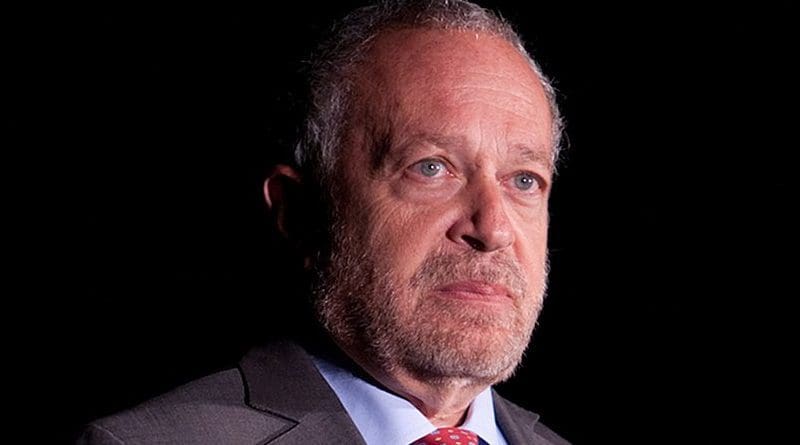

Robert Reich: The Three Big Lessons We Didn’t Learn From The Economic Crisis – OpEd

By Robert Reich

Ten years ago, after making piles of money gambling with other people’s money, Wall Street nearly imploded, and the outgoing George W. Bush and incoming Obama administrations bailed out the bankers.

America should have learned three big lessons from the crisis. We didn’t, to our continuing peril.

First unlearned lesson: Banking is a risky business with huge upsides for the few who gamble in it, but bigger downsides for the public when those bets go bad.

Which means that safeguards are necessary. The safeguards created after Wall Street’s 1929 crash worked for over four decades. They made banking boring.

But starting in the 1980s, they were watered down or repealed because of Wall Street’s increasing thirst for profits and its growing political clout. As politicians from both parties grew dependent on the Street for campaign funding, the rush to deregulate turned into a stampede.

It began in 1982 when Congress and the Reagan administration deregulated savings and loan banks – allowing them to engage in risky commercial lending, while continuing to guarantee them against major losses.

Not surprisingly, the banks got into big trouble, necessitating a taxpayer-funded bailout.

The next milestone came in 1999, when Congress and the Clinton Administration, under then Treasury Secretary Robert Rubin, repealed the Glass-Steagall Act – a 1930s safeguard that had prohibited banks from gambling with commercial deposits. (For the record, I was no longer in the Cabinet.)

Then in 2000, Congress and Clinton barred the Commodity Futures Trading Commission from regulating most over-the-counter derivative contracts, including credit default swaps.

The coup de grace came in 2004, when George W. Bush’s Securities and Exchange Commission allowed investment banks to hold less capital in reserve.

All of this ushered in the 2008 near meltdown – which was followed by another attempt to impose safeguards, the Dodd-Frank Act of 2010.

And now? The Street’s political clout is as great as ever, which explains why the Dodd-Frank safeguards are now being watered down – clearing the way for another crisis.

The second lesson we should have learned but didn’t is how widening inequality makes our economy susceptible to financial disaster.

In the decades leading up to 2008, stagnant wages caused many Americans to go deep into debt – using the rising values of their homes as collateral. Much the same thing had happened in the years leading up to 1929.

Wall Street banks were delighted to accommodate – lending willy-nilly and often in predatory ways – until the housing and debt bubbles burst.

And now? The underlying problem of stagnant wages, with most economic gains going to the top, is still with us. Once again, consumers are deep in debt – inviting another crisis.

The third big lesson we didn’t learn concerned the rigging of American politics. After the crisis, many Americans realized that Wall Street, big corporations, and the wealthy had essentially bought up our democracy.

Americans saw the Street get bailed out while homeowners, suddenly owing more on their homes than the homes were worth, got little or nothing.

Millions lost their jobs, savings, pensions, and homes, but the bankers and big investors came out richer than before.

Bankers who committed serious fraud escaped accountability. No executive went to jail. Big banks like Wells Fargo continued to break laws with impunity.

Many officials involved in deregulating the Street became top executives in the Wall Street banks that benefited from deregulation. Some involved in writing the Dodd-Frank Act are now employed by the same financial institutions that are watering it down.

Meanwhile, big corporations and wealthy individuals continue to flood Washington with money, making it the capital of “crony capitalism.”

Widespread outrage at all this fueled the Tea Party on the Right and the brief “Occupy” movement on the Left. Both eventually morphed into the two anti-establishment candidacies of 2016 – authoritarian populist Donald Trump and democratic populist Bernie Sanders.

And now? Anti-establishment fury remains the strongest force in American politics.

Trump has been using it to conjure up racist and xenophobic conspiracies and to create the most authoritarian regime in modern American history. He promised to “drain the swamp” but has made it bigger and filthier.

Democrats don’t know whether to simply oppose Trump and his authoritarianism, or get behind a reform agenda to wrest control of politics and the economy from the moneyed interests.

But to do the latter they’d have to take on those that have funded them for decades. I wish I had more confidence they will.

Sad to say, ten years after the near meltdown of Wall Street we seem to have learned very little. Only worse: We now have Trump.