Trump Expected To Nominate Powell To Replace Yellen – OpEd

By MISES

By Tho Bishop*

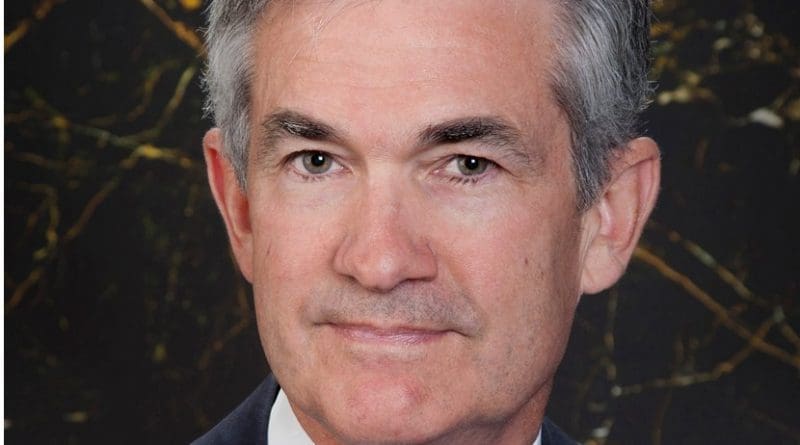

In the end Donald Trump will get what he wanted, a “low interest rate person” who also happened to be a “Republican.” Jerome Powell is expected to replace Janet Yellen in an announcement later this week. If so, this means Trump will ensure that, while the stationary at the Eccles Building will change, the monetary policy guiding it likely will not.

The fact that, in naming Powell, Trump is picking an Obama-appointed Fed Governor for his most important nominations is itself quite fitting. While we have long known that bad monetary policy is bipartisan, Powell’s nomination serves as a particularly useful illustration of how little has changed in Washington since the Bush Administration.

Of course, just as Trump received his loudest applause from Washington for doing his best impersonation of his two predecessors, the President is already being praised for making a “grown up” decision when it comes to the Fed. While his awareness optics likely prevented him from ever truly considering reappointing Janet Yellen –—the preferred choice of the DC and NY — Powell’s nomination ensures that Trump’s scathing criticism of the monetary orthodox has been predictably discarded alongside a number of his most exciting campaign promises.

Now we will see how else Trump squanders his historic opportunity to rearrange the Fed. The administration has signaled that its plans to form a policy consensus with its remaining Fed choices – as opposed to opening FOMC meetings into some truly spirited debate.

This likely means that John Allison, whose resume as head of BB&T during the financial crisis and an admirer of Mises and Hayek made him the best fit for Candidate Trump’s rhetoric, is unlikely to be seriously considered for anything. Of course given the dangerous world the Fed finds itself in, it’s likely for the best that Allison emulates the example of Ludwig von Mises who, when offered a prestigious bank position in the 1929, famously said, “a great crash is coming, and I don’t want my name in any way connected with it.”

Going forward, it will be interesting to see how Republicans in the House and Senate proceed. For years now, House Financial Services Committee Chairman Jeb Hensarling has been pushing Fed reform which would have included requiring the Fed to adopted rule-based monetary policy. While this would have complimented the nomination of John Taylor or Kevin Warsh, Powell has made it clear that he opposes such limits being placed on the Fed.

Going forward, we should expect to see the Fed continue its tediously slow normalization of its balance sheet – what George Selgin has cleverly dubbed Operation SNAIL. Whether the Fed continues with its projected interest rate hike in December may itself depend on Congress. The legislature’s knack for kicking the budgetary can down the road as led to yet another “fiscal cliff” scenario at the end of the year. While we can be ensured that outcome will be more spending (and more debt), the bout of yet another round of arbitrary drama may give the Fed enough of an excuse to follow their lead and hold off until 2018.

About the author:

*Tho Bishop directs the Mises Institute’s social media marketing (e.g., twitter, facebook, instagram), and can assist with questions from the press.

Source:

This article was published by the Mises Institute