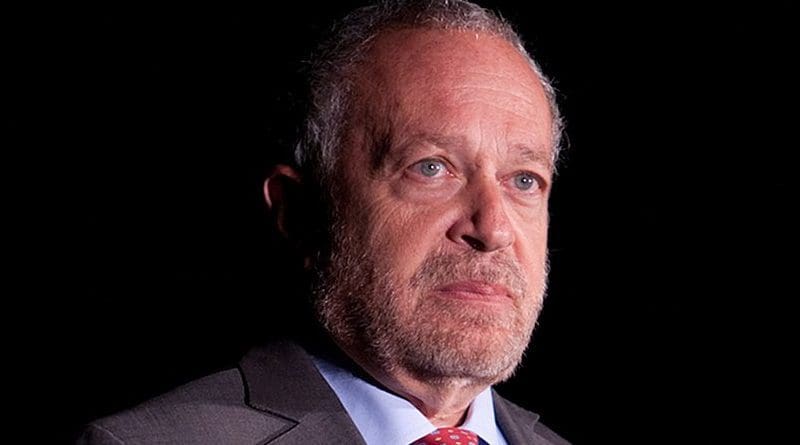

Robert Reich: Six Reasons Why American Corporations Shouldn’t Get A Tax Cut – OpEd

By Robert Reich

Trump and Republicans are trying to sell you the idea that American corporations need a tax cut in order to be competitive. That’s rubbish. Here are 6 reasons why:

First, American corporations don’t need it in order to be competitive internationally. After tax credits and deductions, their effective tax rate is just about the same as paid by corporations in most of our major trading partners, according to the U.S. Treasury.

Second, American corporations are making more money than ever. Their after-tax profits are a higher share of the total economy than ever. American corporations earn nearly half of all global profits, even though the U.S. economy is about a fifth the size of the world economy.

Third, the long-term competitiveness of American corporations depends far more on a well-educated and skilled workforce, modern infrastructure, and basic research than on tax rates. And the way we finance these necessary public investment is through … taxes.

Fourth, American corporations are now paying less in taxes than they have in 65 years. Corporate tax receipts are the lowest percentage of the economy since just after World War II. If corporate taxes are cut, you will have to pay even more in taxes in order to make up the difference.

Fifth, if their taxes were cut, corporations won’t use the extra money to make new investments in plant, equipment, research and development, or jobs. They’re already using their vast stockpiles of cash to buy back shares and thereby boost stock prices, and for extravagant bonuses and salaries to CEOs and other top executives. That’s what they would do with any additional cash.

Sixth, the reason they’re not investing more is because consumers don’t have the purchasing power to buy more, and that’s because most people’s incomes have gone nowhere for decades. And why is that? Because corporations have been holding down wages by outsourcing abroad, substituting software for jobs, contracting work out to part-time workers, and fighting unions.

A corporate tax cut is the wrong solution to the wrong problem. The real problem is stagnant wages of most Americans, coupled with declining public investments in schools, roads, public transportation, and basic research – all the things average working Americans need in order to become more productive and get higher wages. To finance these we need higher corporate taxes, not lower.

I typically like reading different takes on an issue and was genuinely interested in reading your novella of a retort. Unfortunately, your petty name calling and infantile insults ruined your credibility. I am sure some thought provoking logic might have been in there somewhere, but it is smothered by your rabid disdain for Mr. Reich. Your attempt at an argument failed miserably. Better luck next time.