Middle East Still Leads As One Of World’s Most Prolific Arms Markets – Analysis

By Thalif Deen

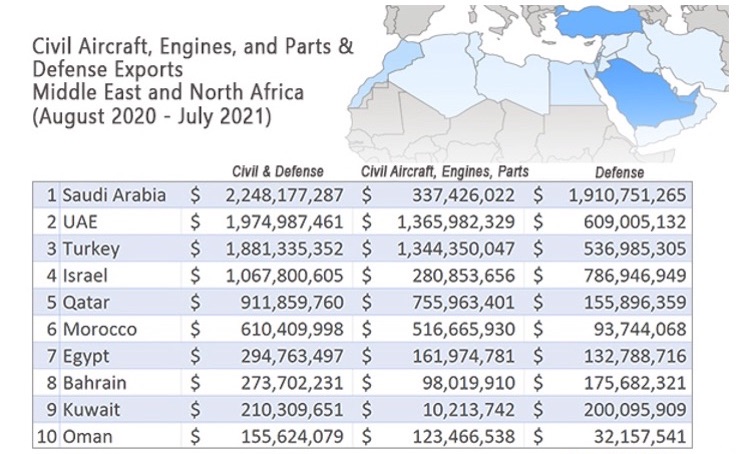

The politically and militarily volatile Middle East continues its run as one of the world’s biggest single arms markets—led primarily by Saudi Arabia. But the Saudi dominance is being gradually challenged by another oil-blessed country in the region: the United Arab Emirates (UAE).

According to the latest report from the US Commercial Service, the trade promotion arm of the US Department of Commerce’s International Trade Administration, the UAE is second only to Saudi Arabia, which has been ranked first globally, due to several large deals, topping $1.9 billion in purchases over the past year, while the UAE’s purchases amounted to $609 million during August 2020-July 2021.

“With growing strategic ties between the United States and the UAE, as well as potential instability in the region, defense exports to the UAE are expected to remain strong for several years,” says the report.

A New York Times report in April quoted a US State Department spokesman predicting a proposed sale of a staggering $23 billion in weapons to the UAE, including F-35 fighter planes and armed Reaper drones. But several members of the US Congress have expressed reservations because the sale of the one of most advanced fighter planes to the UAE may weaken the “qualitative military edge” held by Israel, the only country in the region with F-35s.

Pieter Wezeman, Senior Researcher, Arms and Military Expenditure Programme, at the Stockholm International Peace Research Institute (SIPRI), told IDN since the late 1990s, the UAE has been one of the large recipients of US arms exports.

SIPRI ranks the UAE as the 6th largest importer of US arms for the 25-year period 1996-2020 and the 5th largest importer of US arms during 2016-2020.

In the first half of the past 25 years, he pointed out, it took deliveries of F-16E combat aircraft and related missiles that accounted for a large part of the volume of US arms sales to the UAE.

Over the past 5 years, US arms transfers to the UAE were dominated by deliveries of advanced THAAD and Patriot PAC-3 air and missile defence systems. However, though the high value of US arms sales to the UAE is explained by these especially costly weapon types, the US has supplied a wide diversity of weapons to the UAE.

For example, over the past five years the USA delivered 1000s of relatively low-value armoured trucks and 1000s of guided bombs to the UAE. These have been used in Yemen together with the high value combat aircraft and missile defences.

Meanwhile, the Saudi military arsenal includes F-15 fighter planes, Apache helicopters, Stinger and Hellfire surface to air (SAM) missiles, and multiple rocket launch systems (from the US), Tornado fighter bombers, Bae Hawk advanced jet trainers and Westland combat helicopters (from UK) and Aerospatiale helicopters and air defence systems (from France).

The US weapons systems with the UAE forces include F-16 fighter planes, Blackhawk helicopters and Sidewinder and Maverick missiles while UK’s arms supplies include Typhoon and Tornado fighter bombers and cluster munitions. The UAE is also equipped with French-made Mirage-2000 jet fighters, perhaps upgraded to the Mirage 2000-9 version.

