China’s October Economic Data Heralds A Gloomy Prospect – Analysis

By Anbound

By He Jun

The recent monthly economic data of China, released on November 15 by the country’s National Bureau of Statistics, indicates that the country’s economic situation is not exactly optimistic. Such a development will certainly put pressure on its economic recovery in the fourth quarter this year, further dragging down economic growth throughout the year.

In terms of consumption n, in October, the total retail sales of domestic consumer goods were RMB 4,027.1 billion, down 0.5% year-on-year and 0.68% month-on-month, reversing the previous upward trend and significantly lower than market expectations (up 0.7%). Among them, retail sales of consumer goods other than automobiles amounted to RMB 3,657.5 billion, down by 0.9%. Previously, the indicator had increased by about 2.5% year-on-year in September. In the first 10 months of this year, the total retail sales of domestic consumer goods were RMB 36,057.5 billion, a year-on-year increase of 0.6%; These include retail sales of consumer goods other than automobiles, which amounted to RMB 32,370.2 billion, an increase of 0.5%. Compared with the previous value in September, it fell by 0.1 percentage points. The previous data from January to September saw a year-on-year increase of 0.7%, a year-on-year increase of 0.5% from January to August, and a year-on-year decrease of 0.2% from January to July.

Researchers at ANBOUND point out that, the year-on-year growth rate of consumption returned to negative growth in October is a very negative signal, showing that domestic consumption is further declining under the repeated impact of the COVID-19 pandemic. Since the outbreak of the novel coronavirus in China back in 2020, consumption has been particularly suppressed due to the restrictions imposed on people’s movement. In the past three years, consumption has continued to be sluggish, business closures are increasing, and people’s income expectations are declining. Under repeated blows, the sluggish consumption has changed from a temporary slowdown in the past to a trend of “solidified” decline. Considering the contribution of consumption to the economy, it can be argued that this largest support for China’s economy has become weak.

