A Model For Management That Goes Beyond Profits

By IESE Insight

If you want to know the possible impact of business decisions on profits, simulation models can help. Models can take into account interdependencies and life’s randomness in a way that mere intuition cannot.

But what if you would like to know how managers’ values and attitudes affect the learning, capability-building and mission of your corporation? If you aspire to create more than just financial profits, is there a model for that?

IESE’s Rafael Andreu, Josep Riverola, Josep Maria Rosanas and Rafael de Santiago are working on it. The four professors propose a model that analyzes the behavior of firms as they choose and execute various projects — and learn from those projects to change the companies’ capabilities.

Beyond Profits: Three Key Areas

Firms are characterized according to whether they have, or lack, capabilities in three key areas:

- Effectiveness — i.e., measurable results (usually financial);

- Attractiveness — i.e., the degree to which employees develop professionally and enjoy their jobs; and

- Unity — i.e., the degree to which employees identify with organizational goals and values.

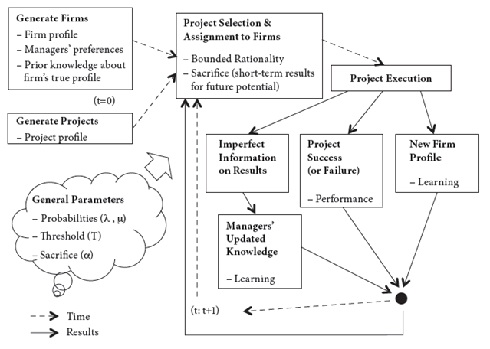

They also look to managers’ preferences for certain types of projects (also characterized by their potential Effectiveness, Attractiveness and Unity). In selecting the projects, the model makes allowances for “bounded rationality” — namely, the real-world limits on the amount of information and time available to make optimal decisions.

Turning down a potentially profitable project in favor of another to better build capabilities for the future is often a smart long-term decision. But how do you analyze accumulated decisions’ potential impact on the firm as it evolves over time? How do you take into account what happens in the market where other firms are doing similarly, but with their own personalities? The authors create a simulation program to help formalize what is often left to informal discussions. They argue that such modelling will help managers understand the trade-offs between short- and long-term objectives and helps them anticipate possible complications arising from switching courses or from imperfect “self-knowledge,” — i.e., when management holds perceptions about some characteristics of the firm that are not really true.

Avoiding a Bleak Future

By working with their model, they conclude that firm stability (and longevity) is, among other things, highly dependent on managers’ ability to estimate the true profile of their companies. While this may sound like common sense, the authors offer an additional insight: Erroneous perceptions can lead to choosing projects that may actually cause a firm to lose capabilities. They write:

Once lost, capabilities are difficult to recover….When managers consider only Effectiveness, ignoring Attractiveness and Unity, things get worse. From all this we conclude that stability is highly dependent on managers’ ability to estimate the true profile of their companies. The old Greek aphorism “Know Thyself” is crucial for success, but it has a consequence that is not at all trivial: if you seek only effectiveness, your future looks bleak.

Of course, the proposed model is built on assumptions and simplifications, yet the authors contend that it provides a structured setting in which learning and capability building can be analyzed. The simulation program (see below) can help illuminate “a variety of hard-to-anticipate emergent behaviors”– at the firm-level, beyond the actions of any single manager. As firms learn from the projects selected, managers can learn from an analysis of their decisions’ impact.

The Model: Overall Structure of the Simulation Program

Source: The authors own elaboration, appearing in the International Journal of Management and Economics, 44(1), 2014, p. 15.