Hasina ‘Managed’ India By Clearing Adani Deal Before Polls – OpEd

By Syed Bashir

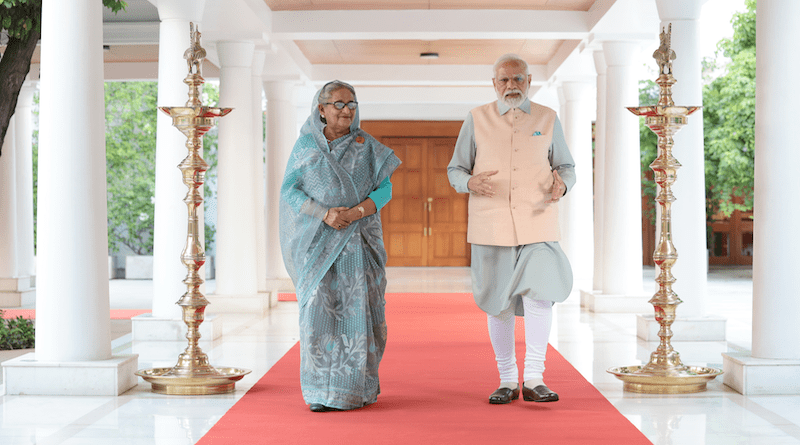

Bangladesh Prime Minister Sheikh Hasina, under huge Western pressure to deliver a free and fair elections, made her return to power a third successive time by ensuring Indian and Chinese support — and a controversial business deal with the Adanis may explain India’s decision to back her at all cost.

Hasina did not back off from operationalising the power purchase agreement with the Adanis despite huge domestic criticism that it was a sellout to the Indian business group considered very close to Prime Minister Narendra Modi.

That, many say, played a role in Modi overruling Indian officials who were circumspect about unconditional support to Hasina, after which she dropped pro-liberation India-friendly politicians from Awami League nominations and allowed her close family members and other cronies to dole out nominations for upto 200 million Taka per seat. The going rate for 50 women reserved seats is said to be around 50 million Taka per seat.

A top Bangladeshi musician in limelight recently for awards won and a TV channel owner were said to be the go-betweens in striking these money-for-nomination scam.

The reason being the quality and popularity of candidates were not a factor in an Opposition-less election. Rumours in Dhaka have it that a part of these collections have reached topshots in Delhi.

Built by Adani Power Ltd – India’s largest private power company founded by Gautam Adani – the $1.7bn Godda plant in India’s Jharkhand state has drawn flak in Dhaka because the power purchase agreement (PPA) has favoured the Indian multibillionaire in every possible way.

The electricity from Godda to Bangladesh is coming through a dedicated transmission line of about 106km up to the Indian border.

The commercial operation began on April 4 last year. In the next three months to June 30, it produced 159.8 crore units of electricity (kilowatt-hour).

The per unit cost was Tk 14.02 ( Rs. 10.58 ) as against Rs 3.24 per unit for the 300 MW Bangladesh agreed to buy in 2012 from India’s public sector behemoth National Thermal Power Corporation ( NTPC).

Under the agreement with Adanis, Dhaka will pay significantly higher prices – in comparison to what it pays for its other coal-based power – for lower-grade coal. That coal will be supplied from an Adani-owned mine in Australia to an Adani-owned port in India from where it will get shipped to the Godda plant, which is in a coal-mining state.

Experts point out that Bangladesh is not getting the benefit of the tax exemption which Adani Power Ltd got when its Godda plant was declared a Special Economic Zone (SEZ) – the exemption should have been passed on to Bangladesh.

In New Delhi, critics have questioned the whole point of the Modi government going the extra mile to ensure “multiple tax benefits” for a private coal plant that will supply electricity to another country at the cost of its own environment and people.

In 2022, a senior Sri Lanka official claimed before a Lankan parliamentary panel that Prime Minister Narendra Modi had pressured President Gotabaya Rajapaksa to award a power project to the Adani Group, but retracted the statement a day later as the controversy spiralled.

The 500-megawatt renewable energy project in the island nation’s northern Mannar district. The Chairman of Sri Lanka’s Ceylon Electricity Board (CEB), MMC Ferdinando, appearing before a parliamentary panel in Colombo Friday, claimed that during his conversation with President Rajapaksa, he was told Modi wanted the project to go to Adanis.

B D Rahmatullah, a former director general of Bangladesh’s power regulator told Al Jazeera that Adanis were the “only beneficiary” in this deal.

“Unfortunately, it seems our government has no intention of revising or getting out of this electricity purchase arrangement despite the growing discontent surrounding it,” Rahmatullah said.

Even though the electricity deal between Adani and the Bangladesh government is nearly six years old, it didn’t create much of a storm – at least politically – for most of this time as its details were never made public.

The deal was struck under a controversial Special Act of Bangladesh that allows the government to make unsolicited PPAs.

Analysts say Bangladesh opted for the electricity deal as it had major political implications for its ruling Awami League (AL) party at the time.

