Norway Energy Profile: World’s Third-Largest Natural Gas Exporter – Analysis

By EIA

Norway is the largest holder of crude oil and natural gas reserves in Europe, and it provides much of the petroleum liquids and natural gas consumed on the continent. Norway was the third-largest exporter of natural gas in the world after Russia and Qatar in 2015.

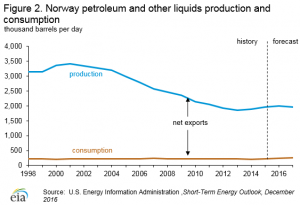

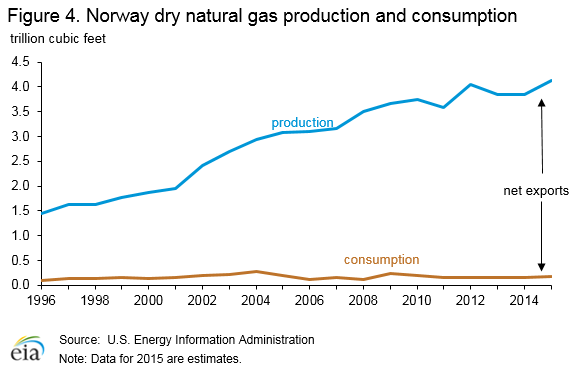

In 2015, the petroleum and natural gas sector accounted for almost 40% of Norway’s export revenues and more than 15% of the country’s gross domestic product (GDP).1 Norway’s petroleum and other liquids production peaked in 2001 at 3.4 million barrels per day (b/d) and declined to 1.8 million b/d in 2013 before growing to slightly less than 2.0 million b/d in 2015. Natural gas production, on the other hand, increased nearly every year since 1993, except for a small decline in year-over-year production in 2011 and 2013.

Hydropower is the principal source of Norway’s electricity supply, accounting for 97% of total electricity generation in 2014. In June 2012, government officials from Norway, Germany, and the United Kingdom confirmed their plans for subsea electric power connections between their countries to strengthen the northern European electricity grid and to increase supply security. The Norwegian state-owned energy system operator, Statnett, will work with the United Kingdom’s National Grid to construct the Norway-United Kingdom cable connection, expected to be completed in 2021. Statnett will also cooperate with Germany to build the Norway-Germany cable, expected to be completed in 2019.2

The historic agreement between Norway and Russia, which defined their maritime boundaries in the Barents Sea and the Arctic Sea and resolved their 40-year old boundary dispute, was fully ratified by both governments in early 2011 and went into effect in July 2011. As a result of the agreement, Norway gained about 34,000 square miles of continental shelf. The agreement requires the two countries to jointly develop oil and natural gas deposits that cross over their boundary.

Petroleum and other liquids

Norway is the largest oil producer and exporter in Western Europe.

According to the Oil & Gas Journal, Norway had 5.14 billion barrels of proved crude oil reserves as of January 1, 2016, the largest oil reserves in Western Europe.3 All of Norway’s oil reserves are located offshore on the Norwegian continental shelf (NCS), which is divided into three sections: the North Sea, the Norwegian Sea, and the Barents Sea. The bulk of Norway’s oil production occurs in the North Sea. New exploration and production activity is taking place further north in the Norwegian Sea and the Barents Sea, where small volumes of liquids and natural gas are currently being produced.

Sector organization

Norway’s Ministry of Petroleum and Energy (MPE) is responsible for overseeing the country’s energy resources. The Norwegian Petroleum Directorate (NPD) reports to the MPE as an advisor, administers exploration and production activities on the NCS, and collects and analyzes data. State-owned Petoro manages the commercial aspects of the government’s financial interests in petroleum operations and associated activities. Petoro acts as the licensee for production licenses and companies.

The largest energy company operating in Norway is Statoil ASA, which was created by the merger of Statoil and Norsk Hydro in October 2007. Norway’s government is the largest shareholder of Statoil, owning 67% of the international energy company. In addition to its operations in Norway, Statoil is a major international company, and it has interests in more than 30 countries.

Several international oil companies have a sizable presence in Norway. The Norwegian government’s subsidy of oil and natural gas exploration, introduced in 2005, refunds 78% of the exploration costs to the companies. In addition, the Norwegian government reduced taxes on onshore oil activities and on liquefied natural gas (LNG) shipped overseas, which has attracted additional international investment.

