Algeria Energy Profile: Major Oil And Natural Gas Producer – Analysis

By EIA

Algeria is a major crude oil and natural gas producer in Africa and has been a member of the Organization of the Petroleum Exporting Countries (OPEC) since 1969, about 10 years after Algeria first began producing crude oil. Algeria is also a participant in the OPEC+ agreement.

Algeria imports very little energy as its domestic consumption is met by its own oil and natural gas production, which is heavily subsidized. Natural gas and oil account for almost all of Algeria’s total primary energy consumption.

In the first quarter of 2023, the Algerian government plans to offer at least 10 exploration blocks in an upstream bidding round, its first since 2014.1

Petroleum and other liquids

Algeria held an estimated 12.2 billion barrels of proved crude oil reserves at the beginning of 2023.2

Algeria’s oil fields produce high quality, light, sweet crude oil with a very low sulfur content. The country’s main crude oil grade is the Sahara blend (API gravity of 46.0° and a sulfur content of 0.10%), which is a blend of crude oils produced at fields in the Hassi Messaoud region.3

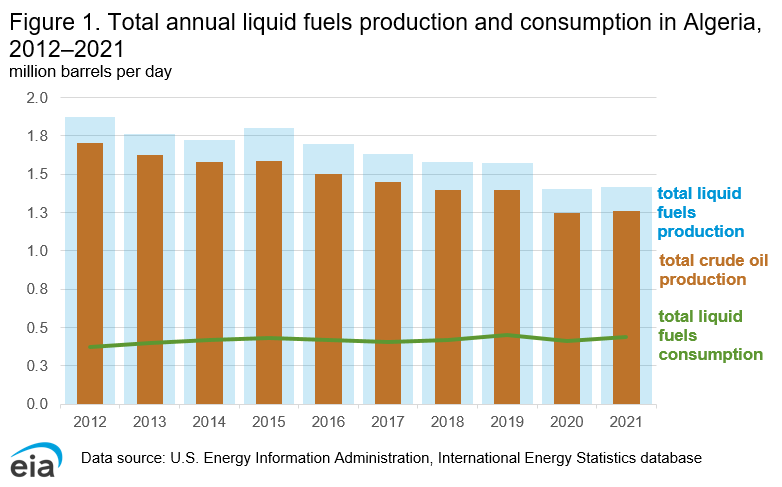

Algeria’s largest oil fields are mature. Algeria has struggled to attract new investment in its upstream segment and been unable to prevent production declines (Figure 1).

In December 2019, the Algerian government introduced a new hydrocarbons law meant to attract international investment in the upstream sector. The law reduces taxes across a number of upstream activities and simplifies the contractual agreement structure and other legal procedures for international investors.4

Sonatrach, Algeria’s state-owned oil company, solely owns and operates Algeria’s refineries, which were built between 1960’s and 1980’s. Most recently, the Adrar refinery (2007) and the condensate splitter at the Skikda refinery (2009) were built.5 A number of proposals were made in 2012 to construct new refineries and to expand existing ones, but progress was repeatedly delayed. Eventually construction started on three of the proposed refineries, the Hassi Messaoud, Bishkra, and Tiaret refineries, and they are set to begin commercial operations within the next five years. Sonatrach is planning to upgrade the Skikda refinery by building a fuel cracker and naphtha processing unit to produce gasoline and diesel, but a final investment decision has not yet been reached (Tables 2 and 3).6

| Refinery name | Nameplate capacity (000s barrels per day) | Status | Ownership/Operator |

|---|---|---|---|

| Adrar | 13 | Operating | JV between China National Petroleum Company and Sonatrach |

| Algiers (Sidi Rezine) | 77 | Operating | Sonatrach |

| Arzew | 81 | Operating | Sonatrach |

| Hassi Messaoud | 23 | Operating | Sonatrach |

| Skikda I | 355 | Operating | Sonatrach |

| Skikda II (natural gas condensate splitter) | 122 | Operating | Sonatrach |

| Total | 671 | ||

| Data source: Middle East Economic Survey as of January 2020, Refining & Petrochemicals |

