Libya’s Struggling Economy: Bringing The Oil Sector Back On Track – OpEd

Despite limited improvements with the new election for democracy, the Libyan economy still lingers well below its potential, obstructed by continuing violent conflict and political uncertainty. Libya sits on the largest known oil reserves in Africa and is heavily dependent on revenues from its oil and gas exports.

Libya’s poor economic performance is clear in the numbers with oil and gas. In 2021 oil got only 11% of the budget allocated to the sector, and in 2019 we didn’t get the budget, and we entered 2020 and 2021 with huge debts.” In addition, the production rates are 1.2 million barrels per day,” but Libya plans to make higher rates “if we can get the budgets.” “Libya hopes to raise its oil production to 1.45 million barrels per day in the end and to 1.6 million barrels within two years.” It aspires to reach the level of 2.1 million barrels within four years.” After periods of sharp decline, production rose to about 1.2 million barrels per day on average today, compared to about 1.6 million before 2011.

Since the 2011 revolution that toppled and killed the dictator Muammar Gaddafi, many armed groups have neglected violence by besieging or destroying oil facilities, and some of them were destroyed under the Haftar regime. In 2014, Libya faced many oils smuggling to companies in Italy, Tunisia, and Switzerland. The Libyan oil sector also faces frequent obstacles and disturbances from employees, most of which are related to the closure of oil facilities as a result of “protests”, false terrorist attacks, or military actions that sabotaged important ports and fields to benefit from the oil money and give it to the Muslim Brotherhood. While Libya’s oil production was between 1.5 million and 1.6 million BPD before the 2011 NATO-backed uprising.

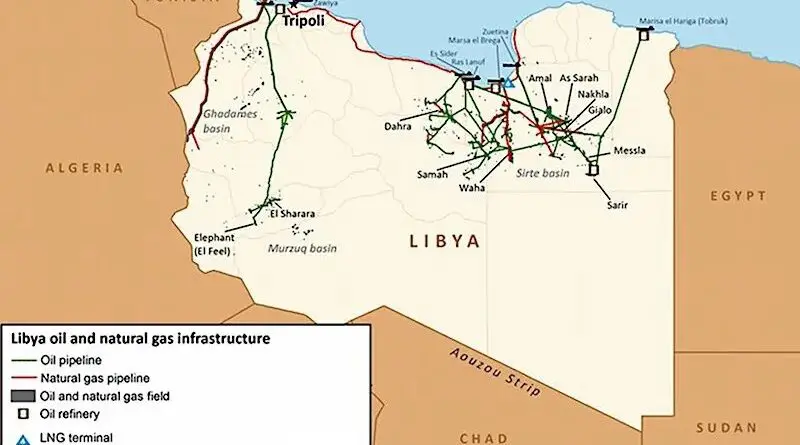

Moreover, we need to increase the oil production of the networks dilapidated and must be stopped regularly to repair pipelines this network 60-year-old equipment that needs to be replaced, but this is not possible because oil and gas companies do not have the budget due to the divisions between rival powers based in Libya’s east and west have long-held the country’s economic activity hostage. Unlike many other Libyan state institutions, the NOC has largely managed to stay neutral in the face of political wrangling, but the institution’s budget was not known due to oil smuggling.

Thus, efforts to rebuild oil and gas infrastructure will need funds ranging from $46-81 billion. Besides oil, Libya has another asset that has yet been explored: it possesses large quantities of gas and makes better use of it that can support the country’s sources of income to re-evaluate and improve Libya.

Most of the Libyan economy is related to the activity of the public sector, while the private sector deals with few and very modest projects, which increased the level of weakness and lack of dynamism prevailing at the economic level, and the Libyan market is not competitive compared to abroad, and the Libyan workforce lacks training, and the shortage and deficit in terms of Human Resources, Poor performance of the banking sector. The difficulties faced by private companies in the real estate sector considering the lack of capabilities and financial resources, as well as the lack of anticipation of available opportunities in general.

There are other problems in securing investment in infrastructure, electricity, water, and health care. He was heavily influenced by the economic, political, and social factors that further divided the country, such as the constant fluctuation in prices. However, in the areas of finance, health, transport, trade, and public services there is a “certain chaos in the activities of the private sector in Libya.” We want to stress the need to create a legal framework for the private sector in the economy.

In financial terms, the Libyan economy is divided into three main sectors for Libya that are considered a strong economy: banking (83%), insurance (16%), and investment (1%). Comparing inflation officially stood at 26.3 percent in 2018, in fact, inflation will rise by up to five times in 2021. This situation mostly comes as a result of smuggling activity, as businessmen and their activities contribute to its heavy dependence on oil revenues, and the agreements signed between Libya, the International Monetary Fund, and the World Bank (WB) allowed Libya to benefit. from a positive circumstance. But after the 2011 revolution, public funds were unwisely spent in many state institutions due to the high expectations of the population and the budget deficit widened to tax and customs revenues. As money was spent in 2015, 36 percent of the central bank’s reserves were used to pay the national budget and try to rebuild the country. In 2016, 70 percent of the budget was withdrawn from the reserves, and the country’s currency reserves of 120-130 billion dollars burned at a rate of 20 billion dollars annually, which means that only an estimated 20-30 billion dollars are left.

Regarding infrastructure, the Local Administration Transfer Committee has initiated many initiatives that need a political player, and the Ministry of Local Government is not concerned with the tensions between eastern and western Libya, this may be an opportunity that should be exploited.

It can achieve stability in the country not only in terms of providing and maintaining sustainable infrastructure, but local structures also need support, state institutions need to be rebuilt, and economic and governance systems inside Libya need decentralization, which is what we need in 2022.