Exploration and production

In 2015, Norway produced 1.96 million barrels per day (b/d) of petroleum and other liquids (Figure 2), 3% higher than in 2014. Norway’s petroleum production has been gradually declining since 2001 as oil fields have matured, although production in 2013 and 2014 increased moderately. The NPD expects that petroleum production will continue to decline slowly from 2016 through 2019, before beginning to grow again in 2020 as the Johan Sverdrup field ramps up production.4 The three largest producing crude and condensate fields in 2015 were Troll (121,000 b/d), Ekofisk (112,000 b/d), and Snorre (110,000 b/d).5 The Troll and Ekofisk fields are located in the Norwegian portion of the North Sea, where most of Norway’s current production occurs. Snorre field is located a little further north, in the southern Norwegian Sea.

In 2015, Norway produced 1.96 million barrels per day (b/d) of petroleum and other liquids (Figure 2), 3% higher than in 2014. Norway’s petroleum production has been gradually declining since 2001 as oil fields have matured, although production in 2013 and 2014 increased moderately. The NPD expects that petroleum production will continue to decline slowly from 2016 through 2019, before beginning to grow again in 2020 as the Johan Sverdrup field ramps up production.4 The three largest producing crude and condensate fields in 2015 were Troll (121,000 b/d), Ekofisk (112,000 b/d), and Snorre (110,000 b/d).5 The Troll and Ekofisk fields are located in the Norwegian portion of the North Sea, where most of Norway’s current production occurs. Snorre field is located a little further north, in the southern Norwegian Sea.

Overall investment in the oil and natural gas industry is declining in response to lower oil prices. Total investments in oil and natural gas extraction and pipeline transport in 2015 were Norwegian kroner (NOK) 195 billion (US $23 billion), NOK 25 billion lower than in 2014. Additionally, as of August 2016, estimated total investments in 2016 are more than 15% lower than investments in 2015.6 The lower levels of investment are the result of lower activity and lower costs.

North SeaNorway has been producing oil from the North Sea since 1971, and the North Sea still accounts for the bulk of Norway’s production. Although most of the Norway’s North Sea fields are in decline, several significant discoveries in the North Sea have been made in recent years. The Norwegian Parliament approved joint development and operating plans in June 2012 for Lundin’s Edvard Grieg oil and natural gas field and Det Norske’s Ivar Aasen Field (formerly called Draupne). Estimated to hold 206 million barrels of oil equivalent, Edvard Grieg began production in November 2015 and is expected to produce 100,000 b/d of oil equivalent at its peak. The nearby Ivar Aasen field, estimated to hold 183 million barrels of oil equivalent, will be tied into Edvard Grieg and begin producing oil in the fourth quarter of 2016.7

The Johan Sverdrup oil field was the largest oil discovery in the world in 2011, with reserves estimated at between 1.7 and 3.0 billion barrels of recoverable oil equivalent resources. This field is located 96 miles west of Stavanger in the North Sea. Johan Sverdrup was initially believed to consist of two fields four miles apart: Avaldnes, discovered by Lundin in 2010, and Aldous, discovered by Statoil in 2011. Further exploration activities revealed they constitute one giant field, renamed Johan Sverdrup in 2012, when the field partners signed a cooperation agreement that named Statoil as the operator. Partners also include Petoro, Det Norske, and Maersk. The field is expected to be a new stand-alone processing and transport hub. Production is scheduled to start in late 2019, eventually reaching a peak of 550,000 b/d-650,000 b/d, accounting for 25% of the forecasted production from the Norwegian continental shelf.8

Barents SeaGoliat is the first oil field to be developed in the Barents Sea. Discovered in 2000, Goliat’s recoverable oil reserves are estimated at 179 million barrels. Eni owns 65% of the field and is the operator; Statoil owns the remaining 35%. Eni is developing the field with a cylindrical floating production, storage, and offloading (FPSO) platform. The FPSO was built in South Korea, shipped to Hammerfest, Norway, and in May 2015 was towed to its destination at the Goliat field, offshore Norway. Production at Goliat began in March 2016 and is expected to ramp up to a peak of 93,000 b/d of oil before declining to about 30,000 b/d. Goliat has estimated recoverable natural gas reserves of 283 billion cubic feet (Bcf). Produced natural gas will be reinjected into the formation to improve oil recovery.9

