Fiscal Policies For A Healthier Economic Future – Analysis

By Ali Alichi, Antonio David and Metodij Hadzi-Vaskov

Governments in Latin America and the Caribbean have announced fiscal support measures amounting to about 8 percent of the region’s GDP to respond to the unprecedented contraction caused by the pandemic crisis. What do these packages comprise and what are their expected macroeconomic effects? What fiscal strategies should countries follow as economies gradually reopen and over the medium term? The recently launched Regional Economic Outlook: The Americas addresses these questions.

Robust response

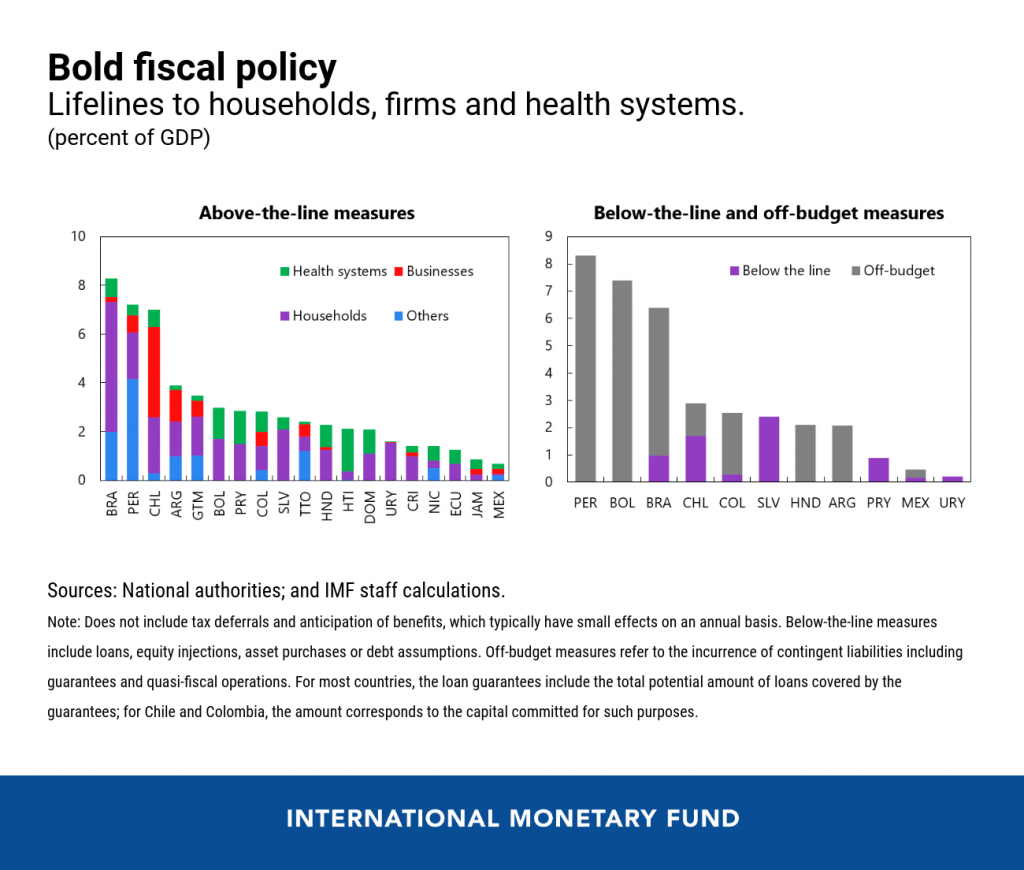

Announced fiscal packages varied in size and composition across countries. So-called “above-the-line” measures consisted of spending increases and tax cuts that directly increased budget deficits. A large share of those went to supporting households with cash transfers and enhanced unemployment benefits. Increased health spending was an integral part of fiscal interventions in all countries. Some also announced public investment programs to boost activity. Measures to support businesses included the suspension of corporate income tax payments.

Other fiscal measures did not immediately worsen deficits, but could bring fiscal risks in the future. Called “below-the-line” and “off-budget,” they aimed mostly at helping companies cope with large revenue losses and liquidity problems that could cause bankruptcy. Below-the-line measures included cashflow support in the form of direct loans, equity injections, asset purchases, and debt assumptions. Off-budget measures include credit guarantees and quasi-fiscal operations, such as loans by state-owned banks.

