August Short-Term Energy Outlook Lowers Crude Price Forecast For 2015 And 2016 – Analysis

By EIA

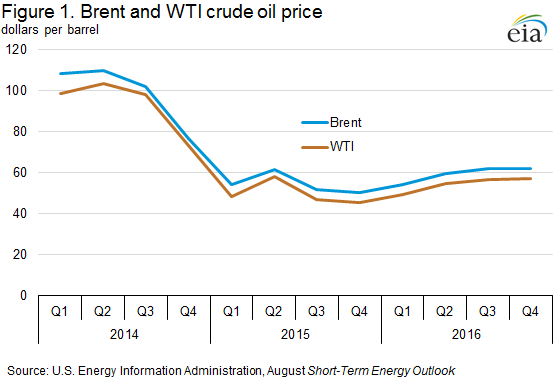

The Short-Term Energy Outlook (STEO) released on August 11 forecasts that North Sea Brent crude oil prices will average $54 per barrel (b) in 2015 and $59/b in 2016, which is $6/b and $8/b lower than projected in last month’s STEO, respectively (Figure 1).

The price decline reflects concerns about lower economic growth in emerging markets, expectations of higher oil exports from Iran, and continuing growth in global inventories. WTI prices are expected to average $5/b below Brent in both 2015 and 2016.

EIA’s updated projection remains subject to significant uncertainties as the oil market moves toward balance. During this period of price discovery, oil prices could experience periods of heightened volatility. The oil market faces a host of uncertainties heading into 2016 including the pace and volume at which Iranian oil reenters the market, the strength of oil consumption growth, and the responsiveness of non-OPEC production to low oil prices. In the more immediate future, there is potential downward price pressure heading into the fourth quarter if refinery runs drop by more than expected during the fall maintenance season.

The current values of futures and options contracts continue to suggest high uncertainty in the price outlook (Market Prices and Uncertainty Report). WTI futures contracts for November 2015 delivery, traded during the five-day period ending August 6, averaged $47/b, while implied volatility averaged 37%. These levels established the lower and upper limits of the 95% confidence interval for the market’s expectations of monthly average WTI prices in November 2015 at $34/b and $64/b, respectively. The 95% confidence interval for market expectations widens over time, with lower and upper limits of $27/b and $103/b for prices in December 2016.

EIA forecasts OPEC crude oil production to increase by 0.8 million b/d in 2015 and remain relatively flat in 2016. Iraq is expected to be the largest contributor to OPEC production growth in 2015. However, there is considerable uncertainty regarding Iraq’s ability to sustain the higher production and export levels, particularly in light of the infrastructure constraints in the southern terminals.

OPEC member Iran is another source of uncertainty regarding production. On July 14, the P5+1 (the five permanent members of the United Nations Security Council and Germany) and Iran reached an agreement that could result in relief from United States and European Union nuclear-related sanctions (which include some oil-related sanctions). If sanctions relief occurs, it will put additional Iranian oil supplies on a global market that has already seen oil inventories rise significantly above historical levels over the past year. This forecast assumes sanctions relief occurs in 2016, contributing to an annual average increase in Iranian crude oil production of 0.3 million b/d from 2015 to 2016, with most of the increase coming in the second half of the year.

The August STEO forecasts U.S. crude oil production will average 9.4 million b/d in 2015 and 9.0 million b/d in 2016, 0.1 million b/d and 0.4 million b/d lower, respectively, than in July’s STEO. EIA estimates total U.S. crude oil production declined by 100,000 barrels per day (b/d) in July and will generally continue to decrease through mid-2016 before growth resumes late in 2016. The decrease in the crude oil production forecast reflects a lower oil price outlook that will reduce expected oil-directed rig counts and drilling and well-completion activities throughout the forecast period.

Expected crude oil production declines are largely attributable to unattractive economic returns in some areas of both emerging and mature onshore oil production regions, as well as seasonal factors such as anticipated hurricane-related production disruptions in the Gulf of Mexico. Reductions in 2015 cash flows and capital expenditures have prompted companies to defer or redirect investment away from marginal exploration and research drilling to focus on core areas of major tight oil plays. Reduced investment has resulted in the lowest count of oil-directed rigs in nearly five years and well completions that are almost half of 2014 levels. Further, the reversal in June and July of the short-lived recovery in crude oil prices and lowered outlook for oil prices over the forecast period are expected to prolong and deepen onshore production declines.

Despite the downward revision to U.S. crude production growth, total non-OPEC supply is expected to increase by 1.4 million b/d in 2015 and remain flat in 2016. This output, combined with OPEC supply increases, will exceed demand in both 2015 and 2016, resulting in continued large inventory builds. EIA currently expects world inventory builds of 2.0 million b/d and 0.9 million b/d in 2015 and 2016, respectively.

