South China Sea’s First Victim: China’s AIIB? – Analysis

Could the Asian Infrastructure Investment Bank (AIIB) suffer collateral damage from China’s territorial claims in the South China Sea? The risk is clearly there.

The AIIB plans to make its first loan as early as the middle of this year.

That’s about the same time a UN arbitration tribunal in The Hague is expected to rule on the Philippines’ appeal against Chinese territorial claims to virtually the entire South China Sea.

Should China reject arbitration and/or the standing of established international fora for South China Sea dispute resolution — China risks painful blow back.

Given the political cover of such precedent, AIIB borrowers could feel emboldened to renege on AIIB loan repayments. China could then find itself lacking international political support in enforcing penalties, having itself rejected respected forms of multilateral dispute resolution.

For decades, China’s been the recipient of large-scale inward investment. As a result, China could write — and capriciously change — rules. But in coming years, China increasingly will be on the other side of the ledger.

That’s because China’s multi-decade accumulation of a US$3 trillion reserve hoard is now economically destabilizing.

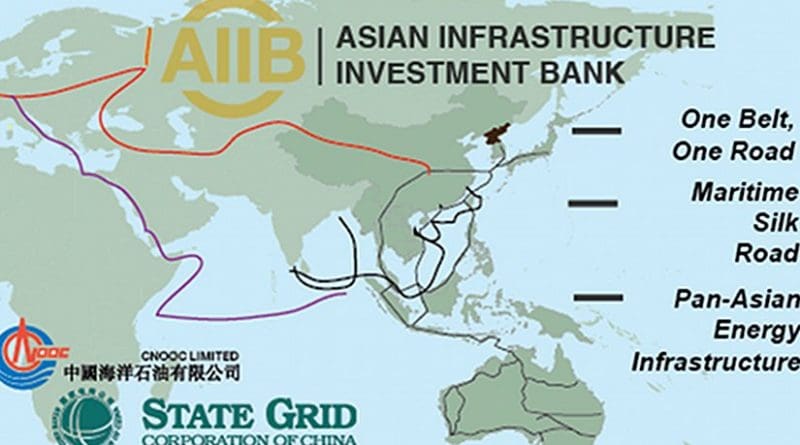

The AIIB was created to put this reserve hoard to work. The goal has been to maintain employment levels in China’s now world-competitive infrastructure state champions.

These companies — like State Grid Corp of China and China National Overseas Oil Company (CNOOC) — are now among China’s largest employers.

Given that China’s internal infrastructure needs are now largely met, these state champions now need overseas contracts to avoid politically destabilizing layoffs.

Shifting from inward investment recipient to outward global investor represents a huge change for China. It will force a change in Chinese thinking.

At present, China believes neighboring countries either are — or should be — an extension of China, where rules are what the Communist Party says they are.

China’s South China Sea Nine-Dotted Line is a manifestation of this. It rests upon two retroactive fictions: undocumented assertions the line has existed ‘since ancient times’ and undocumented claims of its ‘indisputability.’

Given this, potential AIIB borrowers can’t help but wonder whether similar standards may be applied in dispute resolution over AIIB loans. Could land beneath AIIB-funded, Chinese-built infrastructure in third countries be retroactively claimed ‘indisputable’ Chinese territory?

AIIB borrower due diligence now must include evaluation of the above risk.

Already, China’s infrastructure state champions like State Grid Corp. of China and China National Overseas Oil Company (CNOOC) — are experiencing blow back along these lines.

Take Vietnam and the Philippines. Both have clearly benefited from Chinese inward investment. But both also are pushing back.

Vietnam now trades electricity across its border with southern China. Vietnam’s also considered a potential route for the proposed $40 billion Kunming-Singapore Railway.

China and Vietnam also have agreements to cooperative manage fisheries and energy exploration in the Tonkin Gulf.

But at the same time, China’s CNOOC has placed a huge oil and gas exploration rig three times in waters claimed by Vietnam, sparking anti-Chinese riots in Vietnamese cities.

China’s State Grid similarly has suffered blow back — in the Philippines.

In 2008, State Grid won a pivotal contract to upgrade and operate the Philippine electricity grid under a 25 year contract.

Last year the Philippines summarily expelled Chinese State Grid technicians and replaced them with Filipinos. The reason? Undocumented Philippine allegations of a computer virus in the grid.

These two cases — among others — illustrate the ‘social license’ and ‘local caprice’ risk China’s been able to disregard during three decades of rapid internal economic growth in which it could set retroactively malleable rules.

The outside world, however, works differently.

In coming years, China must invest overseas to relieve growing internal economic imbalances and keep its populace employed to maintain political stability. This presents opportunities for borrowers and risks to China.

Ultimately, China’s power to enforce loan repayment on stroppy host countries may be hindered by Chinese precedents in claiming such obligations to be retroactively discretionary. Translation: the strategic gaming advantage now lies with AIIB borrowers.

This should moderate Chinese behavior and lead to a greater appreciation of compromise.

In the South China Sea, Joint Development Areas offer a way to solve this problem.

Look for progress along these lines in 2016.

Source: Grenatec.com