Egypt Energy Profile: Third-Largest Natural Gas Producer In Africa – Analysis

By EIA

Egypt is the third-largest natural gas producer in Africa, following Algeria and Nigeria. Egypt operates the Suez Canal and the Suez-Mediterranean (SUMED) Pipeline, which are important transportation infrastructure in international energy markets. The Suez Canal is a transit route for oil and liquefied natural gas (LNG) shipments traveling northbound from the Persian Gulf to Europe and to North America. Shipments traveling southbound from North Africa and from countries along the Mediterranean Sea to Asia also move through the Suez Canal. Fees collected from these two transit points are significant sources of revenue for the Egyptian government.

Sector organization

According to Egypt’s Ministry of Petroleum, five state-owned enterprises (SOE) manage the petroleum sector:1

- Egyptian General Petroleum Corporation (EGPC)

- Egyptian Natural Gas Holding Company (EGAS)

- Egyptian Petrochemicals Holding Company (ECHEM)

- Egyptian Mineral Resources Authority (EMRA)

Ganoub El-Wadi Holding Company (Ganope)ECHEM develops the petrochemical sector, and EMRA assesses mineral resources and geological mapping of the country.2 EGPC and Ganope both manage upstream oil activities and issue upstream licenses. Ganope focuses on activity in the southern region, while EGPC manages development in the rest of the country.3 EGAS oversees the development, production, and marketing of natural gas and also organizes international exploration bid rounds and awards natural gas exploration licenses. EGAS and EGPC work with international companies to establish joint venture companies that develop and operate oil and natural gas fields. The government earns revenue directly through royalty payments and indirectly through production-sharing agreements between the international companies and the relevant SOE (EGAS or EGPC).4

In the petroleum sector, Eni and Apache Energy are significant international oil and gas companies in terms of overall production volume, according to Rystad Energy’s estimates over the past 10 years. Eni and Apache compete alongside both domestic oil companies, such as EGPC and PICO Cheiron Group, as well as other national oil companies, such as Sinopec. Eni, BP, Apache, and Shell lead the natural gas sector. However, some SOEs such as Rosneft and Petronas also participate, although at smaller overall production volumes.5

The Egyptian government is trying to attract more investors to develop underexplored areas and boost crude oil and natural gas production. In 2019, the government held a licensing round for 10 exploration blocks located in the Red Sea, but only awarded licenses for Blocks 1, 3, and 4 to Chevron, Shell, and jointly to Shell and Mubadala Petroleum, respectively.6 In 2021, the government held another licensing round to award licenses for 24 exploration blocks located in the Western Desert, the Gulf of Suez, the Nile Delta, and the Mediterranean Sea, areas which already have significant production of crude oil and natural gas. The government announced bid winners in January 2022; however, it only awarded eight blocks. Eni received exploration licenses to five blocks, and the other bid winners were BP, Apex International Energy, and United Energy.7

Energy consumption

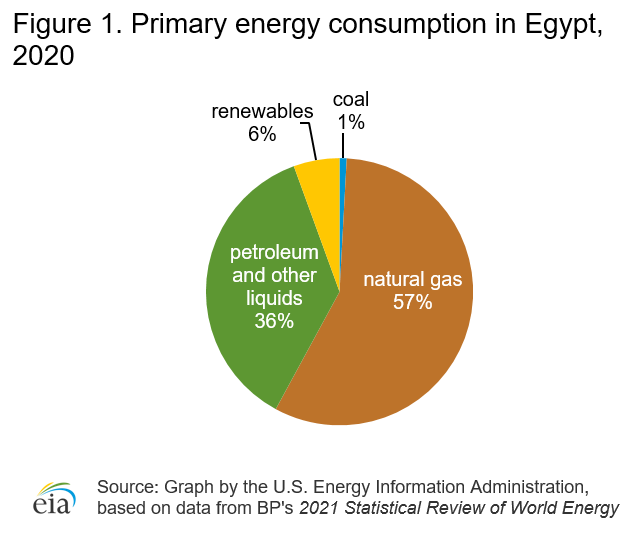

According to the latest estimates in BP’s 2021 Statistical Review of World Energy, the most-consumed fuels in Egypt were petroleum and other liquids (36%) and natural gas (57%) in 2020. Renewable energy and coal accounted for 6% and 1%, respectively, of the country’s total consumption for the same year (Figure 1). Coal is primarily used in Egypt’s industrial sector.8