| Refinery name | Target completion date | Notes |

|---|---|---|

| Hassi Messaoud | 2024 | When completed, refinery is expected to have a capacity to produce 5 million tons of oil products and 120,900 tons of natural gas. Planned refinery capacity is about 112,000 b/d. |

| Skikda | NA | Expansion of refinery planned to enable refinery to produce diesel and gasoline. |

| Tiaret | NA | Initial launch date of 2022 delayed; final investment decision not expected until after 2025. Refinery capacity is expected to be 100,000 b/d. |

| Biskra | NA | Initial launch date of 2022 delayed; final investment decision not expected until after 2025. |

| Data source: NS Energy Business, Energy Capital & Power, Middle East Economic Survey, government press releases, Africa News, S&P Global Platts |

Natural gas

Algeria held an estimated 159 trillion cubic feet (Tcf) of proved natural gas reserves at the beginning of 2023.7

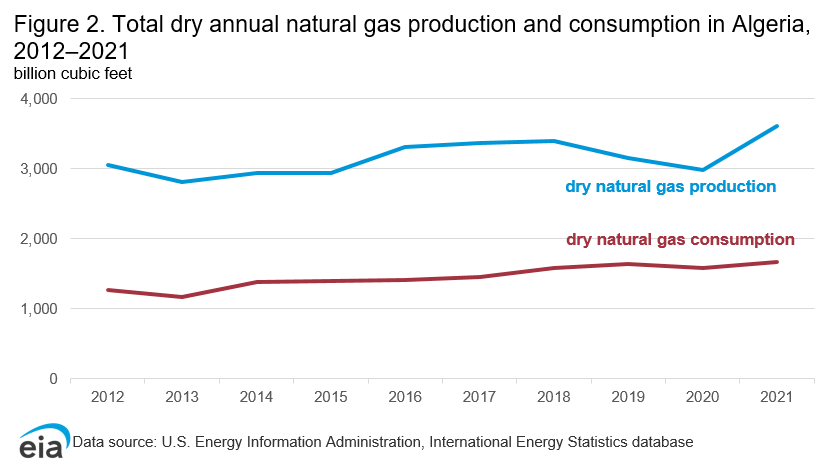

Dry natural gas production averaged about 3.2 Tcf between 2012 and 2021, while dry natural gas consumption averaged 1.5 Tcf over the same time period. In 2020, natural gas production fell as a result of the impact of the COVID-19 pandemic on economic activity and thus lower crude oil consumption, but it quickly rose again in 2021, reaching a record high of 3.6 Tcf (Figure 2).8

According to the Middle East Economic Survey, the increased production in 2021 is attributed to upstream investment that brought online a number of new project startups and expansions, especially at its largest field, Hassi R’Mel, as well as a reduced need for natural gas reinjection at its oil fields as a result of lower crude oil production levels, thus freeing up more natural gas for domestic consumption and export (Table 4).9

| Project name | Location | Status | Operator and ownership | Estimated startup year |

|---|---|---|---|---|

| Touat | Southwest | operating | Neptune (operator) 35%, Engie 30%, Sonatrach 35% | 2019 |

| El Hamra (boosting project) | Illizi Basin | operating | Sonatrach | 2020 |

| North Berkine | Berkine Basin | operating | Eni, Sonatrach | 2020 |

| Menzel Ledjmet SE satellites | Berkine Basin | operating | Sonatrach | 2020 |

| Gassi Touil (peripheral fields) | Berkine Basin | operating | Sonatrach | 2020 |

| Hassi R’Mel (boosting project) | Hassi R’Mel Dome | operating | Sonatrach | 2021 |

| Tinhert phase 1 expansion (Ohanet tie-in) | Illizi Basin | operating | Sonatrach | 2022 |

| Isarene (Ain Tsila) | Illizi Basin | under development | Sunny Hill (operator) 38%, Sonatrach 62% | 2023 |

| Hassi Bahamou/Reg Mouaded (SW Gas Project phase 2) | Southwest | under development | Sonatrach | 2024 |

| Hassi Tidjerane (SW Gas Project phase 2) | Southwest | under development | Sonatrach | 2024 |

| Tinerkouk (SW Gas Project phase 2) | Southwest | under development | Sonatrach | 2024 |

