The Real Meaning Of Deflation – OpEd

By MISES

By Frank Shostak*

For most experts, deflation is bad news since it generates expectations for a decline in prices. Because of this, it is held, consumers postpone their buying of goods at present since they expect to buy these goods at lower prices in the future. Consequently, this weakens the overall flow of current spending and this in turn weakens the economy.

In this way of thinking, economic activity is presented in terms of the circular flow of money. Spending by one individual becomes the earnings of another individual, and spending by another individual becomes a part of the previous individual’s earnings.

So if for some reason people have become less confident about the future and decide to reduce their spending, this is going to weaken the circular flow of money. Once an individual spends less, this worsens the situation of some other individual, who in turn also cuts his/her spending.

According to the former Federal Reserve Board Chairman Ben Bernanke,

Deflation is in almost all cases a side effect of a collapse of aggregate demand — a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers. Likewise, the economic effects of a deflationary episode, for the most part, are similar to those of any other sharp decline in aggregate spending — namely, recession, rising unemployment, and financial stress.1

As one can see by the popular way of thinking deflation is the opposite of inflation, which is seen as general increases in the prices of goods and services.

Now, while it is true that during deflation we observe that prices tend to decline this is however just a description of things, it is not the essence of deflation.

The Essence of Deflation

To establish the essence of deflation we hold that one must trace how this phenomenon emerges. The key for this is to establish the essence of inflation. Contrary to popular thinking, inflation is not about general increases in the prices of goods and services.

Inflation is not set in motion by increases in wages. Inflation is also not set in motion by a decline in unemployment or an increase in economic activity as popular thinking has it.

Inflation is the diversion of wealth from wealth generators towards non-wealth generators brought about by the expansion, or inflating the money supply out of “thin air.”

In a market economy, the key function of money is to fulfill the role of the medium of exchange. By means of money, a product of one specialist is exchanged for the product of another specialist. Alternatively, we can say that something is exchanged for money and then money is exchanged for something else. This means that something is exchanged for something else with the help of money.

This process is disrupted once an increase in money supply takes place. When money is generated out of “thin air,” no real wealth was exchanged for it. The holder of the generated money out of “thin air” can now exchange it for real wealth. Therefore, what we have here is an exchange of nothing for something. An exchange of nothing for something amounts to a diversion of real wealth from those individuals that have produced this wealth to the holders of the generated money out of “thin air.” Note again that the act of wealth diversion was made possible because of the increase in money supply (i.e., inflation).

Popular thinking, however, holds that a growing economy gives rise to a growing demand for money that must be accommodated to prevent economic disruptions. On this way of thinking as long as the increase in money supply is in line with the increase in the demand for money, no negatives to the economy are going to emerge.2

But, irrespective of the state of the demand for money, an increase in money supply must always result in an exchange of nothing for something (i.e. to a diversion of real wealth). Moreover, any amount of money can do the job of the medium of the exchange. Hence, there is no need to increase the supply of money to accommodate an increase in the demand for money. According to Mises,

The services which money renders can be neither improved nor repaired by changing the supply of money. . . . The quantity of money available in the whole economy is always sufficient to secure for everybody all that money does and can do.3

We can conclude that inflation is about a diversion of real wealth from wealth generators towards the holders of newly created money. The increase in the money supply out of “thin air” sets in motion this diversion.

Deflation emerges once the process of wealth diversion comes to a halt. This occurs once the money supply out of “thin air” starts to decline.

Fractional Reserve Banking as the Source of Money Out of “Thin Air”

To illustrate further, we must note that a major factor behind the expansion of money out of “thin air” is the existence of fractional reserve banking.

By fulfilling the role of the intermediary, banks play an important factor in the process of real wealth formation. Banks facilitate the flow of real saving by introducing suppliers of real saving to demanders.

Here’s how it works:

A farmer, Joe, produced 2kg of grains. For his own consumption, he requires 1kg, and the rest he decides to lend for one year to a farmer Bob. The unconsumed 1kg of grains that he agrees to lend is his saving.

By lending the 1kg of grains to Bob, Joe agrees to give up for one year the ownership over this quantity of grains. In return, Bob provides Joe with a written promise that after one year he will repay the 1.1kg of grains. The 0.1kg constitutes an interest. What we have here is an exchange of 1kg of present grains for 1.1kg of grains in a one-year time.

The introduction of money will not alter the essence of what lending is all about. Instead of lending the 1kg of grains Joe will first (sell) exchange his 1kg of grains for money, let us say for $100. Then Joe decides to lend his money via bank A to Bob for one year at the going interest rate of 10%.

On the maturity date of the loan the borrowed money is paid via bank A back to the lender. Thus, Bob — the borrower of $100 — will pay back on the maturity date the borrowed sum and interest to the bank. The bank in turn will pass to Joe the lender his $100 plus interest adjusted for bank fees. To put it briefly, the money makes a full circle and goes back to the original lender.

Observe that ordinary lenders cannot lend without having something to lend.

Now, let’s introduce into our analysis the central bank and the fractional reserve banking. The existence of the central bank and the system of fractional reserve banking permits banks to generate credit out of “thin air.”

Let’s say farmer Joe sells his saved 1kg of grains for $100 and then deposits this with Bank A. Observe that Joe is exercising his demand for money by holding them in demand deposits at Bank A.

Note that the demand deposit of Joe is fully backed by the $100 cash (i.e. the bank keeps cash reserves of 100%). Alternatively, we can say that against the bank deposit, which is the bank’s liability of $100, the bank also holds cash to the tune of $100.

