Fragile And Conflict-Affected Economies Are Falling Further Behind – Analysis

Even before the pandemic, fragile and conflict-affected states (FCS) already confronted some of the greatest challenges among the world’s economies. While not all FCS face active conflict, most are at risk: global levels of violence are at a 30-year high and more than 80 million people had been forcefully displaced prior to the discovery of the coronavirus.

Now, the continuing pandemic poses a significant risk that the divergence between these countries and the rest of the world will widen—and persist.

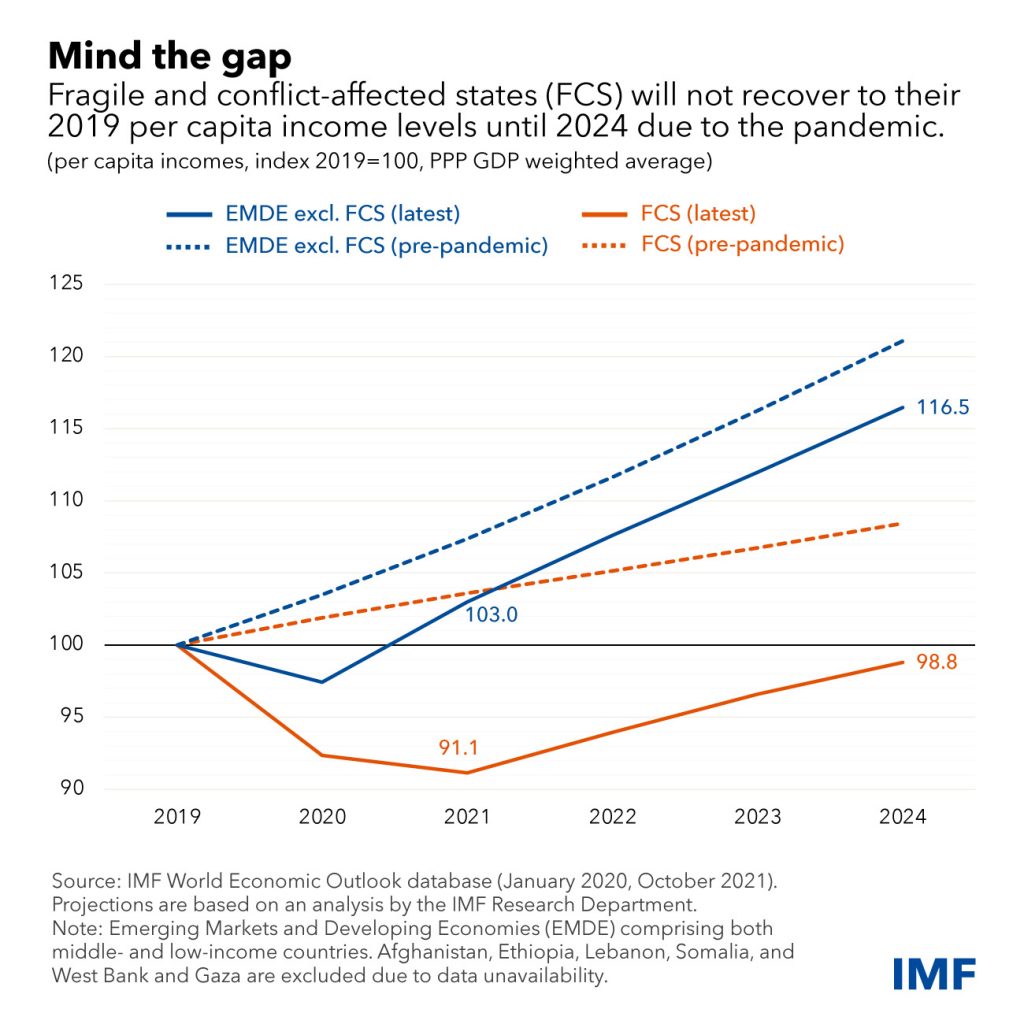

The chart of the week illustrates how the pandemic exacerbated income divergence between these economies and the rest of the world. Per capita incomes in fragile states won’t recover to near their 2019 levels until 2024, IMF projections show; and by then, the gap with pre-crisis per capita income trends is set to remain larger for FCS than for other countries.

These dimming prospects may be difficult to reverse because fragility and conflict interact with—and are often exacerbated by—global trends such as climate change, soaring food prices and gender inequality.

The IMF classifies more than 40 economies as fragile and conflict-affected. Examples include Libya, Yemen, Chad, Democratic Republic of Congo, Somalia, Haiti and Papua New Guinea. Fragile states are already home to nearly 1 billion people and are on course to be home to 60 percent of the world’s poor by 2030 .

While each is different, fragile states typically have reduced institutional capacity and provide limited services for the population. They’re also characterized by limited ability to manage or mitigate social, economic, political, security or environmental risks. Conflict-affected states have active armed violence leading to civilian or military deaths.

In these vulnerable economies, slower recovery has followed an especially hard hit from the pandemic. Their per capita gross domestic product contracted 7.5 percent last year amid increased political tensions, limited policy options to respond to the pandemic, lockdown and other steps to contain the virus, and volatile oil prices.

In addition, debt and inflation pressures are mounting. Compared to pre-pandemic projections, public debt rose by 17 percentage points to 78 percent of gross domestic product in 2020, IMF research shows.

Fragile states also saw consumer prices surge 9 percentage points above their pre-pandemic projections. Food inflation particularly exacerbates food security challenges and is reversing past progress. Global food prices rose 23.1 percent last year, according to the United Nations Food and Agriculture Organization.

Together, these challenges underscore how fragile states risk falling even further behind the rest of the world—and why supporting them, more than ever, must be an international priority.

*About the author: Franck Bousquet is the deputy director coordinating engagement with fragile and conflict-affected states. Prior to joining the IMF, he was the senior director of the World Bank’s Fragility, Conflict and Violence Group. Franck led the development of the Bank’s first Strategy for Fragility, Conflict and Violence.

Source: This article was published by IMF Blog