Petroleum and other liquids

Exploration and production

According to the Oil & Gas Journal (OGJ), Egypt held proved oil reserves of 3.3 billion barrels as of January 2021.9

Egypt has three main crude oil blends. The Suez and Belayim blends comes from aging offshore fields in the Gulf of Suez and are refined domestically, with only small quantities exported. The Suez and Belayim blends are medium, sour crude oil grades. The Western Desert blend comes from the newer onshore fields in the Western Desert and is a light, sweet crude oil (Table 1).10

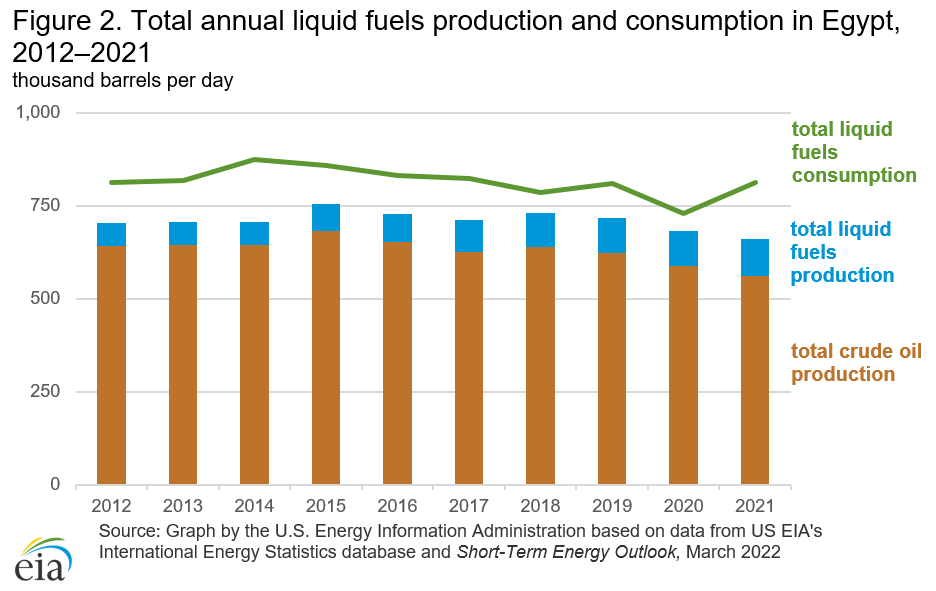

Total liquid fuels production in 2021 was an estimated 660,000 barrels per day (b/d), about 561,000 b/d was crude oil and lease condensate (Figure 2).11

Egypt’s total liquid fuels consumption currently outpaces its oil production. Egypt’s total liquid fuels production has benefited from higher natural gas liquids production from the large offshore natural gas fields that came online in the mid-2010s. However, overall total liquid fuels production has been declining because of a lack of significant crude oil discoveries in recent years.12

| Crude oil blend | API gravity | Sulfur content |

|---|---|---|

| Suez | 30.4 | 1.65 |

| Belayim | 27.5 | 2.20 |

| Western Desert | 41.1 | 0.34 |

| Source: Table by the U.S. Energy Information Administration, based on data from the Egypt Oil & Gas Group |

Transport and storage

The Suez Canal and the Suez-Mediterranean (SUMED) Pipeline are two major routes and transit chokepoints for crude oil and LNG shipments, and they give Egypt a significant role in global crude oil and natural gas trade. If both the Suez Canal and the SUMED Pipeline close, tankers would have to divert around the southern tip of Africa, adding approximately 8–15 days of transit to the United States or Europe and leading to increased shipping costs.13

Egypt has crude oil storage facilities located at the Ain Sukhna and Sidi Kerir terminals, which are located at the beginning and the end of the SUMED pipeline. The Sidi Kerir terminal, located on the Mediterranean, has 27 storage tanks with a total capacity of 20 million barrels, while the Ain Sukhna terminal (located on the Red Sea) has 15 floating storage tanks with a total capacity of 10 million barrels.14

Refining and refined oil products

According to the EGPC, eight refineries with a total nameplate capacity of approximately 762,000 b/d exist in Egypt (Table 2).15

