Oil Companies Announce Significant Write-Downs In Third-Quarter – Analysis

By EIA

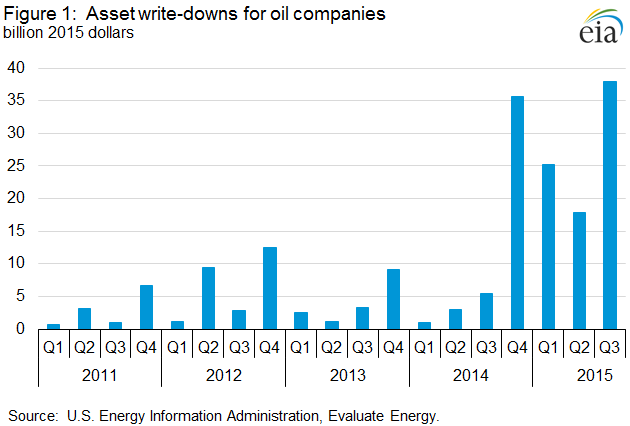

International and U.S. upstream oil companies wrote down $38 billion in assets in the third quarter of 2015, the largest for any quarter since at least 2008 for this set of 46 companies (Figure 1). Low oil prices continue to have a significant effect on the value of companies’ assets and future prospects as well as on current revenue.

Although the volume of total liquids output for this group of companies increased over third-quarter 2014, the fall in oil prices contributed to a year-over-year decline in revenue. Lower oil prices also contributed to a 33% decline in cash flow from operations in the third quarter from the previous year. However, companies reduced capital expenditures by 34% over the same period, and for the first time in a year, these 46 companies showed a surplus of cash from operations over capital expenditures. Large write-downs—also called impairments—as well as reduced cash flow suggest that investment spending will continue to decline absent a meaningful increase in crude oil prices.

The significant increase in impairment charges was an important factor many companies discussed in their third-quarter earnings releases. An impairment charge represents the decrease in value of assets a company owns, typically its amount of proved reserves. Proved reserves are estimated quantities of oil and natural gas that analyses of geologic and engineering data demonstrate with reasonable certainty are recoverable under existing economic and operating conditions. Because oil companies must publish the amount of proved reserves they own every year, an impairment charge reflects assets that have estimates of future net cash flows below what the company already spent to develop them. This situation could result from a combination of geologic and economic factors, but regardless is something that lowers the value of the company.

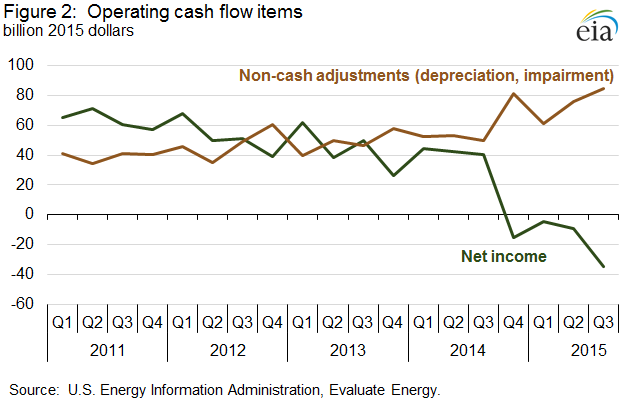

Impairments are nonrecurring reductions in asset values reflected on a company’s income statement but do not represent cash outflows. In the third quarter, impairments represented over 40% of the $85 billion in non-cash adjustments. This is higher than in 2011-13, when impairments averaged only 10% of all non-cash adjustments. Further, the increase in impairments contributed to negative net income for this set of companies for the fourth consecutive quarter (Figure 2).

One example of an impairment charge is Royal Dutch Shell’s announcement to discontinue a Canadian oil sands project, reducing its proved reserves by an estimated 418 million barrels, according to company filings. A different company, Whiting Petroleum, wrote down the value of some assets it acquired from Kodiak Oil and Gas when the two companies merged last year.

Large impairment charges represent acknowledgement by a company that some of its projects are no longer profitable and are being discontinued. While this adjustment reduces the investment expenditures that the company would incur, it also reduces the future estimated cash flow from these projects. Options for conserving cash include reductions in dividends to shareholders, elimination of share repurchase programs or increases in cash through share issuance, increasing debt, or sales of assets. Since 2014, these 46 companies reduced dividends by 16% and share repurchases by 92%. Impairments make increasing debt and selling assets more difficult. Lenders may be less willing to lend if a company’s assets declined in value, or may only be willing to lend up to a certain percentage of the value of a company’s proved reserves, which declined in value from impairments. Selling assets becomes difficult because they are typically sold at a lower valuation than when the company purchased them because of the impairment charge, raising less cash than otherwise would be expected.

U.S. average gasoline and diesel fuel prices decrease

The U.S. average retail price for regular gasoline decreased six cents from the previous week to $2.18 per gallon on November 16, 2015, down 72 cents from the same time last year. The Midwest price fell 13 cents to $2.09 per gallon. The Gulf Coast and Rocky Mountain prices each decreased five cents, to $1.93 per gallon and $2.14 per gallon, respectively. The West Coast price was down three cents to $2.64 per gallon, and the East Coast price decreased less than a penny to remain $2.16 per gallon.

The U.S. average diesel fuel price decreased two cents from last week to $2.48 per gallon, down $1.18 per gallon from the same time last year. The Midwest price fell three cents to $2.49 per gallon, followed by the West Coast price, which was down two cents to $2.70 per gallon. The Gulf Coast and East Coast prices both decreased one cent, to $2.30 per gallon and $2.50 per gallon, respectively. The Rocky Mountain price did not change, remaining $2.49 per gallon.

Residential heating oil price decreases while propane price increases

As of November 16, 2015, residential heating oil prices averaged nearly $2.40 per gallon, 3 cents per gallon lower than last week and almost 99 cents lower than one year ago. The average wholesale heating oil price this week is $1.46 per gallon, over 11 cents less than last week and $1.14 per gallon lower than a year ago

Residential propane prices averaged slightly under $1.94 per gallon, 2 cents per gallon higher than last week’s price and almost 47 cents lower than one year ago. Wholesale propane prices averaged 49 cents per gallon, just shy of 4 cents per gallon lower than last week’s price and 51 cents lower than last year’s price for the same week.

Propane inventories gain

U.S. propane stocks increased by 0.5 million barrels last week to 104.5 million barrels as of November 13, 2015, 23.3 million barrels (28.7%) higher than a year ago. Midwest inventories increased by 0.4 million barrels and East Coast inventories increased by 0.2 million barrels. Rocky Mountain/West Coast inventories increased by 0.1 million barrels while Gulf Coast inventories decreased by 0.2 million barrels. Propylene non-fuel-use inventories represented 3.5% of total propane inventories.