Johan Castberg is another recent discovery in Norway’s Barents Sea. The Johan Castberg field encompasses three finds made in 2011, 2012, and 2014. Johan Castberg is estimated to hold between 400 and 650 million barrels of oil. Statoil, the operator for the field, was due to decide on a development plan for the field in 2015.10 However, mostly because of its remote Arctic location, development of this field will be relatively expensive. In March 2015, Statoil announced that it was pushing back its concept selection decision to the second half of 2016, with an investment decision expected in 2017.11

Oil exports

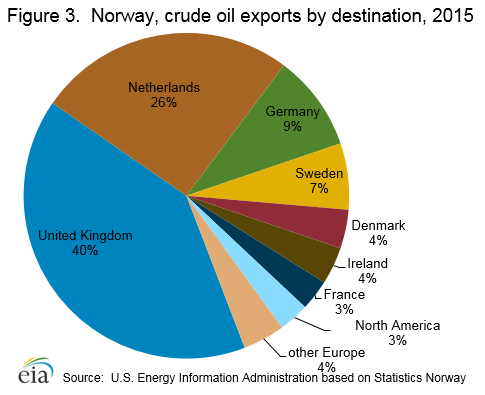

According to Statistics Norway, Norway exported an estimated 1.3 million b/d of crude oil in 2015, of which 97% went to European countries (Figure 3).12 The top five importers of Norwegian crude oil in 2015 were the United Kingdom (40%), the Netherlands (26%), Germany (9%), Sweden (7%), and Denmark (4%).