According to Egypt’s Minister of Petroleum and Mineral Resources, the MIDOR refinery plans to expand and modernize by 60,000 b/d. This project is expected to be completed in the first quarter of 2022, adding an additional crude oil distillation unit, a vacuum distillation unit, a diesel hydrotreater, and a hydrogen unit. This project, which will cost about $2.3 billion, will also increase operational efficiency and production capacity by upgrading and integrating other existing units. TechnipFMC received the engineering, procurement, and construction contract in 2018.16

The Assiut refinery plans to expand and modernize its facilities to add a new naphtha complex and hydrocracking complex. According to NS Energy Business, this project is scheduled to be completed by 2022 and will likely require an investment of about $2.5 billion.17

The Mostorod refinery began operating commercially in 2019, and it was officially inaugurated in September 2020. The refinery has a number of different processing units, including a delayed coker unit, a naphtha and a diesel hydrotreating unit, a hydrocracker, and a sulfur recovery unit. The refinery was originally slated to begin operations in 2017 but experienced delays during its construction phase.18

In April 2021, the Egyptian government and the state-owned Red Sea National Refining and Petrochemicals Company signed an agreement to build an integrated refining and petrochemicals complex in the Suez Canal Economic Zone at Ain Sukhna. The refining and petrochemicals complex will be used to produce a variety of petroleum and chemical products, including polyethylene, polyesters, and bunker fuel, and, when completed, will be the first and largest integrated facility in Africa. The proposed refining and petrochemicals project requires an overall investment of $7.5 billion and, according to Egypt’s Ministry of Petroleum and Mineral Resources, construction will likely be finished by the end of 2024.19

| Refinery name | Operator | Location | Nameplate capacity (barrels per day) |

|---|---|---|---|

| El-Nasr refinery | El-Nasr Petroleum Company | El Suez | 131,000 |

| Mostorod refinery | Egypt Refining Company | Mostorod (Cairo) | 161,000 |

| Alexandria refinery | Alexandria Petroleum Company | Alexandria | 100,000 |

| MIDOR refinery | Middle East Oil Refinery | Alexandria | 100,000 |

| Ameriya refinery | Ameriya Petroleum Refining Company | Ameriya | 80,000 |

| Suez refinery | Suez Petroleum Processing Company | El Suez | 60,000 |

| Assiut refinery | Assiut Petroleum Refining Company | Assiut | 90,000 |

| Tanta refinery | Cairo Petroleum Refining Company | Tanta | 40,000 |

| Total | 762,000 | ||

| Source: Table created by the U.S. Energy Information Administration, based on data from the Egyptian General Petroleum Corporation company website |

