‘Debt Trap Diplomacy’ Blamed For Zambian Debt Crisis – OpEd

By IDN

By Lisa Vives

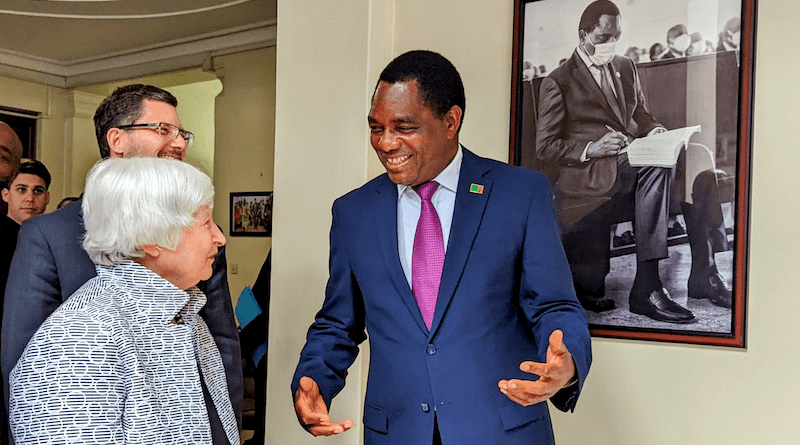

China, the builder of roads, energy, railways and telecom across Africa, came under fire from U.S. Treasury Secretary Janet Yellen during her recent three-country African friendship tour when she singled out the Asian giant for Africa’s looming debt crisis.

Driving past Lusaka, the capital city, with its renovated international airport and newly built firms bearing Chinese signage, Yellen urged Zambian leaders to address Zambia’s heavy debt burden with China immediately.

But she failed to mention other countries and banks that contributed to Zambia’s unsustainable borrowing, leading it to become the first African nation to default on its $42.5 million Eurobond repayment.

Many are asking: How did Zambia get into so much debt?

According to a report by the Chr. Michelson Institute, the largest center for development research in Scandinavia, the Chinese are not the main culprits for Zambia’s looming debt crisis.

The beneficiary of an IMF/World Bank debt relief program, Zambia has borrowed heavily since 2012. China is the single biggest creditor, but Zambia has also borrowed from several non-Chinese sources, including bilateral government loans, loans from fuel suppliers, the Arab Development Bank (BADEA), Israeli sources (for defense purposes) and from regular international banks in the UK, Nigeria and South Africa.

Further, economic decision-making is centralized in the Office of the President without adequate economic considerations.

Several critics have raised the question of whether Zambia has “hidden loans”, similar to those disclosed recently in Mozambique, which led to an economic crisis and major conflicts with donors who provide budget support and other grants.

Still, there is little transparency in Chinese lending operations. Neither the full scope of the loans nor the conditions are fully known. This leads to much uncertainty and speculation.

At present, 22 low-income African countries are either already in debt distress or at high risk of debt distress, according to the UK-based Chatham House. Chinese lenders account for 12 per cent of Africa’s private and public external debt, which increased more than fivefold to $696 billion from 2000 to 2020.

Ultimately, the report concludes, the Zambian government must take full responsibility for the debt crisis as they have received ample warnings against the increasing debt burden from its own economists and opposition, as well as from external advisers, the IMF, World Bank and donors.

China, watching U.S. manoeuvres in Africa, had this to say to the Treasury Secretary’s remarks: “The biggest contribution that the US can make to the debt issues outside the country is to cope with its own debt problem and stop sabotaging other sovereign countries’ active efforts to solve their debt issues.”