What Is A Pyramid Scheme?: Distinguishing The Term From Legitimate Multi-level Marketing Practices – Analysis

By Harold Furchtgott-Roth and Kirk R. Arner*

“Pyramid scheme” sounds sinister. The term is used so routinely and casually that it is easy to imagine it has long been codified as illegal in the United States. It turns out, however, that the concept is a rather recent American legal construct that has yet to be codified in federal statutes.

To many people, “pyramid” evokes marvelous images of an ancient and bygone era. The Great Pyramid of Giza was one of the Seven Wonders of the Ancient World. The ancient Aztecs also had pyramids—works of profound engineering and beauty.

After maintaining a positive and wondrous connotation for millennia, “pyramid” acquired a decidedly negative financial meaning in early twentieth-century America. The Oxford English Dictionary credits the American Samuel Reinsch with its first usage.1

In his Readings on American Government, published in 1909, Reinsch uses the term “pyramid” to discuss “an illicit, unstable financial scheme.” Later, in 1920, the Oakland Tribune described Charles Ponzi’s infamous scheme as a “pyramid.”

The OED also credits Americans with originating the term “pyramid scheme,” which first appeared in the Oakland Tribune in 1949. It gives three examples of the use of “pyramid scheme,” each of which involves financial transactions.

Perhaps surprisingly then, the term “pyramid scheme” does not appear in the U.S. Code. The term appears only four times in the Code of Federal Regulations, exclusively in reference to the illegal sale of government bonds.2 There is no federal statutory definition or regulatory definition of “pyramid scheme,” and efforts to write a statutory definition have not passed Congress.

Nevertheless, the term has such evocative and pejorative connotations that it is frequently used as a term of art in federal complaints, including under Section 5 of the Federal Trade Commission Act and under securities law. Recent examples include FTC cases against AdvoCare 3 and Neora (formerly Nerium).4 According to the Association of Certified Fraud Examiners, the FTC shuts down approximately ten pyramid schemes annually.5

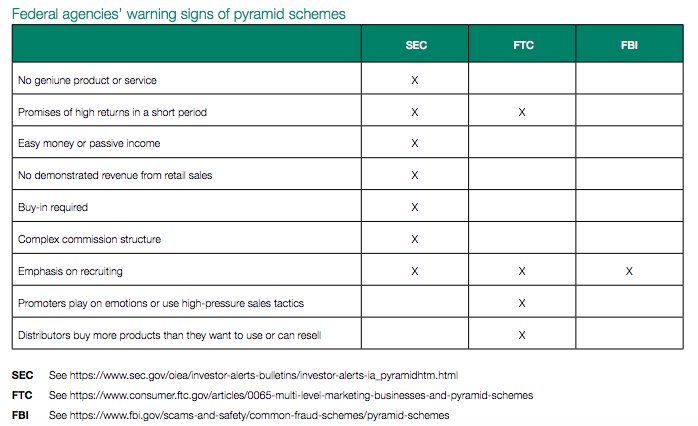

Despite the lack of a standard definition, various federal agencies have web pages warning consumers about the differences between illegal pyramid schemes and legitimate multilevel marketing businesses. The table below presents various informal indicia of pyramid schemes, as determined by the Securities and Exchange Commission, the FTC, and the FBI.

Although these are not formal legal definitions, it is surprising how little overlap there is across federal agencies, whose only point of agreement is that pyramid schemes emphasize recruitment. Moreover, these indicators provide little clarity to consumers because “recruitment” is normally associated with jobs and regarded as a legitimate business activity.

Nor are the other indicators unambiguously and uniquely related to pyramid schemes. “Promises of high returns in a short period of time” are common for many legitimate business opportunities, whether the claims are substantive or mere puffery. So too are promises of “easy money or passive income”; indeed, long-term personal investing is a largely passive endeavor. “No demonstrated revenue from retail sales” is not a reasonable indication of a pyramid scheme, or else every business in the United States without retail sales might qualify. Many legitimate businesses, such as franchises, require “buy-ins,” and others, such as real estate, retail clothing, and insurance agencies, have “complex commission structures.” Patrons of used car dealerships understand the prevalence of “high-pressure sales tactics” in legitimate businesses all too well. And consumers purchasing “more products than they want to use” is perhaps puzzling, but hardly unambiguous evidence of a pyramid scheme. Moreover, many pyramid schemes involve purely financial transactions in which there is no purchase of “products” whatsoever.

Ultimately, the federal agencies’ lists of supposed pyramid scheme indicators do not allow us to distinguish a pyramid scheme from a legitimate business activity on the federal level.

Many states, including California 6 and New York,7 also have similar lists, bound up, respectively, in endless chain and chain distributorship laws. These lists are equally insufficient. That said, many states have been aggressively moving to update their pyramid scheme laws in recent years by enacting strong definitions and banning the schemes.

No doubt, some fraudulent business plans warrant government scrutiny, but current federal efforts to define some business practices as pyramid schemes do not clearly distinguish between harmful and wholesome businesses.

Ancient pyramids, built to withstand adverse elements, have lasted millennia. In contrast, pyramid schemes do not withstand the slightest scrutiny. They are little more than a house of cards, quickly falling apart and hurting those who have “invested” in them.

*About the authors:

- Harold Furchtgott-Roth, Director, Center for the Economics of the Internet

- Kirk R. Arner, Legal Fellow, Center for the Economics of the Internet

Source: This article was published by the Hudson Institute

1 Oxford English Dictionary, https://oed.com/view/Entry/155386?redirectedFrom=pyramid+scheme#eid112152329. ↝

2 Search results for “pyramid scheme,” Govinfo, https://tinyurl.com/sa97ljx. ↝

3 Plaintiff’s Complaint for Permanent Injunction and Other Equitable Relief, Federal Trade Commission v. AdvoCare et al., No. 4:19-cv-00715 (E.D. Texas 2019), available at https://www.ftc.gov/system/files/documents/cases/advocare_complaint_0.pdf. ↝

4 Complaint for Permanent Injunction and Other Equitable Relief, Federal Trade Commission v. Neora et al., No. 3:19-cv-19699 (D.N.J. 2019), available at https://www.ftc.gov/system/files/documents/cases/1623099_nerium_complaint_11-1-19.pdf. ↝

5 “Ponzi Schemes,” Association of Certified Fraud Examiners, https://www.acfe.com/ponzi-schemes.aspx. ↝

6 “Pyramid Schemes / Multi-Level Marketing,” State of California Department of Justice, Xavier Becerra, Attorney General, https://oag.ca.gov/ consumers/general/pyramid_schemes. ↝

7 “Don’t Get Caught in a Pyramid Scheme,” New York State Office of the Attorney General, Letitia James, NY Attorney General, https://ag.ny. gov/consumer-frauds/pyramid-schemes. ↝

Very astute historical and legal review. Perhaps missing is the core of the pyramid scheme whereby the income promised is earned from the mere act of recruiting new members into the scheme and the new members are investing or buying product they don’t need or want just to qualify to participate in the scheme. And example would be MLMs that sell “packs” of Good, Better Best options of for example $500, $1,500 or $3,000 worth of product. The product is inconsequential as it is more than can be consumed but the revenue fuels the income opportunity and therefor all the emphasis of the scheme is on new recruiting. If recruiting stopped there were not be enough repeat customers to maintain current sales and the whole thing falls apart. Regulators today overreach and abuse they mandate by merely accusing MLMs of being a Pyramid ( akin to yelling Shark in the water). They leak the allegation to the media and the bad press kills the enterprise.