The Uncertain Future Of Alibaba – Analysis

By Anbound

By Wei Hongxu

After Alibaba’s founder Jack Ma was reported to have returned to China, the company announced its “biggest overhaul in 24 years”. On March 28th, Alibaba Group Chair and CEO Daniel Zhang issued a letter stating that the business would be split into six major divisions and multiple independent companies, which would operate independently with the possibility of independent financing and going public in the future. with Alibaba Group implementing a holding company management system.

This new structure is known as “1+6+N” with Alibaba Group establishing six major business groups including Cloud Intelligence Group, Taobao Tmall Business Group, Local Services Group, Global Digital Business Group, Cainiao Smart Logistics, and Digital Media and Entertainment Group. Meanwhile, “N” refers to multiple business companies under the group, like Health and offline grocery and dining chain Hema Fresh, as well as potentially new companies in the future. Zhang stated that the market is the best touchstone, and business groups and companies that meet the requirements will have the possibility of independent financing and going public in the future. This self-reform of restructuring has attracted market attention and led to a significant increase in Alibaba’s stock price.

Meanwhile, Alibaba’s organizational restructuring and reform have been seen as having landed on a safe shore after the Ant Group’s regulatory crackdown. Such a move is considered to give Alibaba more room for further development, as well as boost market confidence. The listing of its various business lines is seen as a signal of setting green lights for the capital. Many market institutions believe that after the listing of Alibaba’s major business divisions in the future, their value will be reassessed, and business departments with faster growth will be granted higher price-earnings ratios by the market, unleashing significant shareholder value. Currently, Alibaba’s subsidiaries, including Gaoxin Retail, Alibaba Health, and Alibaba Pictures, have already gone public independently. In addition, Hema, Alibaba Cloud, and Lazada all have the potential for independent listings. Therefore, the new structure means that Alibaba’s overall asset value can be realized through more capital markets, which is good news for investors and the capital market.

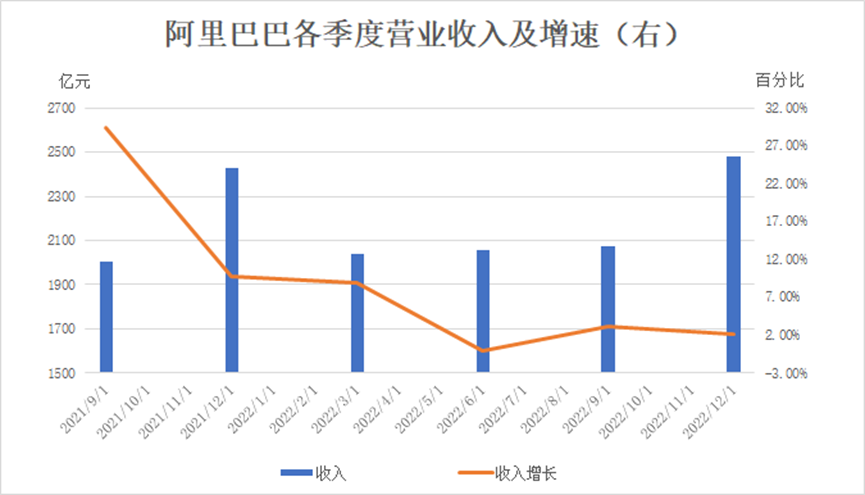

It appears that Alibaba has endured a year of turmoil. In September 2021, when Jack Ma completely exited the Alibaba board, the company’s market value stood at USD 795.4 billion. However, when Jack Ma returned, the U.S. stock market value plummeted to only about USD 220 billion. Moreover, Alibaba’s revenue growth rate has remained in the single digits for five consecutive quarters since the third quarter of the 2022 fiscal year, with the first quarter of the 2023 fiscal year even experiencing negative growth of 0.1%.

In terms of sub-businesses, the core e-commerce business, centered around Taobao and Tmall, has slowed down significantly. Even the highly anticipated Alibaba Cloud has experienced a sharp decline in revenue growth, dropping to 3%. In the latest third quarter of the 2023 fiscal year (fourth quarter of 2022), its quarterly revenue only achieved a 2% year-on-year growth. Thus, it appears that this reform of Alibaba was not a proactive move, but a necessary response to the current situation. Researchers at ANBOUND believe that it may be more about seeking a new path for survival after the bottleneck of the online user traffic economy than about continuing to expand to achieve the next level as before. Therefore, the timing of this reform is crucial, as it will determine Alibaba’s future fate.

Figure: Alibaba’s quarterly revenue and growth rate (right)

Looking at Alibaba’s current six major business divisions, it is clear that the company has not yet been able to break free from its reliance on e-commerce platforms. Although the extent to which the e-commerce platform is subsidizing other businesses has eased, each division can barely achieve profitability or avoid losses. Furthermore, all six of Alibaba’s major business divisions are facing threats from external competitors. Hence, it remains challenging for these other business divisions to break away from the online user traffic resources of the e-commerce platform and achieve independent operation. Alibaba’s overall transition from relying on the e-commerce platform may not be as optimistic as Zhang has portrayed, and it is also unclear what Alibaba’s role and position will be at the group level. It will not be easy to effectively manage the six entity-based business divisions, achieve a balance between decentralization and centralization, and act as an innovation platform and incubator. In addition, the new structure and pattern pose challenges for Alibaba’s future. The question remains whether divide-and-manage will inspire the vitality of subsidiary businesses or cause internal competition among various divisions. Only time will tell.

From a market perspective, Alibaba’s recent reform suggests that the company has effectively segmented its super platform. By shifting its focus to investment and holding, the company’s continuous monetization of its assets through the listing of its sub-business entities raises suspicions of “cashing out and exiting”. Furthermore, after Ant Group was hit with regulatory punishment and rectification, Alibaba’s strategic considerations for its future direction may involve turning reality into virtuality to avoid scrutiny. This shift raises questions about whether this restructuring is keeping pace with the times or retreating hastily, and the future of the company remains unpredictable.

Final analysis conclusion:

Alibaba’s announcement of the most significant organizational change in 24 years has attracted market attention. This seems more like a search for new ways to survive after the bottleneck of the online user traffic economy. It will not be easy to pass market scrutiny through the capital market for each business division in the new structure. All in all, Alibaba still faces a difficult long-term future.

Wei Hongxu is a researcher at ANBOUND