In the past decade, the US report says, the UAE has made great efforts to establish itself as an active participant in the commercial and civil space sectors.

The UAE has sent a spacecraft to Mars and had developed “Mars Science City” outside Dubai to help understand what conditions would be like when living on Mars.

The UAE Space Agency and the Mohammed bin Rashid Space Center (MBRSC), are working closely with US industry and NASA to strengthen cooperation between US and Emirati companies and academia.

The UAE is striving to also incorporate STEM (Science, Technology, Engineering, and Math) along with technology education into academic programs that will create a high-technology workforce capable of supporting future space research and development programs.

According to a New York Times report October 26, “few companies appear financially capable of pulling off the construction of a space station—a tall feat executed only by governments, which have typically been motivated by international relations than profit.”

“The UAE is very interested, and there has been a lot of discussion with us over the past few months”, said Janet Kavandi, president of Sierra Space and a former astronaut.

Regarding the sales of commercial aircraft, the report points out that “economic struggles brought by the COVID-19 crisis, will continue to slow the purchase of additional large civil aircraft from the UAE’s two major carriers—Emirates and Etiha—for the next several years”.

However, there will still be a strong demand for aircraft parts and maintenance, repair, and overhaul (MRO) services.

Emirates Airlines is the largest operator of the Boeing 777, with Etihad, Air Arabia, and flydubai also having substantial fleets to maintain. Due to its large fleet sizes and MRO industry, the UAE is the top market for US aircraft parts in the Middle East and the 7th largest globally.

A breakdown follows:

The US will also be promoting arms sales at several upcoming exhibitions and airshows, including Spain, Nov 3-5, 2021, Feria Internacional de Defensa y Seguridad (FEINDEF); Turkey, Nov. 10-13, 2021 SAHA Expo; Singapore, Feb. 15-20, 2022, Singapore Airshow; France, Jun. 13-17, 2022, Eurosatory; and U.K., Jul. 18-22, 2022, Farnborough.

Wezeman told IDN the US accounted for 64% of UAE arms imports 2016-2020, followed by France with 10%, according to SIPRI figures.

In some cases, the US offerings appear to have been less attractive than those of others, for example the UAE has turned to France for corvettes and tanker aircraft. In some other cases the US was reluctant to sell certain types of equipment, including armed drones to the UAE, which were then acquired from China.

Based on existing contracts and agreements, in particular after two consecutive US administrations agreed in 2020 and 2021 to let the UAE procure 50 F-35 combat aircraft with a full package of advanced missiles and bombs, the arms trade between the two countries is likely to continue at a high volume in the coming years.

Asked whether the UAE is still part of the Saudi-led coalition, which has come under fire for unleashing its fire power on Yemen, and also providing arms to rebel factions in Libya, Wezeman said the role of the UAE in the Saudi led coalition seems to have been diminished significantly over the past two years.

Still, the UAE remains militarily engaged in Yemen, supporting certain armed groups that are more or less aligned with the country’s internationally recognised government, though the details of this remain sketchy and uncertain.

In one of the latest developments, there have been credible reports that the UAE is building a military base on the strategically positioned Yemeni island of Socotra. The UAEs involvement in Libya is also a secretive activity.

In Libya, it is accused by UN monitoring panels to have supplied weapons to the rebel LNA or Haftar army, in contravention of a UN arms embargo, and to have deployed its own troops and equipment and to have staged long range air attacks.

Such actual use of the arms the UAE has imported as part of an assertive and seemingly militarised UAE foreign policy in the Middle East and North Africa, which by many is seen as contributing to the ongoing humanitarian disasters in Yemen and Libya, have raised substantial questions about the appropriateness of arms sales to the country and their effects on regional peace, security, stability, and human rights.