An Inflection Point In US Trade Policy – Analysis

By William Reinsch*

December 2022 highlighted how much US trade policy has changed in recent years. It is tempting to blame the changes on former US president Donald Trump, whose protectionist views were strongly held and clearly stated. Many observers have been surprised by the Biden administration’s continuation of many Trump policies, albeit with different rhetoric, which culminated in the December rejection of two World Trade Organization (WTO) decisions that went against the United States.

The change is due to several developments in the global economy that have been underway for some time. The first is the confluence of trade and national security. US public opinion has shifted markedly against China over the past decade and China is now viewed as both an economic and security threat.

This perception, combined with Russia’s invasion of Ukraine, has made it difficult to have a conversation about trade without also discussing its impact on US national security. Much of the debate has concerned sanctions and export controls, but the Trump tariffs on China, especially steel and aluminium tariffs, have also been a major cause of controversy and, in the latter case, the source of WTO litigation.

The second change is the belief of many in the Biden administration that traditional free trade agreements have benefitted large corporations and their executives at the expense of workers. The administration is determined to rectify that inequity. So far this has meant avoiding traditional trade negotiations that include market access and instead promoting re-shoring, or at least ’friend-shoring’, to bring manufacturing jobs back to the United States. The recently enacted Inflation Reduction Act is a good example of this, providing substantial incentives for bringing manufacturing back to the United States in sectors like semiconductors, batteries and critical minerals.

The third change, long in the making, is companies’ interest in making their supply chains more resilient and less vulnerable to chokepoints and shortages caused by natural disasters, pandemics or political interference. Here, too, companies are interested in security, though for them it is economic and supply security rather than national security, although the former is directly related to the latter. Company efforts to shore up their supply chains generally have the support of the US government.

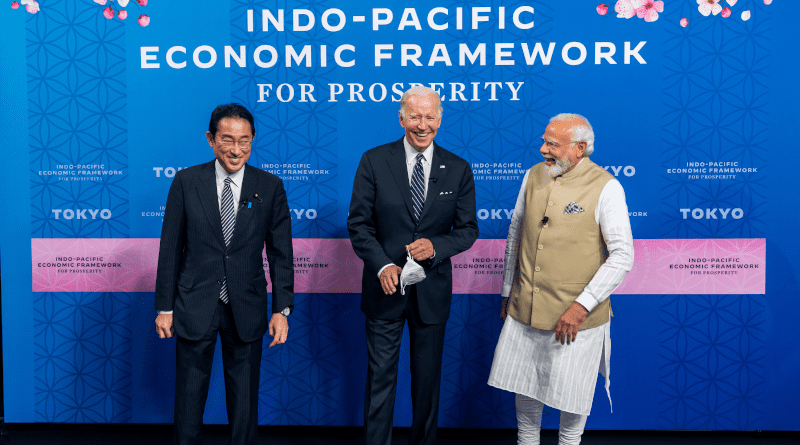

The result of all these trends is a thorough reassessment by both companies and government of the risks of doing business internationally. All three trends are at work in the US economic policy in Asia, particularly in the Indo-Pacific Economic Framework (IPEF). Although no one says it out loud, the IPEF is about reinforcing US presence in the region and presenting an alternative to China’s influence, just as the Trans-Pacific Partnership was. It is also conspicuously not about market access.

Asian nations looking for tangible benefits are not going to find very many. The US approach, typified by its slogan, ’a trade policy for workers’, focuses on better rules and standards on labour and the environment as well as other regulatory issues.

The changes in other countries’ policies that the United States is seeking are not economically or politically cost-free, but so far the United States does not seem prepared to pay for them, arguing that the changes sought are good for these countries and for the world in order to avoid a ’race to the bottom’. That is probably true, but it is not likely to be sufficiently persuasive by itself.

As a result, much of the negotiation will focus on issues not directly related to trade but which align closely with the trends noted above, like supply chain resilience, cooperation, information sharing, infrastructure, decarbonisation, tax and anti-corruption policies.

The most difficult pillar will be the trade pillar. The Asian parties will find many of the US demands difficult to accommodate and without tangible benefits.

In the United States, Biden has put forward the IPEF in response to widespread criticism that he does not have an Asian economic policy. He will soon discover that his proposals do not solve the political dilemma of trade for the Democratic Party. The proposals are too little for the business community who want more market access and too much for the Democrats’ left wing, who will oppose binding trade agreements that might tie the Congress’ hands in developing US policy in the future.

The US rejection of the WTO cases that it lost will further complicate trade negotiations by casting doubt on the US’ willingness to respect international trade rules and undermining its credibility when it seeks to call out other countries for their violations. The United States has been the bulwark of the system for the past 75 years, but it now risks becoming the chief offender.

If the other parties to the IPEF begin to doubt the US commitment to expanding trade and to the international rules that govern it, two things are likely to happen. The IPEF negotiations will be more difficult to conclude and the other nations may start devoting more of their time and resources to other regional groups, such as RCEP and APEC. This would not be in the US’ interest and the consequential increasing in China’s economic influence in the region may not ultimately be in theirs.

*About the author: William Reinsch holds the Scholl Chair in International Business at the Center for Strategic and International Studies in Washington, DC.

Source: This article was published by East Asia Forum