US Petroleum Product Exports Continue To Expand – Analysis

By EIA

Total U.S. petroleum product exports continued to increase in 2015, up 467,000 barrels per day (b/d) from 2014 to 4.3 million b/d, driven by increased exports of distillate fuel, motor gasoline, and propane. Mexico and the region encompassing both Central and South America continued to be major recipients of U.S. petroleum product exports, as exports to the latter region increased in 2015 because of supply constraints that are likely to ease.

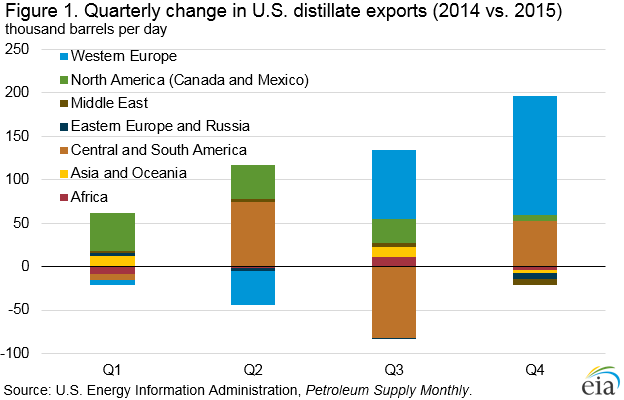

Exports of distillate fuel oil represent the largest component of U.S. petroleum product exports, and averaged 1.19 million b/d in 2015, an increase of 85,000 b/d from 2014. The United States exported distillate fuel to 88 different countries in 2015. The top destination for U.S. distillate exports was Mexico, averaging 143,000 b/d in 2015, an increase of 15,000 b/d from the previous year. Distillate exports to Central and South America averaged 595,000 b/d in 2015, up 10,000 b/d from the previous year. Chile was the region’s largest single importer of U.S. distillate in 2015, averaging 101,000 b/d. As continued high U.S. refinery runs and a warmer-than-normal heating season combined to push U.S. distillate inventories above the five-year average and prices lower, exports of distillate to Western Europe also increased. In the third and fourth quarters of 2015, distillate exports to Western Europe increased year-over-year by 80,000 b/d and 136,000 b/d, respectively (Figure 1). Increased U.S. exports contributed to high distillate inventories in the major refining and petroleum hubs of Amsterdam and Rotterdam in the Netherlands, and Antwerp in Belgium, collectively known as the ARA.

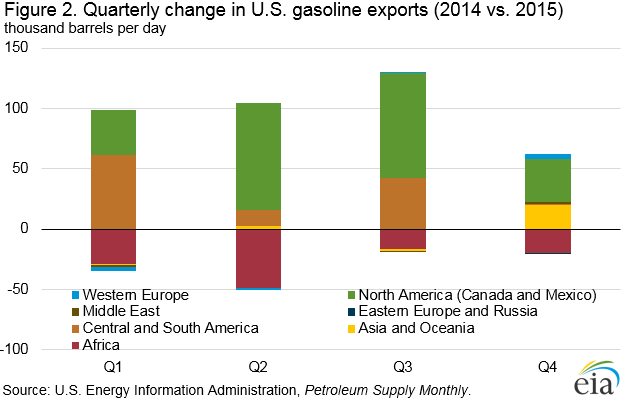

Motor gasoline was the second largest U.S. petroleum product export in 2015, averaging 618,000 b/d to 102 different countries, up 68,000 b/d from 2014. As with distillate, Mexico is the largest recipient of U.S. motor gasoline exports, averaging 307,000 b/d in 2015, one-half of the 2015 total. Central and South America are also a major destination for U.S. motor gasoline exports, receiving 228,000 b/d in 2015, up 29,000 b/d from 2014. U.S. exports of motor gasoline to Africa decreased by 28,000 b/d in 2015 compared with 2014, mostly because of lower exports to Nigeria, one of Africa’s largest gasoline importers, as fuel import program reforms took place (Figure 2).

