Banking Union To Be Set Up In Europe Next Year

By VOR

By Pavel Orlov

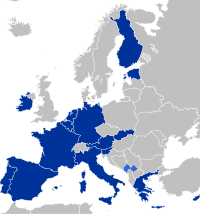

At the summit in Brussels, the EU leaders came to an agreement on setting up a banking union in 2013. After the New Year, the European Central Bank will have the right to control all EU banks and provide assistance to problematic banks bypassing the national governments.

According to French President Francois Hollande who is one of the authors of the initiative, the decision to set up a banking union would become one of the main instruments in fighting the lingering debt crisis in the region.

“It is important to sort out the eurozone problems, to restore the trust of the markets so as to achieve economic growth. A banking union could provide stability and an effective mechanism for coping with the crisis.”

The terms of implementing this ambitious project mentioned at the summit look very short even for the EU which is highly integrated. Still, German Chancellor Angela Merkel believes that all the stages of making an anti-crisis remedy will be completed in time.

Many experts have a sceptical attitude to this initiative. According to analysts, paying off old debts with new loans is taking Europe along the path of the American economic model when the cure for a budget deficit is not raising the efficiency but pumping the economy with more cash, head of the Centre for Economic Research at the Institute of Globalisation and Social Movements Vasili Koltashov says.

“In this situation, whatever shape support to banks takes it will not be effective because banks would demand more and more money and would be afraid to finance the real sector.”

We do not only mean providing financial support to problematic banks and countries but establishing a whole system of criteria for granting loans. In essence, the European Central Bank could become ‘the big brother’ who could look into its neighbour’s purse at any moment. Still, it was not this fact that raised a dramatic dispute but Angela Merkel’s suggestion of granting the EU the right of veto to budgets of some countries.

Greece, Italy and Portugal found themselves in this situation in the past. Now Spain is facing it. Even if Madrid agrees to accept the aid and takes the loan it is unlikely to help either the Spanish economy or the nation as a whole, head of the Centre for Economic Research at the Institute of Globalisation and Social Movements Vasili Koltashov is convinced.

“To make the aid to Spanish banks effective from the economic viewpoint, it is necessary to change the economic policy inside Spain and provide some assistance to the debtors of those banks as well.”

It turns out that instead of financing the population which could stir up the growth of the national economy, Spanish banks would only be able to postpone the date of their own bankruptcy.

The main thing that Europe should do is not controlling the effectiveness of spending the loans but lowering the pressure on the real sector. Many economists believe that, rather than developing economic integration and perfecting financial processes, the EU should solve this problem with writing off debts and raising labour productivity, even if these measures would seem very unpopular.