| Touat Phase 2 | Southwest | planned | Neptune (operator) 35%, Engie 30%, Sonatrach 35% | 2026 |

| Timimoun (ramp up project) | Southwest | under development | Total (operator) 38%, Cepsa 11%, Sonatrach 51% | unknown |

| South Berkine | Berkine Basin | under development | Eni 49%, Sonatrach 51% | unknown |

| Tinher phase 2 expansion (Alrar tie-in) | Illizi Basin | under development | Sonatrach | unknown |

| Tin Fouye Tabankort | Illizi Basin | planned | Total 26.4%, Repsol 22.4%, Sonatrach 51% | unknown |

| Tin Fouye Tabankort Sud | Illizi Basin | planned | Total 49%, Sonatrach 51% | unknown |

Note: boosting projects are development projects that aim to maintain output levels at the El Hamra and Hassi R’Mel fields. Ramp up projects are development projects that aim to increase total output at an existing field.

Coal

Algeria does not hold any reserves of coal and, as a result, produces no coal. Algeria consumes very small amounts of coal, averaging 28,000 short tons per year from 2012 to 2021 (Figure 3).10

Electricity

Algeria has renewable energy potential as a result of its geographic features that are conducive to renewable power generation, such as its relatively long coastline on the Mediterranean Sea suitable for wind and desert regions that could provide high levels of solar.11

Algeria has 13 hydropower plants, mainly located in the northern parts of the country where rainfall is relatively plentiful.12 Although the share of renewable energy in the generation mix remains limited, it is growing. Algeria’s electric power sector primarily uses fossil fuel-derived sources for generation, comprising about 97% of total power capacity in Algeria.

Algeria’s total electricity capacity nearly doubled between 2011 and 2020. Additions of natural gas-fired or combined-cycle natural gas turbine (CCGT) power plants, which generate electricity more efficiently relative to Algeria’s older power plants, propelled most of this growth.13Sonelgaz had planned to bring an additional 4 gigawatts (GW) of CCGT capacity online by the end of 2021, but it only achieved the partial startup of the 1.4 GW Bellara CCGT plant and a 1.2 GW unit at the Naama CCGT plant. Although the growth of electricity capacity was significant, construction of many of the CCGT plants have reportedly faced considerable delays.14

The Algerian government’s renewable energy targets call for 15 GW of power capacity at a rate of 1 GW per year by 2035.15 To achieve these ambitious targets given the relatively short timeframe and low capacity of renewable energy-derived power capacity (of less than 1 GW in 2020), the government seeks to attract foreign investment in power projects. In December 2021, Algeria launched a call for bids to install 1 GW of solar photovoltaic capacity, split into 11 projects ranging in size from 50 megawatts (MW) to 300 MW. However, the deadline to submit bids was postponed, and the estimated project start dates for these contracts, once awarded, is around the end-2023 or early 2024.16

Energy trade

According to our estimates and Kpler’s estimates, Algeria imports virtually no crude oil. Crude oil exports from Algeria averaged about 599,000 barrels per day (b/d) between 2012 and 2021, including a decrease in 2020 because of the COVID-19 pandemic’s impact on global petroleum consumption. In 2021, Algeria exported about 428,000 b/d of crude oil and condensate, and a majority of the exports went to Europe (289,000 b/d). France (80,000 b/d) and Spain (49,000 b/d) received most of these exports. Relatively smaller volumes were exported to the Asia-Pacific and Western Hemisphere.17

According to estimates by Kpler, Algeria exported an average of 115,000 b/d of liquefied petroleum gas (LPG) between 2017 and 2021. Algeria exported butane and propane from its refineries to Europe and Africa, which were its top two primary regional destinations in 2017–2021. Europe accounted for an average of 76% of total LPG exports, and Africa accounted for an average of 14% over that time period.18

Given the abundance of natural gas relative to its domestic needs, Algeria does not import any natural gas, and it exports the natural gas it does not use for domestic consumption. Algeria exported an average of about 1.7 Tcf of natural gas between 2011 and 2020.19