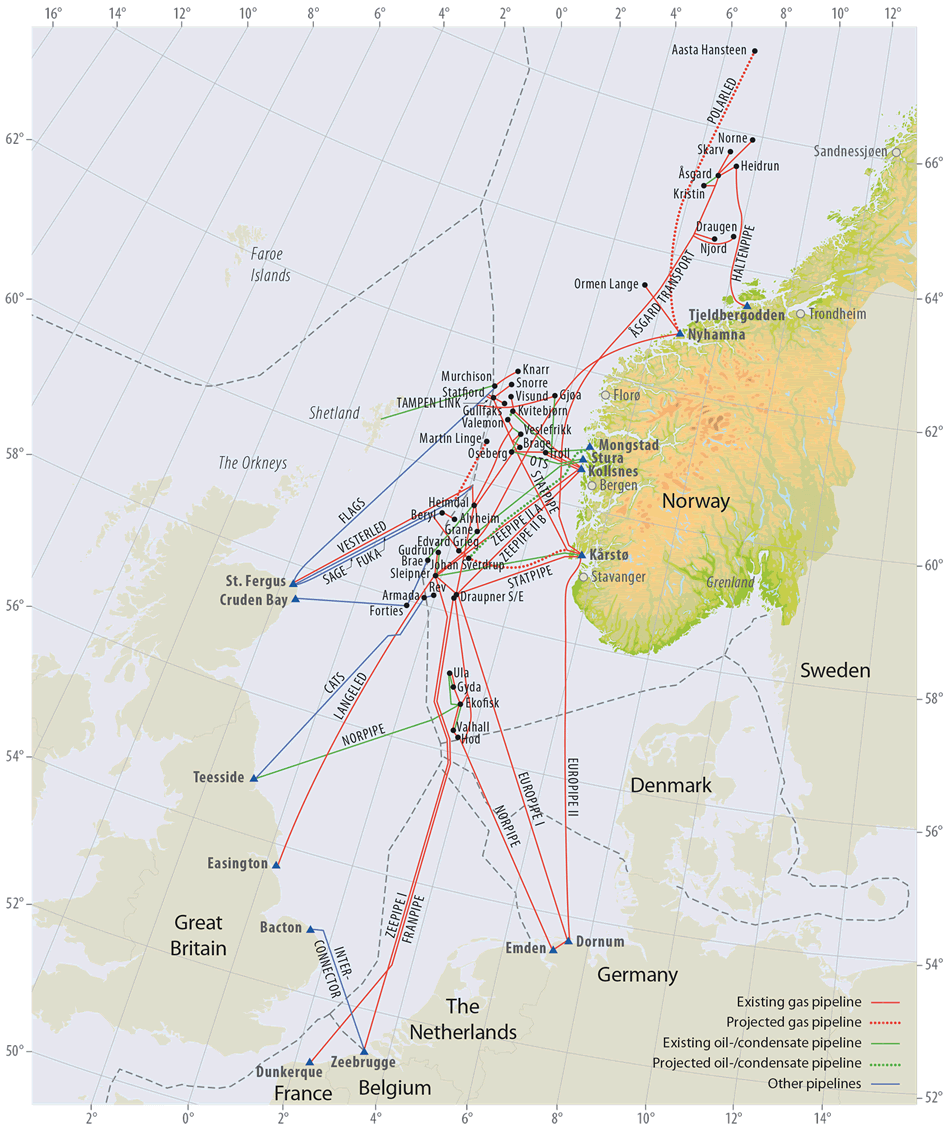

Pipelines

Norway has an extensive network of subsea oil pipelines, with a capacity to transport about 1.8 million b/d of crude oil and condensate to processing terminals on Norway’s coast.13 Many smaller pipelines connect North Sea fields to one of the major pipelines. Remaining offshore oil production is brought onshore by shuttle tanker.

ConocoPhillips operates the 830,000 b/d capacity subsea Norpipe, which connects Norwegian oil fields in the Ekofisk system (as well as associated fields in both Norwegian and United Kingdom waters) to the oil terminal and refinery complex at Teesside, England.14

Brent benchmark crude

A benchmark crude is a specific crude oil that is widely and actively bought and sold, and to which other types of crude oil can be compared to determine a price by an agreed-upon differential. Brent, the most widely used global crude oil benchmark, is composed of four crude oil blends: Brent, Forties, Ekofisk, and Oseberg (BFOE). The Brent and Forties blends are produced offshore in the waters of the United Kingdom, and the Ekofisk and Oseberg blends are mainly produced offshore in the waters of Norway. North Sea Brent crude oil loadings average slightly less than 1 million b/d, with the two Norwegian crude oil streams accounting for about 40% of the total.

The Brent benchmark was originally based on the output of the Brent field, a single field in the United Kingdom’s sector of the North Sea. However, as production from the Brent field declined, other fields and blends were added to the benchmark. Today the Brent benchmark encompasses the four BFOE crude blends, production of which are also mostly now in decline. Production and loading of Ekofisk and Oseberg blend crudes have been generally declining in recent years. Even though the benchmark itself accounts for only a small portion of total world crude oil production, it remains a key indicator for world crude oil pricing.

Refining

As of the end of 2015, Norway had 346,000 b/d of crude oil refining capacity. The country has two major refining facilities: the 120,000 b/d refinery at Slagentangen, operated by ExxonMobil;15 and the 226,000 b/d Mongstad plant, operated by Statoil.16 Most of the output from both refineries is exported, and Norway is an important supplier of gasoline and diesel fuel to the European Union (EU). Statoil dominates the retail products market in Norway, and the company has also expanded into other European markets.

Natural gas

Norway is the world’s third-largest exporter of natural gas after Russia and Qatar, and the seventh-largest producer of dry natural gas as of 2015.

According to the Oil & Gas Journal, Norway had 68 trillion cubic feet (Tcf) of proved natural gas reserves as of January 1, 2016.17 Despite maturing major natural gas fields in the North Sea, Norway has sustained increases nearly every year in total natural gas production since 1993 by continuing to develop new fields.

Sector organization

As is the case in the oil sector, Statoil dominates natural gas production in Norway. A number of international oil and natural gas companies, including ExxonMobil, ConocoPhillips, Total, Shell, and Eni, have a sizable presence in the natural gas and oil sectors in partnership with Statoil.

State-owned Gassco is the operator for Norway’s natural gas pipeline network, including the network of international pipelines and receiving terminals that exports Norway’s natural gas to the United Kingdom and continental Europe. The pipelines are owned by Gassled, a joint venture between the Norwegian government (46% ownership) and Statoil (5% ownership). The remaining 49% is owned by two Canadian pension funds, other institutional investors, and private companies.