Quantifying the effects

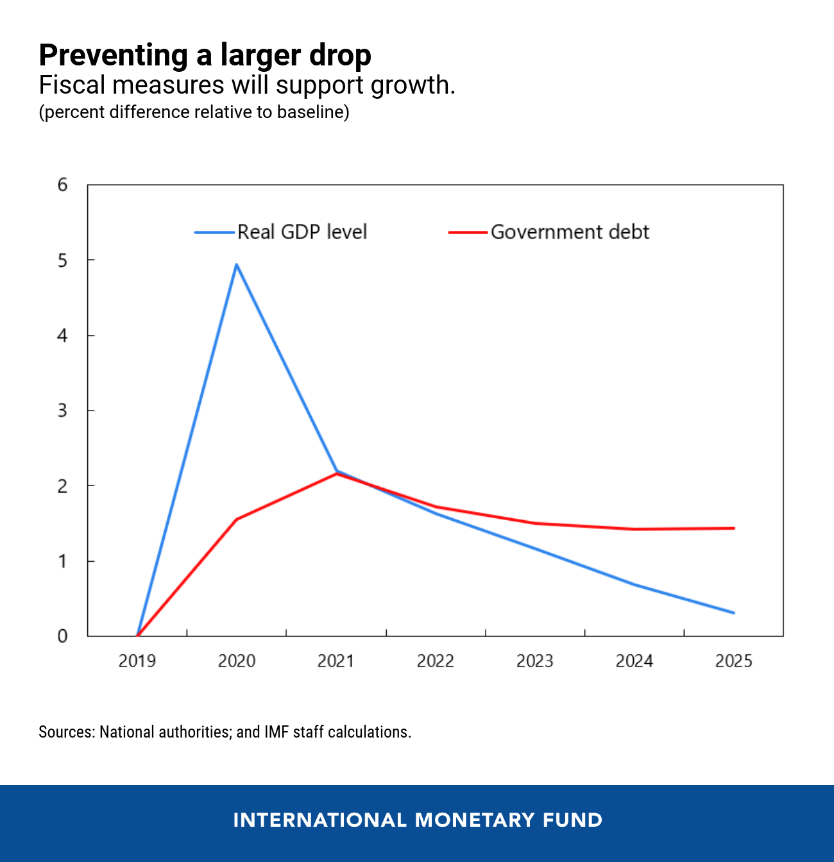

Our analysis shows that these efforts have helped to prevent a deeper recession. If fully implemented, the announced measures could raise the region’s GDP by about 6-7 percent within a year, with above-the-line measures contributing about 5 percent, while below-the-line and off-budget measures could add 1.5 to 2 percent. These support packages would also lead to an increase in public debt in the order of 2 percent of GDP.

Fiscal policy going forward

Going forward, fiscal policy should be geared towards facilitating the resumption of activity and continued protection of the most vulnerable. This should be accompanied by explicit and well-communicated commitments to rebuild fiscal buffers in the medium term. In that context, fiscal rules will play an important role in anchoring expectations and fiscal sustainability over the medium term.

Fiscal space will be the crucial factor in calibrating policies. As uncertainty regarding the recovery and possible scarring effects from the pandemic are high, countries with fiscal space should follow a gradual approach in withdrawing emergency lifelines. To facilitate the recovery, governments could provide some fiscal stimulus, including, for example, temporary payroll tax cuts to incentivize hiring, and additional public investment.

In countries with limited fiscal space, the priority would be to preserve measures with the largest social impact (e.g., unemployment benefits and social assistance), increase the efficiency of spending and revenue mobilization, and explore further low-cost financing sources.

Addressing the crisis legacies

After the pandemic is under control, the role of fiscal policy will be to rebuild buffers, as well as undertake reforms to address the crisis’ legacies and structural issues.

For example, government debt ratios, projected to increase by more than 10 percentage points of GDP in 2020, are expected to remain elevated. While some fiscal consolidation will likely be necessary, social protection should be safeguarded. In many cases, safety nets should be expanded to ensure better access to basic utilities, education, health care, and formal job markets. Moreover, strengthening unemployment benefits and social safety nets could increase the effectiveness of mechanisms that stabilize incomes after economic shocks (the so-called “automatic stabilizers”).

Raising revenues will be indispensable to securing fiscal sustainability over the medium term. This can be achieved with tax reforms centered on improving collection of value-added, sales, and corporate taxes; rationalizing inefficient and regressive income tax breaks; and broadening income tax bases (in some cases by raising the top personal income tax bracket).

Finally, governments in the region should consider gradually scaling up public investment to boost potential growth and accelerate their transformation into more resilient and sustainable economies, especially if accompanied by improvements in public investment management.

This article was published by the IMF in Dialogo a Fondo