According to BP’s 2022 Statistical Review of World Energy, Algeria exported about 1.9 Tcf of natural gas in 2021, most of which went to Europe. About 567 billion cubic feet (Bcf) of natural gas was exported as LNG, and the remaining 1.4 Tcf was shipped via pipeline.20

Algeria is among the top African LNG exporters and primarily exports its LNG to Europe.21 Algeria has four LNG terminals currently in operation, all owned and operated by Sonatrach.22 Between June 2020 and July 2021, the Skikda LNG terminal was shut down as a result of a sudden failure of a turbine control mechanism at the terminal. The incident did not affect LNG deliveries because Sonatrach had spare liquefaction capacity at its other terminals at Arzew.23 In February 2022, Sonatrach signed a contract with Sinopec to expand and upgrade the Skikda LNG terminal by increasing its storage capacity and modernizing its port facilities to accommodate larger vessels (Table 5).24

Algeria has three major intercontinental pipelines that export natural gas to Europe: the Enrico Mattei (Transmed) pipeline, the Medgaz pipeline, and the Maghreb-Europe (MEG) pipeline. The capacity of the Medgaz pipeline, which delivers natural gas to Spain, increased from 283 Bcf per year to 378 Bcf per year at the end of 2021 after a third turbo compressor was put into service.25

Algeria suspended delivery of natural gas exports via the MEG pipeline to Spain in October 2021 as a result of increased political tensions between Algeria and Morocco, which is a destination as well as a transit country for Algeria’s natural gas exports.26 However, in June 2022, deliveries of natural gas through the MEG pipeline resumed, albeit in the opposite direction, when Spain began exporting natural gas to Morocco. Spain is reportedly using LNG imports (not from Algeria) sourced on the international market, which are then re-gasified and transported to Morocco.27

The construction of two major regional pipelines, the Gasdotto-Algeria Sardegna-Italia (GALSI) pipeline and the Trans-Saharan Gas pipeline (TSGP), has been proposed but no final investment decision has been announced. In June 2022, the energy ministers from Niger, Nigeria, and Algeria signed a memorandum of understanding to set up a task force for the Trans-Saharan Gas pipeline that aimed to update the existing feasibility study. If built, the Trans-Saharan Gas pipeline could transport piped natural gas from Nigeria to Algeria’s Hassi R’Mel field, where natural gas could be transported to Europe via Algeria’s intercontinental pipelines.28 Talks regarding the development of the GALSI pipeline project, which originally aimed to deliver natural gas to Italy, have reportedly restarted, and the pipeline could potentially transport green hydrogen instead. No concrete plans have been announced.29

Algeria imports all the coal it consumes, nearly all of which was metallurgical coal. Algeria imports small quantities of bituminous coal.30

| Project Name | Ownership | Start date | Number of trains | Number of storage tanks | Nominal liquefaction capacity (billion cubic feet per year) | Storage capacity (million cubic feet) |

|---|---|---|---|---|---|---|

| Arzew GL1Z | Sonatrach | 1978 | 6 | 3 | 379 | 11 |

| Arzew GL2Z | Sonatrach | 1981 | 6 | 3 | 394 | 11 |

| Arzew GL3Z | Sonatrach | 2014 | 1 | 2 | 226 | 11 |

| Skikda GL1K | Sonatrach | 2013 | 1 | 1 | 216 | 5 |

| Total | 1,215 | 38 | ||||

| Data source: GIIGNL 2022 Annual Report |

| Pipeline name | Status | Ownership | Route | Start date | Length of pipeline (miles) | Pipeline capacity (billion cubic feet per year) |

|---|---|---|---|---|---|---|

| Enrico Mattei (TransMed) pipeline | operational | Sonatrach, Eni | Algeria to Italy via Tunisia | 1983 | 1547 | 1183 |

| Maghreb-Europe Gas pipeline (MEG) | operational1 | Sonatrach, Naturgy, Enagas, Galp Energia | Algeria to Spain/Portugal via Morocco | 1996 | 844 | 424 |

| Medgaz pipeline | operational | Sonatrach, Naturgy | Algeria to Spain via the Mediterranean Sea | 2011 | 473 | 378 |

| Gasdott Algeria – Sardegna Italia (GALSI) pipeline | shelved | Sonatrach, Edison, Enel, Hera Group | Algeria to Italy | unknown | 538 | 283 |

| Trans-Saharan Gas pipeline (TSGP) | proposed | Sonatrach, Nigerian National Petroleum Corporation, Niger Ministry of Petroleum, Energy, and Renewable Energies | Nigeria to Algeria via Niger | unknown | 2580 | 1059 |

1Deliveries of natural gas from Algeria to Morocco and Spain/Portugal via the MEG pipeline were suspended in October 2021. The pipeline resumed transportation of natural gas, but in the opposite direction, with Spain exporting natural gas to Morocco.