Petroleum and other liquids exports

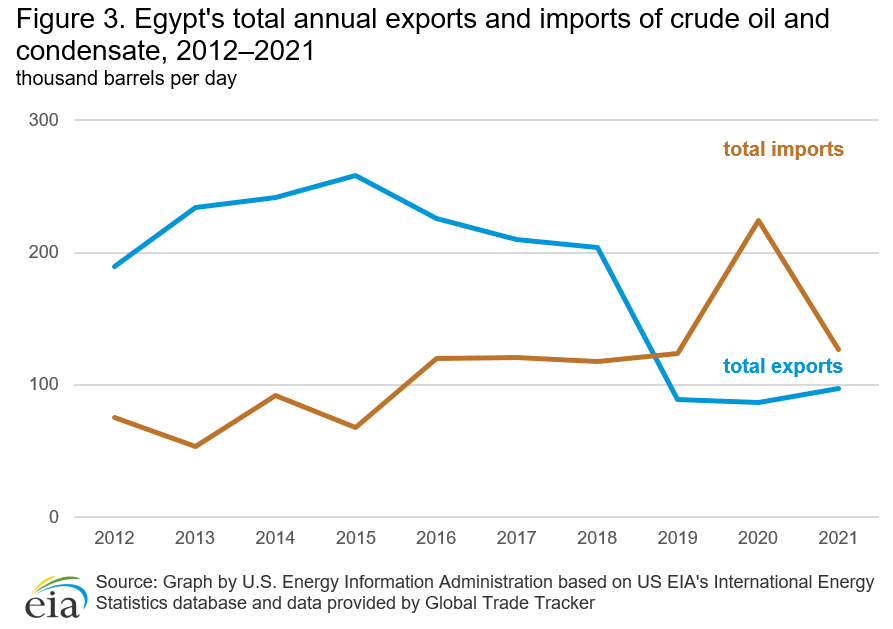

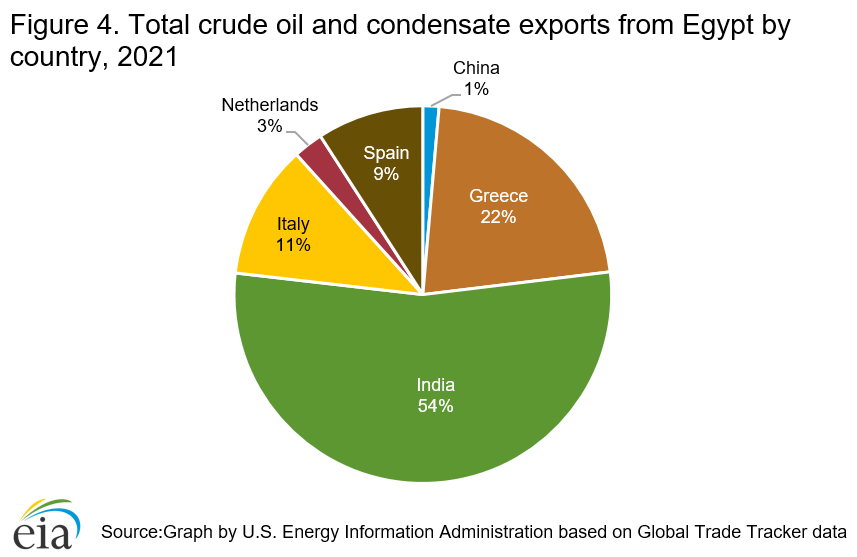

In 2021, Egypt imported about 127,000 b/d of crude oil and condensate and exported about 98,000 b/d (Figure 3). Over half of Egypt’s crude oil exports went to India, and the remainder went to China and countries in Europe (Figure 4).20

Natural gas

Exploration and production

According to OGJ, Egypt held 63 trillion cubic feet (Tcf) of proved natural gas reserves as of January 2021.21

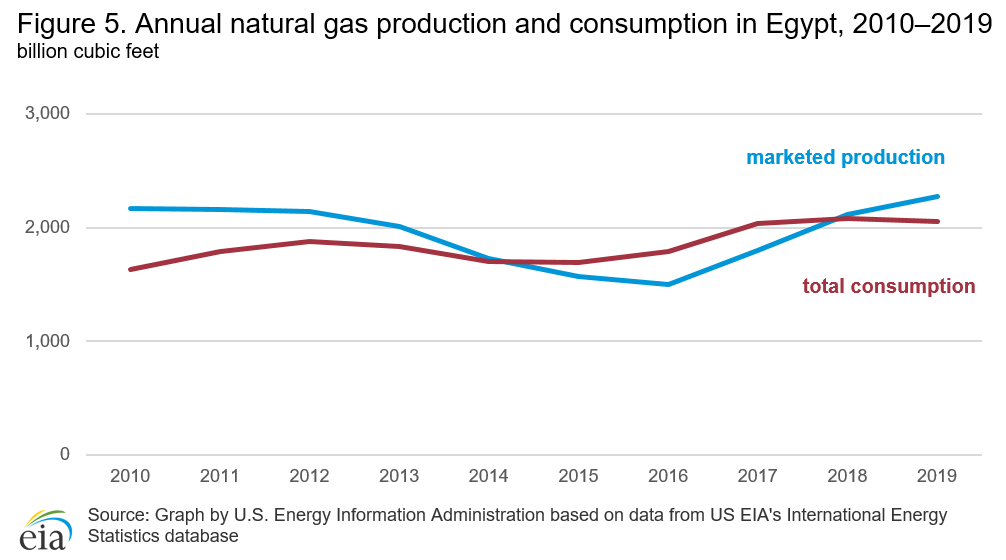

Egypt produced about 2.3 Tcf of dry natural gas in 2019 and consumed about 2.1 Tcf in that same year22 (Figure 5). Egypt’s natural gas production rose significantly as a result of large natural gas discoveries in the mid-2010s, such as the Zohr, Atoll, and West Nile Delta projects that were fast-tracked for development. Natural gas consumption, meanwhile, has remained relatively flat, allowing Egypt to export some of its surplus natural gas via pipelines and as LNG.23

