pray for strict regulation of financial markets to protect the poor. But is strict government oversight what really protects the vulnerable from financial harm?

“If finance is unregulated, it becomes pure speculation driven by various monetary policies, the Pope said. “This situation is unsustainable. And it is dangerous. So that the poor do not suffer painful consequences from this system, financial speculation must be carefully regulated. Speculation. I want to underline that term. May finance be a form of service, and an instrument to serve the people, and to care for our common home!”

It’s not unusual for speculation to be treated with considerable wariness. In 2004, for instance, a document issued by the World Council of Churches even placed money-laundering and speculation under the same heading. The meaning of the term is also elastic. Writing in the late-1920s, the Jesuit economist Oswald von Nell-Breuning commented that “one general definition [of speculation] cannot capture all the nuances.”

In its fundamentals, speculation is about the future – specifically, navigating through and profiting from the uncertainties associated with the future. A hedge fund, for instance, borrows large amounts of money to speculate upon the future worth of, say, a commodity or a currency over varying periods of time. “Forward dealings,” as they are called, seek to capitalize upon expected price movements on goods, products, or shares over a period of time in the hope of selling high and buying low. Such dealings can involve also buying or selling goods at a later date at a fixed price in the expectation that, in the meantime, prices will fall (a “bear” transaction) or rise (a “bull” transaction).

But when a hedge fund decides to go “long” or “short” on the future price of a good, it rarely does so on a whim. Instead it acts on the basis of a calculated risk. Such businesses usually employ large numbers of forecasters, traders and mathematical modelers in an effort to make as accurate a speculative estimate as possible. Though often caricatured as an activity that produces enormous gain on the basis of little labor, speculation actually involves large amounts of work undertaken by highly knowledgeable groups of people who stand to lose a great deal if they make significant errors in judgment.

As Pope Francis recognizes, speculation is part-and-parcel of the modern economic world. He also plainly believes that it is subject to the demands of morality and justice. The question thus becomes: How do we judge whether any act of speculation is right and just, or wrong and unjust?

We’re all speculators

At the most elemental level, any reflection on speculation’s moral dimension should begin with recognition that all economic activity contains an element of speculation. Everyone needs to make choices about how they spend and invest their income within a context of uncertainty and based upon imperfect knowledge of the future. Even the mundane activity of placing some of our capital in a savings account at our local bank involves some speculation insofar as we make the assessment – as opposed to knowing with absolute certainty – that the bank will remain solvent.

Like all human acts, the morality of a free choice deemed to be speculative requires close examination of the specifics of that choice. The first point to make is any act of speculation based on telling falsehoods (whether outright lies or spreading rumors about the future economic prospects of a given good) is always wrong because the choice to lie is in itself, at least from the standpoint of Christian ethics and natural law, an intrinsically evil act.

Such acts, however, are very different from the type of speculation that involves 1) no choice of evil and 2) making prudential judgments about what we buy and sell in the marketplace in light of what we judge is likely to happen in the future on the basis of knowledge, experience and evidence. Risk-assessment is integral to such acts, and ascertaining the reasonableness of assuming a given risk is central to the moral analysis of any act of speculation. The higher the risk, the greater the degree of the due diligence which can be reasonably demanded.

Reflecting on these and other factors in the mid-20th century, the economist, lawyer and Austrian priest Johannes Messner listed several criteria as essential for determining whether a given act of speculation was just. In addition to underscoring that lying or theft automatically rendered a speculative act evil, Messner specified that a just act of speculation required (1) a thorough knowledge of the present state of the market; (2) adequate study of the influences upon the possible development of supply and demand; (3) a serious effort to discern possible tendencies in the marketplace; and (4) a prudent engagement of capital that does not unduly risk the speculator’s ability to meet his existing liabilities.

The first three of Messner’s guidelines are essentially counsels to choose and act prudently so as to calibrate risk responsibly. The fourth criteria reflects the requirement to respect the demands of commutative justice. In other words, speculation cannot substantially compromise your ability to meet your pre-existing contractual obligations to others.

Finance, futures and basic needs

A common criticism of speculation is that it can negatively affect some people’s access to some basic necessities of life. The objection is that speculators who expect an increase in the price of a good and consequently buy many future contracts effectively drive up the price of goods for which there is presently a high demand, thereby putting them beyond the reach of those with less material resources.

There are instances in which speculation can distort prices. Someone who owns a futures position larger than the supply of the underlying deliverable good available at the market price might be able to “corner the market” and drive up prices. The evidence suggests, however, that this is always a transient effect and that such cases are also relatively rare. Indeed, direct evidence for a strong relationship between substantive price movements and speculative activity is very weak.

