Ralph Nader: Letter To John Chambers, CEO Of Cisco – OpEd

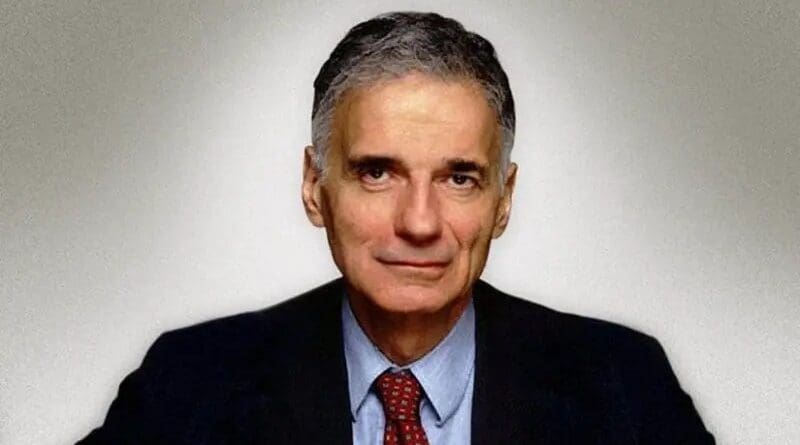

By Ralph Nader

John T. Chambers, CEO

Cisco Corporation

170 West Tasman Drive

San Jose, California, 95134-1706

Dear Mr. Chambers:

Cisco share valuation may not be one of your priorities but your owners

A little history is instructive. In March 2000 Cisco stock soared above $80 per share. There have been no splits since that time. In the intervening eleven years, Cisco has become a much larger company measured by sales, profits and cash reserves. Cisco has acquired numerous companies in this interval and expanded well beyond its core business. Each year, sales have increased along with profits. Yet the share price is nearer to $15 following a decline in the past few weeks from a range of $24 per share. Appalling!

Moreover, Cisco has very little debt and is still dominant in its core business, though confronting aggressive competition.

As a shareholder, I urge you to do something to enhance the value of Cisco shares. The long-delayed and paltry annual dividend of 24 cents per share is hardly adequate. Here is what your Board of Directors should approve to begin the process of restoring confidence in your remaining shareholders in the company: Cisco hoards $43+ billions of dollars in cash. There are about 5.55 billion shares outstanding. Increase the annual dividend to 50 cents and pay out a one-time special dividend of $1 per share. Such a decision will help increase consumer demand in our sorrowful economy since there would be a higher propensity of that money being spent than remaining inert in Cisco’s coffers perhaps tempting another misadventurous acquisition.

It is time for a long overdue Cisco shareholder revolt against a management that is oblivious to building or even maintaining shareholder value. It is as if management is in a counter-intuitive, bizarre, defacto conflict of interest against its own company investments and those held by their institutional and individual shareholders.

It is hardly necessary to relate that many shareholders want some returns, after these many years, and not another stock buyback. They want cash from the reserve their company sits on year after year. They may be ready to organize, judging by the ones with whom I have spoken and by some comments made privately and publically to the press.

Please respond to my suggestion of a 50 cents dividend and a one-time payout of a special $1 dividend. Non-financial corporations are sitting on nearly $2 trillion in largely inert money. Our economy has substantial unused capacity and lower recessionary demand. Domestic investment is not exactly booming. What is needed is an increase in consumer demand. These companies need to increase their dividends not just to provide shareholder value, but also, as a side benefit, to enhance spending power by the recipients in the marketplace.

If you believe it is easier for you to decide on a larger dividend policy following a demand of thousands of shareholders and some large institutional holders like Fidelity and Vanguard and the worker pension funds, please let that be known. I’ll be making this letter public shortly.

Sincerely yours,

Ralph Nader