U.S. average gasoline and diesel fuel prices decrease

The U.S. average retail price of regular gasoline fell six cents from the week prior to $2.63 per gallon as of August 10, 2015, 88 cents lower than at the same time last year. The West Coast price led the declines, down 12 cents per gallon to $3.36 per gallon. The Gulf Coast price decreased six cents per gallon to $2.34 per gallon, while the East Coast price declined five cents to $2.52 per gallon. The Midwest price was down four cents to $2.47 per gallon, and the Rocky Mountain price decreased three cents to $2.80 per gallon.

The U.S. average diesel fuel price decreased five cents from last week to $2.62 per gallon, $1.23 per gallon lower than the same time last year. The West Coast and East Coast prices both fell six cents, to $2.85 per gallon and $2.71 per gallon, respectively. The Gulf Coast, Midwest, and Rocky Mountain prices each decreased five cents, to $2.49 per gallon, $2.52 per gallon, and $2.64 per gallon, respectively.

Propane inventories gain

U.S. propane stocks increased by 2.4 million barrels last week to 92.8 million barrels as of August 7, 2015, 22.5 million barrels (32.0%) higher than a year ago. Gulf Coast inventories increased by 2.5 million barrels and Rocky Mountain/West Coast inventories increased by 0.2 million barrels. East Coast inventories decreased by 0.2 million barrels while Midwest inventories remained unchanged. Propylene non-fuel-use inventories represented 5.0% of total propane inventories.

Saudi Arabia already in crisis.

Expert assessment of Academy of Geopolitics.

The budget deficit of Saudi Arabia can reach 20% of GDP. The country for the first time for the last eight years started borrowing money in the financial markets. One of bonded loans was placed this week. But experts believe that the saved-up reserves to the kingdom will last still for a long time, and Riyadh won’t refuse the policy of strengthening of oil export. This week Saudi Arabia placed state bonds for 20 billion reals ($5,3 billion). It is the second loan for this summer — the size June made 15 billion reals ($4 billion). The kingdom can attract $27 billion by the end of the current year. Money was necessary for saudita because of double falling of prices of oil, receipts from which export form almost all income of the country. In 2015 the budget was under construction of calculation of price of oil in $105 for barrel. We will remind that at Saudi Arabia the income from export of oil makes more than 90% of state revenues. Deficiency of the state budget of the country, according to experts of Academy, can make 20% of GDP this year. These are about $140 billion. For comparison: the budget deficit of Russia is predicted in the current year of 3,4% of GDP, or about $40 billion. Saudi Arabia closed the arisen hole at the expense of an expenditure of the saved-up reserves until recently. Since August, 2014 for maintenance of the public expenditures the kingdom spent $65 billion from the state reserves which $672 billion equal at the moment. It should be noted that the budgetary problems of Saudi Arabia turned out to be consequence her politicians in the oil market. The kingdom supports the excess offer of oil and low price level to keep the market share and as much as possible to complicate strengthening of production of slate oil in the USA. And here the IMF considers that to make real GDP growth next year — 2,7%. In many respects, it manage to achieve due to maintenance of high level of state expenses, including due to decumulation of reserves. $672 billion very impressive sum, but experience of other countries ( including Russia) shows that it can be spent very quickly, especially, if to support state expenses at the current level. Therefore the kingdom, most likely, will continue to borrow money in the market.For Russia it not the best signal. Present forecasts of the government assume an increase in prices for oil next year and if it isn’t, the budget will continue to be under pressure. And reserves at Russia are almost twice less, than at Saudi Arabia.

Besides the country is under sanctions, and economic growth negative. All this does the Russian economy more sensitive to falling of oil quotations, than economy of the Saudi kingdom.

Same strengthens positions of Riyadh at negotiations with Moscow on such sensitive topics as Syria, Iran and Palestine. Saudita do all new trade offers to the Kremlin that that refused support of the Syrian president Bashar Assad.

At the negotiations of Foreign Ministers Adel al-Dzhubeyra and Sergey Lavrov completed the other day, it was talked, for example, of the contract for delivery of the Russian “Iskander ” missile systems. Riyadh also offered investments into $10 billion. Thus, as experts of Academy of Geopolitics believe that the change on the Syrian question is quite possible. However, are for this purpose necessary not only the Saudi billions, but also positive shift in the Russian-American relations as in the Kremlin perceiveRiyadh only as the ally of Washington.

Arayik Sargsyan, the President of Academy of Geopolitics, the academician, the Honourable Consul of Macedonia in Armenia.

Respect.