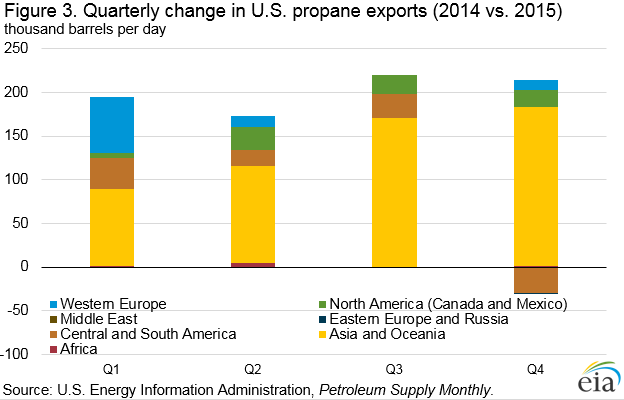

U.S. exports of propane nearly matched those of motor gasoline in 2015 at 615,000 b/d in 2015, up 193,000 b/d from the previous year. Low U.S. propane prices have encouraged the expansion of propane export capacity since 2013. Unlike exports of distillate and motor gasoline, U.S. propane exports are destined mainly for Asia, averaging 220,000 b/d in 2015, an increase of 138,000 b/d over 2014 (Figure 3). Asia is expected to be the leading source of global propane consumption growth, with an expanding petrochemical sector as the main driver.

Some of the imports from the United States in the region encompassing Central and South America in 2015 reflected supply constraints that are likely to be temporary (Figure 4). For example, Ecuadorian demand for U.S. gasoline increased while PetroEcuador’s 110,000 b/d Esmeraldas refinery was closed for most of the year for a major upgrade. Colombian demand for U.S. gasoline and distillate supplies increased after a reduction in supply from neighboring Venezuela and delays in the opening of Ecopetrol’s new 165,000 b/d refinery in Cartagena. U.S. motor gasoline exports increased to Colombia and Ecuador in 2015, up 15,000 b/d, and 10,000 b/d, respectively, over last year. Supplies from the new and upgraded refineries in Ecuador and Colombia, along with Petrobras’s new 230,000 b/d Abreu e Lima refinery in Brazil, have the potential to reduce the need for gasoline and distillate imports from the United States.

U.S. average retail regular gasoline and diesel fuel prices increase

The U.S. average retail regular gasoline price increased 12 cents from the previous week to $1.96 per gallon, but was down 49 cents from the same time last year. The largest regional increase was on the West Coast, where the price was up 15 cents to $2.39 per gallon, followed by the Gulf Coast, which increased 14 cents to $1.75 per gallon. The Midwest and East Coast prices both gained 11 cents to $1.93 per gallon and $1.88 per gallon, respectively.

The U.S. average diesel fuel price increased eight cents from the prior week to $2.10 per gallon, down 82 cents from the same time last year. The East Coast, Midwest, and Gulf Coast prices all increased eight cents to $2.15 per gallon, $2.07 per gallon, and $1.99 per gallon, respectively. The Rocky Mountain and West Coast prices were $2.00 per gallon and $2.29 per gallon, respectively, each up seven cents from last week.

Propane inventories gain

U.S. propane stocks increased by 0.2 million barrels last week to 62.5 million barrels as of March 11, 2016, 8.2 million barrels (15.1%) higher than a year ago. Gulf Coast and Rocky Mountain/West Coast inventories increased by 0.5 and 0.1 million barrels, respectively, while Midwest and East Coast inventories decreased by 0.3 and 0.1 million barrels, respectively. Propylene non-fuel-use inventories represented 4.8% of total propane inventories.

Residential heating oil price increases, propane price is unchanged

As of March 14, 2016, residential heating oil prices averaged $2.12 per gallon, less than 3 cents per gallon higher than last week and 91 cents per gallon lower than last year’s price for the same week. The wholesale heating oil price this week averaged $1.29 per gallon, nearly 5 cents per gallon higher than last week and almost 65 cents per gallon lower than a year ago.

Residential propane prices were virtually unchanged from last week and averaged $2.02 per gallon, 32 cents per gallon lower than one year ago. Wholesale propane prices averaged 56 cents per gallon, 3 cents per gallon higher than last week and 13 cents per gallon lower than the price last year.