The Canadian pension funds invested in Gassled in 2011 expecting moderate but predictable returns, which are typical for established pipeline companies. However, in 2013, the Norwegian government announced that it would cut the tariff rate for natural gas pipelines by 90% as of January 1, 2016. The Canadian pension funds and some other investors filed a lawsuit claiming that the tariff reduction was illegal and financially damaging. In October 2015, the court ruled against the investors. The investors appealed the decision, with the appeal hearing set to begin in January 2017. Norway is generally a low-risk country for investors, where these types of disputes are rare.

Production and development

Norway produced 4.1 Tcf of dry natural gas in 2015, a significant increase over 2014 (Figure 4). Norway’s largest producing natural gas field is Troll, which produced 1.2 Tcf in 2015, representing 30% of Norway’s total natural gas production that year. The four next-largest producing fields in 2015 were Ormen Lange (0.6 Tcf), Åsgard (0.3 Tcf), Kvitebjørn (0.2 Tcf), and Snøhvit (0.2 Tcf). These five fields accounted for 63% of Norway’s total dry natural gas production in 2015.18

Norway had eight oil and natural gas fields under development as of September 2016, two of which have significant natural gas reserves.19 The Martin Linge field in the North Sea holds an estimated 0.7 Tcf of recoverable natural gas and about 66 million barrels of petroleum liquids. The Aasta Hansteen field is located in the Norwegian Sea, north of the Arctic Circle. This field is more than 180 miles from land. The development plan for the field includes building a nearly 300-mile undersea pipeline to transport natural gas from the field to the Nyhamna natural gas processing plant. Aasta Hansteen holds an estimated 1.6 Tcf of recoverable natural gas as well as a small volume of liquids. Statoil, the main shareholder and operator of Aasta Hansteen, has also made several smaller discoveries in nearby fields that could be developed in the future. Both fields are scheduled to start production around 2018.

Exports

Norway exported about 95% of its natural gas production in 2015. Most of Norway’s natural gas exports were transported to European Union (EU) countries via Norway’s extensive export pipeline infrastructure, and 0.1 Tcf was exported to EU countries as LNG. The remaining 0.1 Tcf went to other parts of the world as LNG.20

International natural gas pipelinesNorway operates several important natural gas pipelines (Table 1)21that connect directly with other European countries, including France, the United Kingdom, Belgium, and Germany. These pipelines are operated by Gassco. Some pipelines run directly from Norway’s major North Sea fields to processing facilities in the receiving country. Other pipelines connect Norway’s onshore processing facilities to European markets (Figure 5).

| Facility | Status | Capacity (trillion cubic feet per year) | Total length (miles) | Origin | Destination | Details |

|---|---|---|---|---|---|---|

| Norpipe | operating | 0.6 | 280 | Ekofisk area | Emden, Germany | started operation in 1977 |

| Zeepipe I | operating | 0.5 | 500 | Sleipner platform | Zeebrugge, Belgium | started operation in 1993 |

| Europipe I | operating | 0.6 | 390 | Draupner platform | Dornum, Germany | started operation in 1995 |

| Zeepipe IIA and IIB | operating | 1.8 | 190 | Kollsnes gas plant | Sleipner platform (IIA) and Draupner platform (IIB) | started operations in 1996 (IIA) and 1997 (IIB) |

| Franpipe | operating | 0.7 | 520 | Draupner platform | Dunkirk, France | started operation in 1998 |

| Europipe II | operating | 0.8 | 410 | Kårstø gas plant | Dornum, Germany | started operation in 1999 |

| Vesterled | operating | 0.5 | 220 | Heimdal field | St. Fergus, Scotland | started operation in 2001 |

| Langeled | operating | 0.9 | 720 | Nyhamna gas plant | Easington, England | started operation in 2007, connects to the Sleipner platform. |

| Tampen and Gjøa | operating | 0.6 | 14 Tampen and 80 Gjøa | Statfjord and Gjøa fields | connects to the FLAGS pipeline to St. Fergus, Scotland | started operations in 2007 (Tampen) and 2010 (Gjøa) |

| Sources: U.S. Energy Information Administration based on Statoil and Gassco. | ||||||