Source: This article was published by EIA

Endnotes

- “Algeria Prepares Oil & Gas Bid Round,” Middle East Economic Survey, Vol. 65, Issue 44, November 4, 2022.

- “Worldwide Look at Reserves and Production,” Oil & Gas Journal, Worldwide Report [Table], December 5, 2022.

- “Crude Grades,” McKinsey Energy Insights, accessed December 6, 2022.

- International Trade Administration, “Algeria Hydrocarbons Law,” Market Intelligence, February 25, 2020. International Energy Agency, “Law No. 19-13 – Law governing hydrocarbon activities,” June 28, 2022. International Energy Agency, “Law No. 05-07 – Law governing hydrocarbon activities,” February 22, 2022. Mehdi S Haroun and Nora Djeraba, “Overview of the New Algerian Hydrocarbons Law,” Energy Law Exchange, King & Spalding LLP, March 13, 2020.

- “Algeria Eyes Refinery Bidders As Gasoline, Diesel Consumption Dips,” Middle East Economic Survey, Vol. 60, Issue 08, February 24, 2017. “Algeria Finally Advances Major Refinery Project,” Middle East Economic Survey, Vol. 63, Issue 02, January 10, 2020. Abdelghani Henni, “Sonatrach reviews CNPC’s Adrar refinery contract,” Refining & Petrochemicals, January 26, 2012.

- “Algeria’s Planned Hassi Messaoud Refinery: Chinese, Korean Firms In The Running,” Middle East Economic Survey, Vol. 61, Issue 22, June 1, 2018. “Hassi Messaoud Oil Refinery Project,” NS Energy Business, accessed December 6, 2022. “Refinery News Roundup: Some refineries in Africa remain offline,” S&P Global Platts, May 18, 2021.

- “Worldwide Look at Reserves and Production,” Oil & Gas Journal, Worldwide Report [Table], December 5, 2022.

- (Lejla deleted from Word document)

- “Algeria’s Gas Output Turnaround,” Middle East Economic Survey, Vol. 64, Issue 20, May 21, 2021. “Algeria: Record Gas Output,” Middle East Economic Survey, Vol. 64, Issue 29, July 23, 2021. “Algeria’s Gas Burn Surges Amid Record Power Demand,” Middle East Economic Survey, Vol. 64, Issue 38, September 24, 2021. “Algeria Smashes Gas Output Record For 2021, Can It Keep Up?” Middle East Economic Survey, Vol. 65, Issue 12, March 25, 2022.

- U.S. Energy Information Administration, International Energy Statistics database, accessed December 29, 2022.

- International Trade Administration, “Algeria – Renewable Energy: Current Market Trends,” Energy Resource Guide, accessed January 6, 2023.

- “Algeria Powers Ahead with Huge Renewable Energy Plans,” International Energy Forum, June 21, 2021.

- “Algeria Adding Powergen Capacity, But Big CCGT Progress Piecemeal,” Middle East Economic Survey, Vol. 62, Issue 28, July 12, 2019. “Algeria Sees Power Efficiency Leap As CCGTs Ramp Up,” Middle East Economic Survey, Vol. 63, Issue 42, October 16, 2020.

- “Algeria’s Power Output Falls For First Time On Record In 2020,” Middle East Economic Survey, Vol. 64, Issue 04, January 29, 2021. “Algeria Launches 1GW Solar PV Tender,” Middle East Economic Survey, Vol. 65, Issue 01, January 7, 2022.

