Cyprus Admits Deficit To Exceed Forecast

By EurActiv

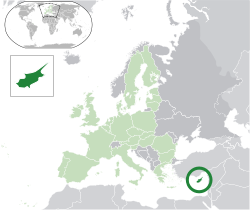

(EurActiv) — Cyprus, which holds the rotating EU presidency, is set to exceed its fiscal deficit target this year unless measures are taken to improve its finances, a government spokesman said today (23 August).

The admission comes as authorities are in the midst of complex negotiations with international lenders for a bailout to shield Cypriot banks that are heavily exposed to Greece.

The deficit will be around 4.5% of gross domestic product, government spokesman Stefanos Stefanou told reporters.

The government had forecast a deficit of 3.5% of GDP for this year, after growth in revenue in the first half of the year was slower than expected because of a deeper-than-anticipated recession.

Cyprus’ economy contracted for a fourth straight quarter in the second quarter of 2012, data showed last week, bringing the annualised decline in output to 2.3%.

The island, which represents 0.2% of the economy of the eurozone, was running a deficit of 3.0% of GDP in the first half of the year.

Authorities have prepared a plan for further cutbacks in spending and on boosting revenue, Stefanou said.

“This is now going to be more specific. Taking the data of the first half into account we will continue efforts to be as close to our target as possible,” he said.

The troika, a team of international lenders from the European Central Bank, the IMF and the European Commission, carried out two missions to Cyprus over July to assess the island’s bailout needs.

It was not clear when the troika would return to Cyprus. “That will depend on the course of negotiations,” Stefanou said, briefing journalists after a cabinet meeting.

The precise amount of aid is unclear, but Cyprus will require about €2.3 billion – or more than 10% of its GDP – just to buffer its two largest banks badly hit by their exposure to Greece.

Cash will also need to cover Cyprus’ fiscal requirements, because it has been unable to access international capital markets for funding since May 2011 because of double-figure yields demanded by investors.