Egypt’s Zohr field reached its peak production of 1.1 Tcf per year in February and March 2021, but technical problems have decreased its production; water breakthrough issues decreased output at the field to about 876 Bcf–912 Bcf per year. Eni (the operator) and its concession partners (Rosneft, BP, and Mubadala Petroleum) plan to drill additional wells to increase capacity, but the outcome remains uncertain. The West Nile Delta development’s Raven project, brought online in April 2021, also has not reached its stated capacity of 329 Bcf per year, producing about 219 Bcf per year as of June 2021. The lower-than-expected output from Egypt’s recent natural gas discoveries may slow natural gas production growth.24

In July 2020, Eni announced a new natural gas discovery at the Bashrush well in the North El Hammad concession, Greater Nooros area, located offshore in the Mediterranean. Initial testing at the well placed production estimates at about 11.7 Bcf per year. Eni is planning to coordinate with its concession partners—BP, TotalEnergies, and EGAS—to quickly develop the field and bring its production online. The Bashrush discovery is the latest significant addition to some of the offshore discoveries made in the last decade in the Mediterranean that have boosted Egypt’s total natural gas production.

Transport and storage

Pipelines

The Arab Gas Pipeline (AGP) is a natural gas pipeline that originates in Arish, Egypt, and connects to Israel, Jordan, Syria, and Lebanon. Sabotage or attacks by militant groups have repeatedly disrupted AGP’s transport of natural gas since its construction. The AGP, which has a reported capacity of 234 Bcf per year, currently supplies natural gas from Egypt to Jordan at between 26 Bcf and 44 Bcf per year. Lebanon is currently repairing its connection to the pipeline to restart natural gas imports from Egypt and plans to complete the repairs by March 2022.26

Israel and Egypt are reportedly planning to build a natural gas pipeline onshore that could provide up to an additional 177 Bcf per year. The proposed natural gas pipeline would be the second between the two countries—the first being the subsea Eastern Mediterranean Gas (EMG) Pipeline that runs from Ashkelon in Israel to Arish in Egypt. The EMG pipeline has a nameplate capacity of about 318 Bcf and transports natural gas from Israel’s offshore fields to Egypt for domestic consumption or export.27

LNG

Egypt currently has two LNG export facilities, the Spanish-Egyptian Gas Company (SEGAS) LNG facility and the Egyptian LNG facility (ELNG). SEGAS LNG is a single LNG train located in Damietta on the Mediterranean coast. Since the start of commercial operations in 2004, Egypt underutilized SEGAS LNG, leading to the plant’s closure in December 2012 as a result of growing domestic energy demands. The plant restarted LNG exports in February 2021 after Eni, Naturgy, and the government of Egypt and its SOEs reached an agreement to restart the plant.28 ELNG is located at Idku and has two LNG trains. ELNG began production in May 2005, but like the SEGAS LNG, the facility experienced a temporary shut-in in 2015 as a result of high domestic demand for natural gas and insufficient feedstock for the facility to export (Table 3).29

Egypt has one floating storage and regasification unit (FSRU), provided by BW Gas, and it is located at the SUMED port. BW Gas FSRU began operating commercially in September 2015. Egypt’s other FSRU, provided by Höegh, left the country in October 2018 after Egypt terminated its charter. Egypt reportedly maintains one FSRU to ensure security of natural gas supplies.30

| Project Name | Ownership | Start date | Location | Capacity (billion cubic feet per year) |

|---|---|---|---|---|

| SEGAS LNG | Eni (50%); EGAS (40%); EGPC (10%) | 2004 | Damietta | 266 |

| Egyptian LNG | Train 1 – Shell (35.5%);Petronas (35.5%); EGAS (12%); EGPC (12%); TotalEnergies (5%) Train 2 – Shell (38%); Petronas (38%); EGAS (12%); EGPC (12%); | 2005 | Idku | 346 |

| Total | 612 | |||

| Source: Table by the U.S. Energy Information Administration, based on data from the Global Energy Monitor, Hydrocarbons Technology, NS Energy Business, Eni company website |