“It was not a secret to the AL that Adani was closely tied with Indian Prime Minister Narendra Modi, and a business deal that favours Adani would ultimately bring political favour from Modi to AL government,” Saimum Parvez, research fellow of the department of political science of Vrije University in Brussels, was quoted by Al Jazeera as saying.

“And Awami League needed that favour from India, a key regional power, to secure political legitimacy to stay in power through severely controversial elections [including one in 2014] and they needed all the support from India, the regional superpower,” Parvez added.

He said the deal with Adani didn’t create much furore for a long time as the AL government successfully contained any sort of criticism with its firm grip on the opposition parties and muzzled the press with draconian laws.

But that started to change from mid-2022 onward, Parvez said, as the country started to feel the heat of inflation, price hikes, shrinking foreign reserves, and embezzlement of millions of dollars from a series of banks, leading to a rise in public discontent.

“After a long time, opposition political parties successfully arranged several massive protests in the latter half of 2022. And then the Hindenburg report was released in the beginning of this year,” said Parvez, giving them more ammunition for their protests.

In January, Adani, who was the world’s second-richest man just a few months ago, was thrown at the centre of a worldwide scandal when a bombshell report by a US-based short-seller named Hindenburg Research accused him of stock market manipulation and fraud. Within a few weeks, Adani lost more than $100bn of his wealth.

Despite being embroiled in such controversies, Gautam Adani was hosted by Bangladesh Prime Minister Sheikh Hasina in July last year after the Adani-built Godda Ultra Super-Critical Thermal Power Plant in Jharkhand began supplying electricity to Bangladesh.

“Honoured to have met Bangladesh PM Sheikh Hasina on full load commencement and handover of the 1600 MW Ultra Super-Critical Godda Power Plant. I salute the dedicated teams from India and Bangladesh who braved COVID to commission the plant in a record time of three-and-a-half years,” said Mr. Adani in a social media pos

The press note from the Adani Group informed that the first unit of 800 MW capacity of the Godda plant began commercial operations. “The commissioning of the Godda USCTPP marks a significant milestone for the Adani Group and the Bangladesh Power Development Board (BPDB) and also for the close cooperation and strong economic ties between the two nations. Adani Power has become a partner in Bangladesh’s economic growth and prosperity by supplying uninterrupted and reliable electricity at competitive tariff,” said the Adani Group in a statement.

Now it is reliably learnt that Bangladesh’s power purchase from Adani Power contributed to the massive profit the Indian conglomerate made in the first nine months of the 2023-24 fiscal year.

In November 2017, Bangladesh inked a deal with Adani Power Jharkhand, a wholly-owned subsidiary of the multinational company headquartered in Ahmedabad, to import electricity amid criticism from analysts that the deal would benefit the Indian company more.

In April-December of 2023-24, Adani Power’s continuing revenue rose 40 percent to 37,173 crore rupees (Tk 48,911 crore). The Jharkhand unit contributed 5,326 crore rupees, or 14.3 percent of the total.

Thus, Adani Power’s profits rose 230 percent year-on-year to 18,092 crore rupees (Tk 23,805 crore) in the nine months, according to the company.

Bangladesh turned to India to meet its growing demand for electricity and supply power cost-effectively to the northern part that does not have large power units.

When the deal was struck with Adani, Bangladesh’s power production capacity stood at 12,922 MW, with the highest generation standing at 9,507 MW, according to the website of the Bangladesh Power Development Board.

The plant, located on 425 hectares of land in the Godda district of the Indian eastern state of Jharkhand, started commercial production in the first quarter of India’s fiscal year that begins in April.

During the earnings call last week, Shailesh Sawa, then chief financial officer of Adani Power, said the company achieved sales growth in the third quarter. The operating and financial performance of the incremental capacity of 1,496 megawatts of the Godda power plant was included.

The continuing revenue of Adani Power increased 72 percent year-on-year to 13,405 crore rupees in the October-December quarter. Profit skyrocketed to 2,738 crore rupees from 9 crore rupees during the period, figures disclosed by the company showed.

The company attributed the heavy net profits to the surge in revenue and lower finance and fuel costs.

“The revenue growth came thanks to the higher operating capacity after commissioning of the Godda plant and improved power offtake following the growth in demand and lower imported fuel prices,” the company said in its presentation made to analysts.

The inclusion of the Godda power plant added 1,824 crore rupees to the revenue of Adani Power in the third quarter.

The multinational’s EBITDA (earnings before interest, taxes, depreciation, and amortisation) rose 242 percent year-on-year to 5,059 crore rupees in the quarter. EBITDA indicates how well a company is managing its day-to-day operations.

The company said the EBITDA grew on the back of a higher contribution on account of the lower fuel cost and strong merchant prices.

In the second quarter spanning July to September, Adani Power’s revenue climbed 61 percent to 12,155 crore rupees, partly due to the 2,034 crore rupees contributed by the Godda plant.

In the first quarter, Godda plant added of 1,468 crore rupees to the revenue.

The opinions expressed are the author’s own