Consider now the case when bank A takes a portion of Joe’s deposited money and lends it out. Let us say that bank A takes $50 from Joe’s demand deposit and lends this to Bob. By lending Bob $50 bank A opens a demand deposit for Bob to the tune of $50. Note that the spending power prior to the lending to Bob stood at $100 however now it is $150 — the lending to Bob lifted the supply of money by $50.

What we have now is $150 in demand deposits ($100 demand deposits of Joe and $50 in demand deposits of Bob) that are only backed by the $100 cash that was originally deposited by Joe. Observe that bank A’s liability of $150 in demand deposits is supported by cash of $100. Bank A keeps cash reserves against its deposit liability to the tune of 100/150 i.e. 66.7%. If both Joe and Bob were to decide to collectively withdraw $150 and keep the cash in their pockets Bank A will have a problem since it only has $100.

Now on the maturity date Bob repays the $50 to bank A. This means that once Bob pays the bank $50, bank A closes Bob’s demand deposit for this amount. Observe the $50 is not repaid to an original lender because there was never such a lender. Consequently, the money supply contracts by $50 once bank A closes Bob’s demand deposit. (Note again bank A created credit out of “thin air” by lending nothing, which on the maturity date went back to nothing).

As long as banks continue to expand credit out of “thin air”, various non-productive activities continue to prosper. At some point however, because of the relentless expansion in the money supply out of “thin air”, which sets the diversion of real wealth, a structure of production emerges that ties up much more consumer goods than the amount it releases. (The consumption of final consumer goods exceeds the production of these goods).

A Decline in the Subsistence Fund Leads to Deflation

This excessive consumption relative to the production of consumer goods leads to a decline in the subsistence fund. This in turn weakens the support for individuals that are employed in the various stages of the production structure.

Consequently, the performance of various activities starts to deteriorate and banks’ bad loans start to rise. In response to this, banks curtail their lending activities out of “thin air” and this in turn sets in motion a decline in the money supply. (Remember the money supply declines, all other things being equal, once the loans that were generated out of “thin air” are repaid and not renewed). The fall in the money supply begins to undermine various non-productive bubble activities i.e. an economic slump emerges. Also given that now we have less money per goods this amounts to a general decline in the prices of goods. (Note that a price of a good is the amount of dollars spend per unit of a good).

Even if the central bank were to be successful in preventing the fall in money supply, this cannot prevent an economic slump if the subsistence fund is declining. Money cannot substitute the consumer goods required to support the life and wellbeing of individuals. So-called policies aimed at countering a fall in prices do nothing more than provide support to non-productive activities.

Thus, deflation is not general decline in prices as such. It emerges in response to the decline in the subsistence fund. An important cause behind this decline is an earlier increase in money supply brought about by central banks and fractional-reserve banking.

Recent data may help to illustrate the current risks:

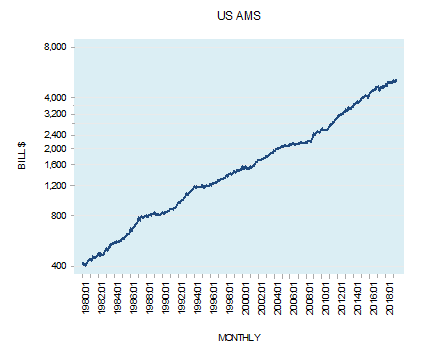

Since the early 1980’s the money supply as depicted by our adjusted money supply measure (AMS) displays a visible strength. It stood at $5,101 billion in April 2019 against $418.5 billion in January 1980 – an increase of 1,119%.

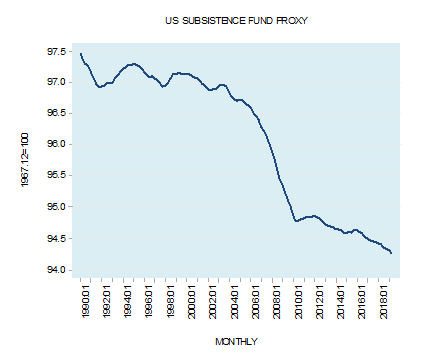

Our proxy for the US subsistence fund displays a visible decline since June 2003 (see chart).

If this proxy is a valid indicator of the state of the subsistence fund then this raises the likelihood for a protracted economic slump ahead. Government policies that will aim at fixing various symptoms such as declining price inflation and economic activity are likely to weaken the subsistence fund further thereby making things much worse.

Conversely, if both the central bank and the government cease to intervene this will enable the private sector to quickly build up the subsistence fund and lay the foundations for a genuine economic prosperity.

The biggest problem we face is this: even if the central bank were to be successful in preventing the fall in money supply, this cannot prevent an economic slump if the subsistence fund is declining. Money cannot substitute the consumer goods required to support the life and wellbeing of individuals. So-called policies aimed at countering a fall in prices do nothing more than provide support to non-productive activities.

Hence, the more the central bank and the government try to do to lift the economy by attempting to fix the symptoms such as the fall in prices and rising unemployment, the worse things become.

- 1. Ben S Bernanke: Deflation – making sure “it” doesn’t happen here Speech by Mr Ben S Bernanke, Member of the Board of Governors of the US Federal Reserve System, before the National Economists Club, Washington, DC, 21 November 2002.

- 2. George Selgin – Should We Let Banks Create Money?, The Independent Review, Summer 2000 p 93-100.

- 3. Ludwig von Mises, Human Action, 3rd rev. ed. (Chicago: Contemporary Books, 1966), p.421.

*About the author: Frank Shostak‘s consulting firm, Applied Austrian School Economics, provides in-depth assessments of financial markets and global economies. Contact: email.

Source: This art article was published by the MISES Institute