Global Economy Dodges Bullets, But Stuck In Mud – Analysis

Leaders could revitalize global economic growth by defying special interests and tackling long-term challenges, whether inequality or climate change.

By David Dapice*

The US economy ended 2018 with a whimper and 1.1 percent annual rate of GDP growth and then started the first quarter of 2019 with a bang – 3.1 percent growth. The economy has since settled back to 2 percent or less, where it seems likely to linger unless major shocks occur.

The world economy is slowing, too, but fears of an escalation in China-US trade tensions or a very disorderly Brexit have eased. Three cuts in interest rates by the US Federal Reserve along with large liquidity injections to prevent disorderly short-term money markets have helped keep the economy turning over, if not humming. Consumers keep spending, but business investment is sluggish. Monetary authorities have eased about as much as they can. Short and long interest rates in the United States are now zero in real terms – adjusted to remove the effects of inflation and reflect real borrowing costs and yield – and negative in nominal terms in much of Europe and Japan. The United States is running a trillion-dollar federal deficit at full employment and deficits will worsen with the current tax and spending laws, so any further significant fiscal easing must come from elsewhere.

A major question mark is China. It has not resorted to extremely expansionary credit growth or very large government deficits. Its economy is officially growing about 6 percent a year, but many outside experts suggest that the actual growth rate is 2 to 3 percentage points lower than that. In any case, China’s imports in 2017 were lower in US dollars than in 2013. Precautionary buying ahead of tariffs led to a large jump in imports for 2018, but stagnation and decline in import value since. For example copper, a commodity sensitive to global economic strength, has bounced around a range of US$2.50 to $3 per pound during the last year and is currently $2.65, suggesting muted overall global demand. Similarly, crude oil prices have remained stable in the mid-$50 range for much of the year despite political and supply shocks in the Middle East. These signals suggest neither a collapse nor healthy growth, but more slow, continuing growth. There are different views on why growth is so sluggish.

One popular view is that inequality is to blame. The rich save, and the middle and lower classes spend what they can earn or borrow. The world seems to have excess savings and not enough demand. Data on income or wealth inequality are not as robust as GDP, but in the United States and probably in China, there has likely been a concentration of gains in the top few percent in the past decades. Similar patterns are less marked in Europe and Japan. While populists often blame immigration and trade for these trends, more substantial culprits are automation and less influential unions, along with tax reforms that reduce marginal rates for the wealthy.

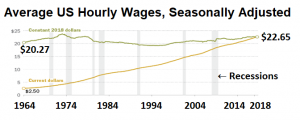

It is notable that several years of low unemployment in the United States have yet to push real wages up much, as a graph from the Pew Research Center shows – average real hourly wages are finally catching up to those of the 1970s! Given that real GDP per capita has more than doubled during this period, it is clear that most of the productivity gains have gone to profits or very high salaries. If indeed, there is a lack of demand which can only be remedied by borrowing, if income distribution remains unchanged, it would explain periodic credit crises as borrowing outruns the ability to repay. It would also explain why moves to strengthen lending rules lead to sluggish GDP growth: Credit growth is constrained and spending based only on incomes is not sufficient to drive healthy demand growth.

Another perspective emphasizes the age structure of the population and workforce. Older people do not spend as much as those just forming families and buying their first home. If student debt or uncertain job prospects lead to delayed marriage and household formation, or lower birth rates altogether, that would depress demand. Likewise, a higher proportion of old people would tend to reduce spending. There are fewer secure pensions, and saving for a possibly long old age is prudent. Certainly, labor forces are growing more slowly and aging. This tends to lower growth rates.

A third line of analysis argues that short-term shareholder value maximization exerts a negative influence on growth. Firms tend to invest less in research and development, machines or employees, preferring to use profits or even debt, to buy back shares of stock. That increases profit per circulating share and tends to boost the share price. Slow productivity growth is consistent with this story. Total factor productivity, counting both capital and labor, grew only 4 percent from 2005 to 2017, compared to 12 percent in the previous 12-year period. This line of argument overlaps with those who suggest that there is less effective competition due to a few dominant firms. This is said to reduce pressures to improve productivity and that R&D is often directed to less productive uses such as imitating similar drugs or apps for software, with little new real innovation. A monopoly or dominant firm is not required to innovate much and can buy out or copy smaller innovators.

Behind all of these explanations – which are not mutually exclusive – is the political gridlock which makes it so difficult to undertake obvious and necessary measures, such as maintaining or improving infrastructure. From collapsing bridges to fragile grids causing fires to air traffic delays, there are real costs to this neglect. With air pollution now worsening, traffic congestion increasing, and climate-related fires and floods increasing losses, it is notable that the US national political system seems incapable of doing much except perhaps worsen or ignore many of these problems. So long as low-hanging fruit is left unharvested, it is not surprising that growth will be slower than it has been previously or could be if intelligent compromises allowed better policies and implementation. Massive infrastructure spending that is regularly talked about by politicians in Washington could trigger growth, but is unlikely in a deeply divided country heading towards election.

Having said this, it may be that the need to curtail carbon emissions will require investments that reduce pollution, but do not add much to measured output. There are “win-win” investments that reduce costs and carbon, but in some cases there will be a net burden. Rising ocean levels, agriculture disruptions, and floods, fires and extreme temperatures impose costs that reduce growth. Thus the prospects for future growth, barring unexpected technical developments, are muted. This, in itself, could make political compromise more difficult since there is less growth to share.

*David Dapice is the economist of the Vietnam and Myanmar Program at Harvard University’s Kennedy School of Government.