The Loss Of The Exorbitant Privilege – OpEd

Since the Marshall Plan’s adoption, the US dollar has been the world’s undisputed reserve currency. The basic function of a reserve currency is to offer liquidity to the rest of the globe. This is only achievable if the country maintains a permanent current account deficit. This deficit is a direct effect of the reserve currency’s overvaluation in relation to the majority of other currencies.

The traditional commodity sector is diminishing over time as a result of this overvaluation. This means that the reserve currency economy must prioritize high-tech, services, and, in particular, financial services. The function of the reserve currency is to recycle excess savings into debt, specifically treasuries, which can then be transformed back into stocks. This is beneficial to the financial sector. This explains why the City of London became the world’s financial capital, followed by Wall Street after the Marshall Plan.

The structural overvaluation of the dollar helped industrial enterprises outside of the United States. The extra return was visible in the form of high savings, first in Japan and then in China. By implementing hefty trade taxes, Trump has attempted to reduce that excess return and hence the savings. These trade duties are akin to a currency depreciation for producers outside of the United States. This helps to explain why the stock market in the United States outperforms markets in other countries. Long-term returns on U.S. and non-U.S. stocks are the same. So, if the stock market in the United States has been performing well recently, it’s time for a reversal, only to be disappointed because Biden is more extremist than Trump in certain ways.

Outside of the United States, governments and corporations owe trillions of dollars. Those parties believe they can always fund themselves in U.S. currency. Authorities in the United States, on the other hand, have transformed the dollar into a weapon. Almost every financial institution operates in the United States and, as a result, must follow U.S. regulations that apply globally. Iran, Sudan, and Venezuela have already felt the impact of losing access to international payments. Russia was recently added to the list, and the Russian central bank is no longer able to access its dollar reserves.

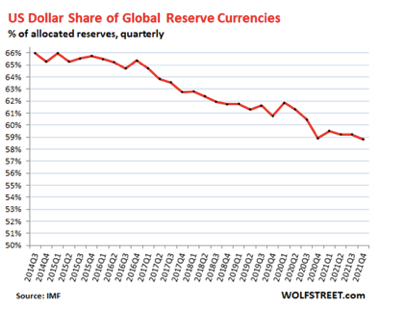

The Eurozone’s and the United States’ monetary madness makes holding dollars or euros undesirable. This policy, in addition to artificially low interest rates, is driving up inflation. The appeal of these two currencies is diminishing now that it appears that even central bankers can lose all of their money in euros and dollars. Nobody will keep reserves in a country where they can easily be confiscated, as Russia is currently experiencing. The dollar dominates world trade, but its share is gradually diminishing. This movement has been hastened by the Russian invasion.

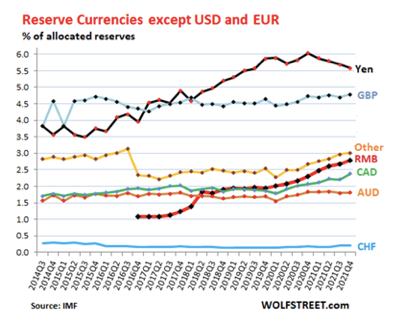

Since the Great Financial Crisis, China has worked to reduce its reliance on the United States and the U.S. currency. One way it is doing so is by establishing financial relationships with Asian countries. Interest rates throughout the big Asian trading bloc will converge to those on the Chinese yuan, just as the Marshall Plan did for European interest rates. The introduction of the digital renminbi will hasten this process.