Sudden price increases are more adequately explained by dramatic increases in demand for a given good, combined with a relatively static supply of that same good. Over the long and medium term, the price of something like food in the conditions of a market economy is determined by the forces of supply and demand. If agricultural industries produce enough food to meet or even exceed demand, agricultural prices will fall. These are the factors that ultimately drive food prices – not speculation.

Nor is there much evidence to support the argument that the profits made by speculators in futures markets are made at the poor’s expense. To grasp this point, we need to understand precisely how speculation in futures markets works.

If you need 2,000 bushels of wheat today, you have to pay the present going price of a bushel of wheat that’s needed today. This is known as the spot price (say, $100). Imagine, however, that you don’t need the 2,000 bushels today, but you will need them in one year’s time. The futures market allows you to buy these bushels for delivery in one year’s time at the futures price of $90. The farmer is willing to sell you these bushels because it guarantees him a sale. This mutually beneficial arrangement is mediated through a futures contract.

The futures market, however, also allows you to buy bushels of wheat without you having any intention of receiving them yourself from the farmer. In these cases, you contract with the farmer for the same 2,000 bushels at the lower futures price with the bushels to be delivered to the holder of the contract in one year’s time. By purchasing the contract, you do so in the hope that you can sell it to someone else prior to the delivery at a price closer to the higher spot price.

If the supply of wheat remains stable, those who anticipate they will need 2,000 bushels of wheat in a year’s time may inquire if I am willing to sell them my contract. In such instances, I break even. If, however, demand for wheat grows, they may seek to pay more for my futures contract than they otherwise would. In this instance, I make a profit. But if the wheat supply turns out to be greater than expected, those who need the wheat will very likely be able to secure a better deal from someone other than myself. In these circumstances, if I sell my futures contract, it might well be for less than the price I paid in the beginning – in this case, I lose money.

What’s important to note here is that the speculator’s ability to make a profit does not emanate from cheating anyone. Nor does it arise from any magical ability on the speculator’s part to make the wheat price increase. Instead, I only derive a profit if I correctly estimate that the demand would be greater than the supply at a particular point in the future. Likewise, my loss would proceed from my failure to ascertain that the supply was going to outstrip demand in a year’s time. In any case, it is not futures markets that puts necessities beyond the poor’s capacity to pay. That is a question of supply and demand – not speculation on future prices.

Speculation as stabilizer

Beyond the morality of a given act of speculation, it’s worth highlighting how speculation can contribute to the more efficient use of economic resources and greater stability in the availability of these goods for everyone, including those on the income scale’s lower end. How so?

Speculation can smooth the relative stability of economic life by helping to calibrate the supply and demand of many goods beyond the short-term. To use the same example of wheat: If the futures price for wheat goes up, this indicates that a critical mass of those who analyze future trends in the wheat industry believe that prices are going to increase in the future. This market signal tells farmers that they need to plant, grow and harvest more wheat. This enhances the availability of wheat for all and keeps wheat prices stable, if not down.

But speculation also allows consumers of wheat like cereal companies and bakers to protect themselves from sudden upward price movements in the future by locking in what they estimate to be a lower future price. And it is not just the producers who benefit. To the extent that speculation helps to steady and lock in lower prices over the medium- and long-term, it allows everyone to make economic choices in circumstances of greater certainty.

None of this is to deny that problems in financial markets can occur. Too much liquidity in the financial system can result in too much money being used to speculate on a limited number of goods, currencies and commodities. Observe, however, that once again, the problem is not speculation per se. The problem is excessive liquidity in financial markets, often courtesy of excessively loose monetary policy pursued by central banks. It’s not impossible that when Pope Francis said, “If finance is unregulated, it becomes pure speculation driven by various monetary policies,” this was what he actually meant.

Pope Francis insists that finance and financial markets should be at the service of people. He’s right. And speculation is an integral part of those markets. Like any freely willed human act, it is subject to the demands of morality. In making such judgments, however, it’s important to know what is involved. Otherwise, it would be all too easy to contribute to the demonizing of a financial practice that, in many respects, renders considerable service to the common good’s economic dimension.

*About the author: Samuel Gregg is director of research at the Acton Institute. He has written and spoken extensively on questions of political economy, economic history, ethics in finance, and natural law theory. He has an MA in political philosophy from the University of Melbourne, and a Doctor of Philosophy degree in moral philosophy and political economy from the University of Oxford.

Source: This article was published by the Acton Institute

Further research needs to be undertaken on the macro-micro linkages of structural fiscal policy and its impact upon livelihoods of the poor and vulnerable. IMF and WB rescue packages come immediately to mind.