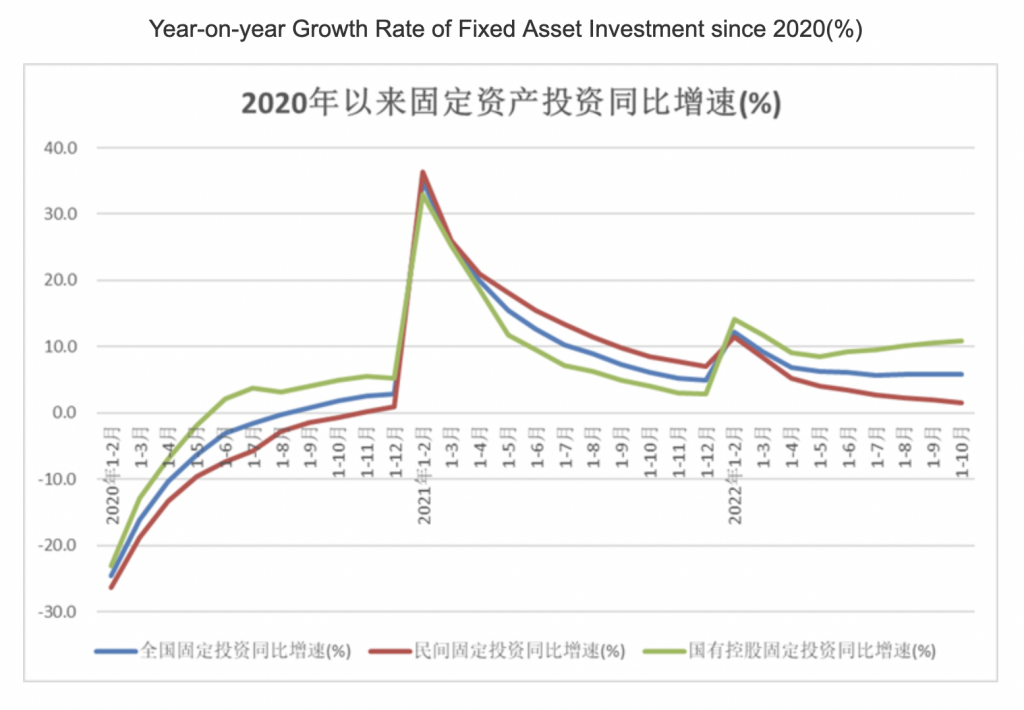

Investment data also paints a gloomy picture. From January to October, the national fixed asset investment (excluding rural households) was RMB 47,145.9, a year-on-year increase of 5.8%. This growth rate is the second lowest cumulative investment growth rate so far this year, only higher than the 5.7% recorded in January-July. It should be noted that the first 7 months of this year are the most affected by the pandemic in China. Notably, in the first 10 months, private fixed asset investment was RMB 25,841.3 billion (accounting for 54.8% of national investment, the lowest value since private investment), an increase of 1.6% year-on-year, while state-controlled investment increased by 10.8% year-on-year. The growth rate of private investment has further declined, and the gap with the growth rate of state-controlled investment in the same period is further widening. In terms of registration type, the fixed asset investment of domestic enterprises increased by 6.0% year-on-year, and the fixed asset investment of Hong Kong, Macao, and Taiwanese enterprises increased by 2.3%. Meanwhile, the fixed asset investment of foreign enterprises decreased by 3.0%. This means that although the number of foreign investments attracted by China continues to grow, fixed asset investment by foreign companies is already reducing.

In terms of foreign trade, a slowdown in the external demand market may put a bottleneck on China’s past optimistic exports. Since 2020, exports have been an important factor driving the country’s economy to maintain growth. The world suffered a setback in production due to the pandemic, causing orders to shift to China, which has resumed production. In 2021, China’s import and export of goods increased by 21.4% year-on-year; Among them, exports reached RMB 21.7 trillion, a year-on-year growth rate of 21.2%. However, this year’s export pull is significantly lower. As international market demand slows due to higher U.S. interest rates and high inflation, the economic slowdown in advanced economies will dampen demand, affecting China’s exports. In the first 10 months of 2022, China’s imports and exports of goods increased by 9.5% year-on-year (halving the growth rate in the same period last year), and exports increased by 13% year-on-year. Slower growth in external demand and exports will affect economic recovery this year.

In terms of industrial production, in October, the added value of industries above the designated size increased by 5.0% year-on-year (6.3% in September). From a month-on-month perspective, in October, the added value of industries above the designated size increased by 0.33% over the previous month. From January to October, the added value of industries above the designated size increased by 4.0% year-on-year. In terms of economic type, in the same month, the added value of state-controlled enterprises increased by 4.4% year-on-year; Joint-stock enterprises increased by 5.9%, and foreign-invested enterprises and Hong Kong, Macao, and Taiwan investment enterprises increased by 2.0%; The private sector grew by 3.1%. It is worth noting that the climbing process of the country’s domestic industrial growth, which began at the bottom in April this year, began to encounter obstacles in October and turned downward.

There are obvious negative factors affecting China’s economic growth. The repeated impact of the COVID-19 outbreaks is the biggest influencing factor. On the other hand, the continued downturn in the real estate market, weak investment, and risk accumulation have also generally dampened the urban economy and gradually dragged banks down. Furthermore, the slowdown in external demand under a variety of factors is gradually weakening the role of exports in driving the economy. October was the first month of the fourth quarter of 2022, and the economic signals presented at the beginning of the quarter were negative, which was undoubtedly a blow to the market’s expectations of increased efforts to stabilize growth in that quarter. Judging from the rebound of the novel coronavirus outbreaks in many parts of the country in November, there may be another wave of blows to the fragile economy. Many signals point to the possibility that the stabilization of the economy in the fourth quarter will not be as good as expected. If the economic growth rate in this period does not reach even 4%, it will be difficult for the Chinese economy to reach the 4% growth rate for the whole year.

Final analysis conclusion:

The latest Chinese economic data in October does not offer a promising prospect, where it actually heralds a weaker-than-expected fourth quarter and far less than expected growth throughout the year. In this regard, the country’s domestic market should be prepared for what comes next.

He Jun is a researcher at ANBOUND