Liquefied natural gas

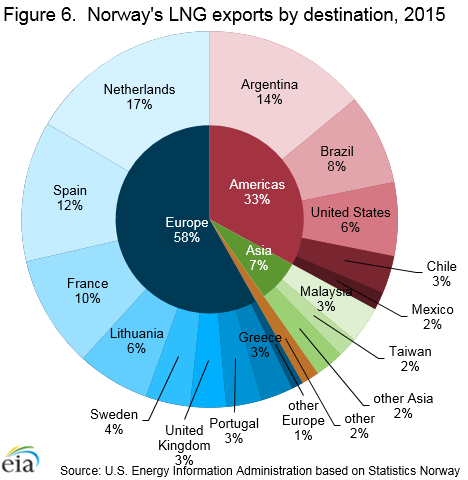

Shipments of Norwegian liquefied natural gas (LNG) totaled approximately 198 Bcf in 2015, up from 184 Bcf in 2014. European countries received 58% of Norway’s LNG exports in 2015, most of which were exported to the Netherlands (Figure 6).22

Norway’s first large-scale LNG liquefaction facility opened in 2007. Statoil operates the LNG export terminal and liquefaction facility at Melkoya, Norway, near Hammerfest. The facility draws natural gas from the Snohvit natural gas field, Norway’s first natural gas development in the Barents Sea. The Melkoya facility, the first large-scale LNG export terminal in Europe, has a design capacity of 4.2 million metric tons per year (mt/y) of LNG.

Norway has several small-scale LNG facilities, including three small-scale liquefaction plants with a combined capacity to produce 0.44 mt/y of LNG. Norway has been at the forefront of a growing small-scale LNG industry in the Nordic countries. LNG is distributed by small tanker ships and by tanker trucks to ports and inland facilities in Norway, Sweden, and Denmark. Finland’s first small-scale LNG receiving terminal was completed in 2016, and it is scheduled to start commercial operations in September 2016. LNG is mainly used by industrial consumers, and it is increasingly being used as marine fuel.

Hydrocarbon gas liquids

Hydrocarbon gas liquids includes both natural gas liquids (such as ethane, propane, and butanes) and olefins produced by natural gas processing plants, fractionators, crude oil refineries, and condensate splitters. Norway’s growing natural gas production has resulted in increasing yields of natural gas plant liquids (NGPL), making Norway Europe’s leading producer of NGPL. As natural gas production has grown in Norway, the quantities of recovered NGPL have increased significantly, from 124,000 b/d of oil equivalent in 2000 to 338,000 b/d of oil equivalent in 2015.23 Most NGPL are produced at the Kårstø processing plant, north of Stavanger, Norway, which can process about 3.1 Bcf per day of wet natural gas and unprocessed condensate that it receives from a number of fields on the Norwegian continental shelf, including Åsgard, Sleipner, and Mikkel.24

The significant NGPL output of the natural gas processing and fractionation capacity in Norway, particularly at Kårstø, has resulted in the port of Kårstø becoming Europe’s largest LPG export facility and one of the largest and most modern such terminals in the world. Propane and butane originating at the port move by tanker to destinations around the world.25 However, while Norway’s exports of liquefied petroleum gas (LPG, a mixture of propane and butane) continue to rise, output of ethane has been gradually declining.

Historically, ethane produced at Kårstø was shipped by barge to petrochemical crackers at Rafnes, Norway, and Stenungsund, Sweden. The diminishing ethane output, however, is no longer sufficient for Ineos at Rafnes and Borealis at Stenungsund to operate their plants at full capacity. In March 2015, Ineos began importing ethane from the Sunoco Logistics’ export terminal at Marcus Hook, Pennsylvania, to their Rafnes plant, where it is used as feedstock in the production of ethylene. In September 2016, Ineos also began importing ethane from Enterprise Product Partners’ terminal in Morgan’s Point, Texas.

As of the end of 2016, Ineos had four specially built ethane carriers under long-term charter, and before the end of 2017 the company is expected to add another four ethane carriers to its fleet. The ships will transport ethane between the two U.S. export terminals and Rafnes, as well as possibly other European destinations on the North Sea. The export of U.S. ethane to Norway has resulted in a traditional energy exporter becoming a significant importer of ethane from the United States at an expected rate of approximately 25,000 b/d going forward.

Electricity

Hydropower accounted for 97% of the electricity produced in Norway in 2014.

