Pakistan Economic Situation Far From Satisfactory

s per “The State of Economy Report 2021-22” released by State Bank of Pakistan, the country’s economic growth is expected to moderate considerably in FY23. Having delivered a headline growth approaching 6% in FY22, the country is expected to even miss the revised growth target of 3% to 4% this time round.

In addition, the government has targeted to reduce the fiscal deficit to 4.9% of GDP in FY23 from 7.9% in FY22, an outcome that would be achieved through both revenue and expenditure measures. Widening of tax base through elimination of exemptions, increase in tax rates and reinstatement of fuel taxes are expected to boost tax receipts. The non-tax revenues are also expected to improve with the re-imposition of PDL.

It must be kept in mind there can be slippages on the expenditure with respect to rehabilitation efforts. The IMF is insisting on higher collection in order to keep the fiscal and primary deficits within permissible levels. Analysts expect fiscal deficit to hover around 6.5% of GDP, despite higher tax collection.

This deviation could be due to: 1) higher debt servicing and 2) potential slippages during 2HFY23 owing to election and flood relief related spending.

Current account deficit situation is expected to improve beyond the original estimates of 3% of GDP in FY23 due to various demand suppression measures implemented by the government.

Likewise, commodity prices have also softened which will reduce the pressure on CAD even further. However, the loss to agriculture produce, induced by the recent floods, is likely to step up import of agriculture commodities, especially cotton.

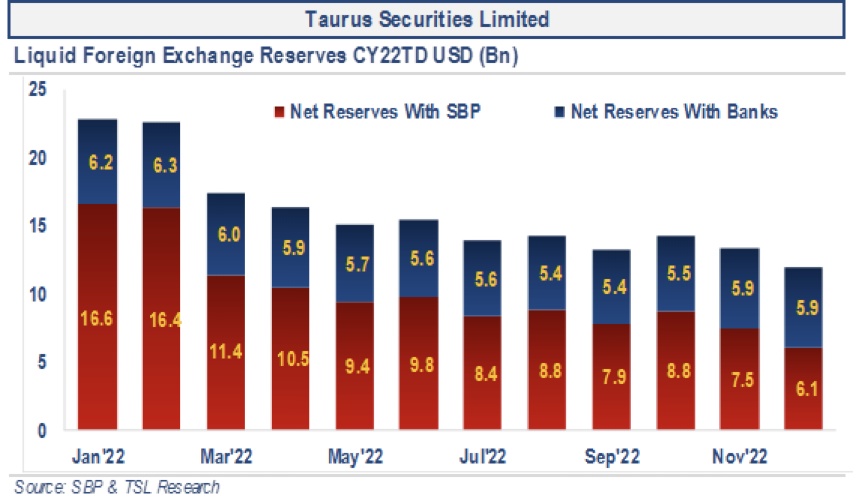

Everyone must keep in mind that Pakistan’s economy is in an extremely fragile state at present with foreign exchange reserves slipping close to US$6 billion, barely enough to provide import cover of 1.16 months.

The external debt is reported at US$127 billion, equivalent to 40% of GDP. Pakistan faces significant challenges on the debt rollover. To this end, during 5MFY23, the gross inflow (including US$1.2 billion from IMF) has been only US$4.9 billion, while the amortization payments have been US$4.1 billion. The market has been jittery and analysts expect the volatility to continue throughout CY23.

As per the central bank, the recent flooding will impinge the country’s real economic activity through various channels, where the losses in agriculture sector arising from the damages to crops and livestock are likely to reverberate through the rest of the economy.

The current estimates for headline growth are 1.7% while analysts expect only a limited uptick in growth outlook during FY24, despite a low base effect, as the central bank would want to keep the indigenous demand in check to manage external account.

Fiscal side is not much better either. The GoP has targeted to reduce the fiscal deficit to 4.9% of GDP in FY23 from 7.9% in FY22, an outcome that would be achieved through a combination of both revenue and expenditure measures. FY23 has got off to a good start in term of collection with FBR exceeding its collection targets for 5MFY23.

There is currently an impasse over the IMF talks over the disbursement of the next US$1.0 billion tranche, with the fund and local authorities unable to agree on the quantitative targets. Analysts expect fiscal deficit to clock in at 6.5% of GDP, despite higher tax collection.

The GoP and the central bank are anticipated to keep the import bill under the wraps beyond FY23 in order to maneuver space on external front. This may result in interest rates remaining elevated and strict control of opening of L/Cs. The fallout, which may inevitably come as a result of adopting this strategy, will be visible in lower headline growth and tax collection. Analysts anticipate GDP growth to remain subdued beyond FY23.