The Pigouvian Tax Is A Myth – OpEd

A familiar question in a standard microeconomics graduate seminar goes something like this: a Pigouvian tax is not market distorting. True or false?

The expected answer: true.

True?

Any fiscal intervention being definitionally a distortion of how a given market would otherwise operate, how can this be?

Spoiler alert: it boils down to little more than academic charlatanry.

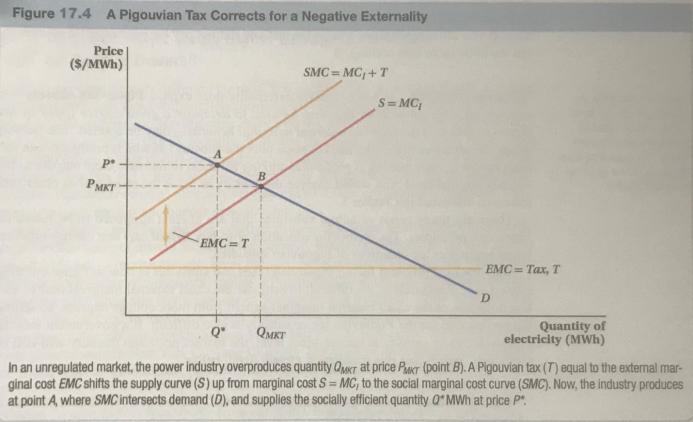

First, a Pigouvian tax is a type of tax “levied on an activity that raises a good’s price to take into account the external marginal costs imposed by a negative externality” (all definitions come from Austan Goolsbee, Steven Levitt, and Chad Syverson’s Microeconomics, 3rd ed.). Along with Pigouvian subsidies, which are “paid for an activity that can be used to decrease a good’s price to take into account the external marginal benefits,” such interventions rest on the same mistaken assumption as every other government intervention in the market: that the optimal quantity of a good and its price can be known in advance of the individual actions of consumers and producers in the given market.

Apart from a jargonistic label meant to obscure this basic fact, a bit of mathematical manipulation is used to further belie the truth.

Consider the following illustration of a hypothetical electricity market with a single producer: the government has decided that it would be better if the supplier produced less electricity at a higher cost to consumers, a dubious notion our current situation is well suited to illustrating. To the concerned technocrat, however, the SMC, or social marginal cost, of electricity, a completely fictional metric, is higher than the producer’s marginal cost (a very real and measurable thing), thus necessitating intervention!

Figure 1: A Pigouvian Tax Corrects for a Negative Externality

Applying its tax and shifting the supply curve up and to the left, the technocrat effectively chooses a price suited to their political agenda. Unsurprisingly, as with the progressives’ obsession with handicapping and eliminating America’s own fossil fuel industry, a policy meant to optimize a desired outcome fails, resulting in all new negative externalities—which no doubt must be addressed as well!

The truth is that all subsidies, tariffs, regulations, and taxes distort how actors would otherwise behave. When tragic shortages result, however, as in the recent case of baby formula, the finger will be predictably pointed everywhere but at the source: government interventions in the market.

The solution, it follows, is more intervention—stunting all possible innovation that might have sprung from other producers attempting to provide a service or good that addresses the supposed problem. The promise is always that this time is different, but history shows this to be either a deliberate lie or a lesson still unlearned.

The total compensation of the average public sector employee being fully twice that of their private sector counterparts, it is just as easy to believe the one as the other. But in either event, it is unacceptable. This example of the regular poverty of academic economic thinking only further illustrates the need for alternative institutions to educate the public. It is the responsibility of concerned and honest intellectuals, therefore, to offer such alternatives, and to fight the obvious lies, half truths, and mistaken assumptions that drive much of what passes for public policy in the United States.

As the Biden administration continues to pursue Donald Trump’s turn toward autarky, we can expect ever more such interventions—such as subsidies to industries supposedly vital to “national security interests.” One such example is the microchip industry, which because of covid-induced supply chain disruptions has seen billions mindlessly thrown down the domestic manufacturing drain.

Though undeniably popular with voters, the long-term effects of overproduction will be lost in the shuffle of all the later problems the government’s other interventions will have caused. Or perhaps the government will see fit to address that problem, too, with a new tax.

Such is what passes for thinking in Washington and in the much of the ivory tower, and it is this intellectual poverty and obsession with control that is largely responsible for the multifront economic mess were are in now—not the actions of an autocrat half a world away, whatever the Republicans, Democrats, and their loyal corporate media and think tank accomplices would have you believe.

This article was also published at the MISES Institute

Would you argue the same with say: heroine? That the dealers profit is real and tangible, while the social cost is a construct? Or is there some nuance to this?