West Creating Rift Between Saudi Arabia And Iran – OpEd

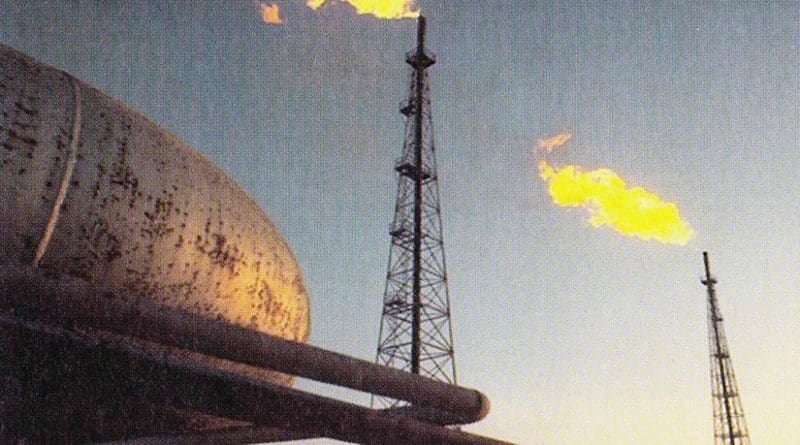

Major oil producers are scheduled to meet in Kuwait to deliberate on the outcome of their collective cut in production. It is expected that they won’t make any decisions until May, but are likely discuss the slow pace of market adjustment.

A survey of 13 oil market analysts by Bloomberg concludes that OPEC has little choice but to continue their production cuts. “They’ll probably think they need to grin and bear it longer. The glue that bound them together to begin with, which was higher prices, is the glue that will continue to bind them together.”

A point to be dealt with by all is ‘Saudi Arabia might demand Iran cutback if OPEC is to extend deal’. Speculation about whether or not OPEC will extend its production cut deal for another six months will be one of the most significant variables affecting oil prices in the short run. Western media has once again started spreading disinformation, “Saudi Arabia might only agree to an extension if Iran agrees to cut its production, something that it did not have to do as part of the initial deal”.

The western media is prompting, “Iran agreed to a cap on production slightly higher than its October baseline for the January to June period, but Saudi Arabia is growing tired of taking on the bulk of the sacrifice for the market adjustment and might stipulate that other countries make a larger sacrifice if the deal is to be extended through the end of the year”.

The western pinch can be understood by a Reuters report quoting a Saudi energy ministry official that crude exports to the United States in March would fall by around 300,000 barrels per day (bpd) from February and hold at those levels for the next few months.

The official said the expected drop, in line with OPEC’s agreement, could help draw down inventories in the United States that stood at a record 533 million barrels last week. It is also believed that Saudi exports to other regions, notably Asia, will not face any cut, rather these may increase. Therefore, the western media is once again making hue and cry that unless OPEC extends the curbs beyond June or makes bigger cuts, oil prices are not likely to improve.

The question remains whether OPEC, whose committee monitoring the cuts will meet over the weekend in Kuwait, will extend the deal? In Russia, private oil producers are ditching their skepticism and lining up behind an extension of output cuts after previous oil price increases compensated for lost income.

In the United States, shale drilling has pushed up oil production by more than 8 percent since mid-2016 to just above 9.1 million bpd, though producers have left a record number of wells unfinished in Permian, the largest oilfield in the country, a sign that output may not rise as swiftly as drilling activity would indicate.

While, I am not an expert to suggest anything to OPEC, I would have no option but to tell them that if no cap is put on oil output in the United States, they (OPEC) have no obligation to cut output. On the contrary they should start dumping their oil in the United States, rather than giving it a chance to increase indigenous production. OPEC must once again let the price go down below US$25 per barrel. This will render the producers from the United States uneconomical. OPEC should also stop considering Iran its enemy as it (Iran) can’t increase output in near term.