- International Trade Administration, “Algeria – Renewable Energy: Current Market Trends,” Energy Resource Guide, accessed January 6, 2023. “Algeria Powers Ahead with Huge Renewable Energy Plans,” International Energy Forum, June 21, 2021.

- “Algeria Launches 1GW Solar PV Tender,” Middle East Economic Survey, Vol. 65, Issue 01, January 7, 2022. “Algeria Extends 1GW Solar Tender, Again,” Middle East Economic Survey, Vol. 65, Issue 24, June 17, 2022. “Algeria Solar: Target 2023,” Middle East Economic Survey, Vol. 65, Issue 28, July 15, 2022.

- U.S. Energy Information Administration, International Energy Statistics database, accessed November 1, 2022. Kpler crude oil flows database, accessed January 11, 2023.

- Kpler crude oil flows database, accessed January 11, 2023.

- U.S. Energy Information Administration, International Energy Statistics database, accessed November 7, 2022.

- BP, 2022 Statistical Review of World Energy, 71st edition, June 2022.

- See medium-term and long-term contracts in force for 2021 in the International Group of Liquefied Natural Gas Importers (GIIGNL), 2022 Annual Report, May 24, 2022, pg. 12.

- International Group of Liquefied Natural Gas Importers (GIIGNL), 2022 Annual Report, May 24, 2022.

- “Algeria’s Sonatrach shuts Skikda LNG export terminal,” LNG Prime, June 21, 2021. “Algeria’s Sonatrach resumes Skikda LNG production,” LNG Prime, August 6, 2021. “Algeria’s Skikda LNG Export Terminal Down,” Middle East Economic Survey, Vol. 64, Issue 25, June 25, 2021.

- Sanja Pekic, “Sonatrach and Sinopec sign Skikda LNG storage tank deal,” Offshore Energy, February 18, 2022. “Algeria Eyes Greater LNG Access with Skikda Port Expansion,” Middle East Economic Survey, Vol. 65, Issue 32, August 12, 2022.

- “Algeria will expand the capacity of the Medgaz pipeline to Spain by 1/3,” Enerdata, November 10, 2021. “Naturgy and Sonatrach establish that the Medgaz expansion will start operations in the fourth quarter of 2021,” Naturgy press release, July 13, 2021.

- Intissar Fakir, “Given capacity constraints, Algeria is no quick fix for Europe’s Russian gas concerns,” Middle East Institute, March 8, 2022. Francis Ghilès, “Escalating rivalry between Algeria and Morocco closes the Maghreb-Europe pipeline,” Barcelona Center for International Affairs, November 2021.

- Álvaro Escalonilla, “Spain allows Morocco to use the Maghreb-Europe gas pipeline in a new sign of rapprochement,” Atalayar, February 2, 2022. Juan Peña, “The Maghreb-Europe gas pipeline connecting Spain with Morocco is back on steam,” Atalayar, June 29, 2022. Safaa Kasraoui, “Maghreb-Europe Pipeline: Gas Supply Spain Sends To Morocco is From US,” Morocco World News, July 4, 2022. “Spain Restarts Natural Gas Flows to Morocco on Maghreb-Europe Pipeline,” Pipeline & Gas Journal, June 29, 2022.

- Martina Schwikowski, “African countries seek to revive Sahara gas pipeline,” DW, August 12, 2022. Ali Boukhlef, “Algeria: The Trans-Saharan pipeline, a Nigerian alternative to Russian gas?” Middle East Eye, September 10, 2022. International Trade Administration, “Algeria Trans Saharan Gas Pipeline: Trans-Saharan Gas Pipeline Project to Connect European Union to African Energy Producers,” Market Intelligence, September 22, 2022. “Dreams Of A Trans-Saharan Gas Route To Europe,” Middle East Economic Survey, Vol. 65, Issue 33, August 19, 2022.

- Hacene Houicha, Dalila Henache, “Will Algeria-Italy Galsi Pipeline Be Revived?” echoroukonline.com, October 17, 2022. “Algeria: Energy Minister Arkab relaunches the hypothesis of the Galsi pipeline project with Italy,” Agenzia Nova, December 20, 2022.

- U.S. Energy Information Administration, International Energy Statistics database, accessed December 29, 2022.