Electricity generation in Norway in 2014 was 140 billion kilowatthours (BkWh), of which 136 BkWh came from hydropower. According to Statistics Norway, total net consumption of electricity in 2014 was 117 BkWh, about 2% lower than in 2013.26

About 97% of all electricity generation in Norway comes from hydropower. The remaining electricity is generated from fossil fuels and other renewables, including wind and biomass. The largest renewable energy power generator in Europe is Statkraft, which is owned by the Norwegian state and is a major supplier of hydropower. Norway’s electric grid is owned and operated by Statnett. Statnett is responsible for ensuring the reliability and efficiency of the electric grid and for balancing electricity supply and demand. The company is owned by the Norwegian state, and its revenues from operating the grid are regulated by the Norwegian Water Resources and Energy Directorate under the Ministry of Petroleum and Energy.

In the late 1990s, Norway, Sweden, Finland, and Denmark integrated their electricity markets into a single market for the Nordic region. In 2008, a 0.7 gigawatt capacity subsea power cable allowing electricity trade between Norway and the Netherlands began operating. In addition, subsea power cables to connect Norway to Germany and to the United Kingdom are currently under construction. They are expected to be completed by 2019 and 2021, respectively, and both will have transmission capacities of 1.4 gigawatts.27 Norway also has a small interconnection with Russia in the far north. In 2014, Norway imported 6 BkWh of electricity and exported 22 BkWh. Most of the imports and exports went to or came from Sweden. Trade with the Netherlands and Denmark accounted for most of the remaining imported and exported electricity, with only small amounts traded with Finland and Russia.

Notes:

- Data presented in the text are the most recent available as of December 28, 2016.

- Data are EIA estimates unless otherwise noted.

Endnotes:

2Statnett, Cable to the UK and NORD.LINK, accessed May 27, 2015

3Oil & Gas Journal, “Worldwide Look at Reserves and Production,” (December 7, 2015) p. 22.

4Norwegian Petroleum Directorate, The shelf in 2015 – Petroleum production, (January 14, 2016).

5Norwegian Petroleum Directorate, Fact Pages, Monthly Production – by field, accessed August 18, 2016.

6Statistics Norway, Investments in oil and gas, manufacturing, mining and electricity supply, Q3 2016, accessed September 6, 2016.

7Lundin Petroleum, Operations—Norway, accessed September 6, 2016.

8Statoil, Johan Sverdrup, accessed August 31, 2015 and Lundin Petroleum, Operations—Johan Sverdrup, accessed August 31, 2015.

9Eni Norge, Goliat Facts, accessed September 6, 2016.

10Norwegian Petroleum Directorate, Fact Pages, Johan Castberg, accessed August 31, 2015.

11Statoil, “New timeline for Johan Castberg and Snorre 2040,” (March 6, 2015).

12Statistics Norway, External trade in goods, accessed September 2, 2016.

13Norwegian Petroleum Directorate, Oil and Condensate Pipelines on the Norwegian Continental Shelf, (updated March 10, 2016).

14ConocoPhillips, Norway, The Pipelines, accessed August 27, 2015.

15ExxonMobil, Norway, Refining and supply, accessed September 2, 2016.

16Statoil, Annual Report 2015, p. 38.

17Oil & Gas Journal, “Worldwide Look at Reserves and Production,” (December 7, 2015) p. 22.

18Norwegian Petroleum Directorate, Fact Pages, Monthly Production – by field, accessed August 18, 2016.

19Norwegian Petroleum Directorate, Recent Activity, Reserves in fields under development (pdo approved fields), accessed September 7, 2016.

20Statistics Norway, External trade in goods, accessed September 1, 2016.

21Statoil, Norway’s Gas Transport System, accessed August 13, 2015 and Gassco, Pipelines and Platforms, accessed August 13, 2015.

22Statistics Norway, External trade in goods, accessed September 1, 2016.

23Norwegian Petroleum Directorate, Facts – Production, Annual Production, 1971-2015, accessed September 1, 2016.

24Statoil, Kårstø Processing Plant, accessed September 18, 2015.

25Ibid

26Statistics Norway, Electricity, 2014, Table 3: Generation, imports, exports and consumption of electricity (December 22, 2015).

27Statnett, Brief History, Cable to the UK, and NORD.LINK, accessed May 27, 2015.