Natural gas exports

Egypt primarily exports its natural gas as LNG, although in 2018, it began exporting natural gas to Jordan via the AGP. Historically Egypt has been a net exporter of natural gas, but in the mid-2010s, Egypt had to import natural gas to meet increasing domestic consumption. Egypt’s total natural gas exports have steadily increased since 2016, after some of its recent natural gas discoveries began producing, which created a surplus of natural gas for the country to export. Egypt’s natural gas imports declined to nearly zero by 2019 after reaching a record high of 294 Bcf in 2016; Egypt exported about 177 Bcf in 2019, according to US EIA’s latest estimates.31

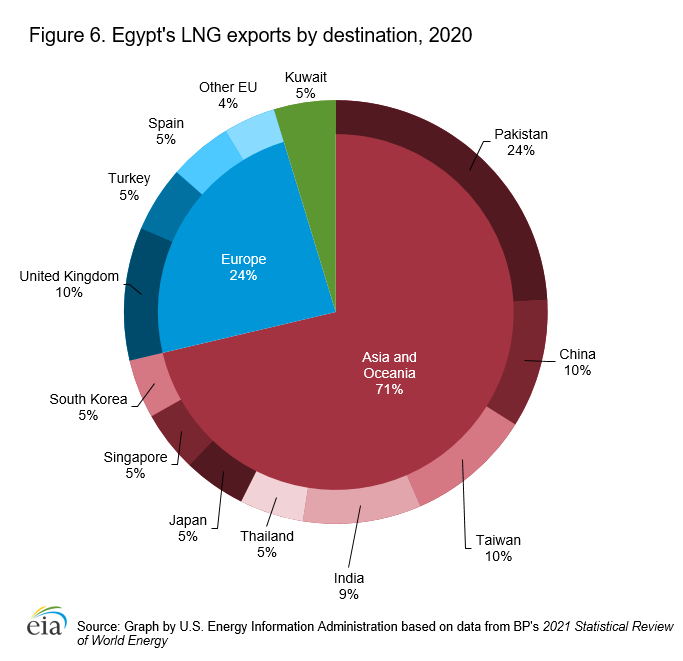

Egypt exported about 64 Bcf of LNG in 2020, according to the latest estimates provided by BP’s 2021 Statistical Review of World Energy. Most of Egypt’s LNG went to countries in the Asia Pacific region, with Pakistan, China, and Taiwan as the three largest importers. The United Kingdom also imported about 6 Bcf, or 10%, of Egypt’s total exports in 2020 (Figure 6).32

Electricity

Sector organization

The Ministry of Electricity and Renewable Energy (MOEE) oversees the generation, transmission, and distribution segments. The Egyptian Electricity Holding Company (EEHC) SOE oversees activities in the power sector through its subsidiaries. Five of EEHC’s subsidiaries manage the generation segment, and the EEHC and the Egyptian Electricity Transmission Company (EETC) manage the transmission segment. Nine other subsidiaries of the EEHC manage the distribution segment. The Egyptian Electricity Utility and Consumer Protection Regulatory Agency is the main power market regulator responsible for setting electricity tariffs, and the MOEE provides oversight on the other authorities operating in the electricity sector, such as the New and Renewable Energy Authority, the Atomic Energy Authority, and the Hydropower Plant Executive Authority.33

In February 2015, the government approved a law (the Electricity Law No. 87 of 2015, or the 2015 Electricity Law) that aimed to encourage transparency in the power market and attract private sector participation in the generation, transmission, and distribution segments. The 2015 Electricity Law shifts the power sector from state-directed management to regulatory management, which could potentially increase private-sector investment. The 2015 Electricity Law grants an initial period of eight years to develop and implement these measures, which recently was extended to 2025.34

Egypt can develop renewable energy resources given its solar potential and high wind speeds, particularly in the Gulf of Suez and the Nile Valley. The Egyptian government looks to capitalize on these potential resources with renewable energy power projects in its latest energy policy plan, the 2035 Integrated Sustainable Energy Strategy. The 2035 Strategy emphasizes developing renewable energy sources and sets a long-term goal to increase renewables’ share, particularly solar and wind, to 42% by 2035.35

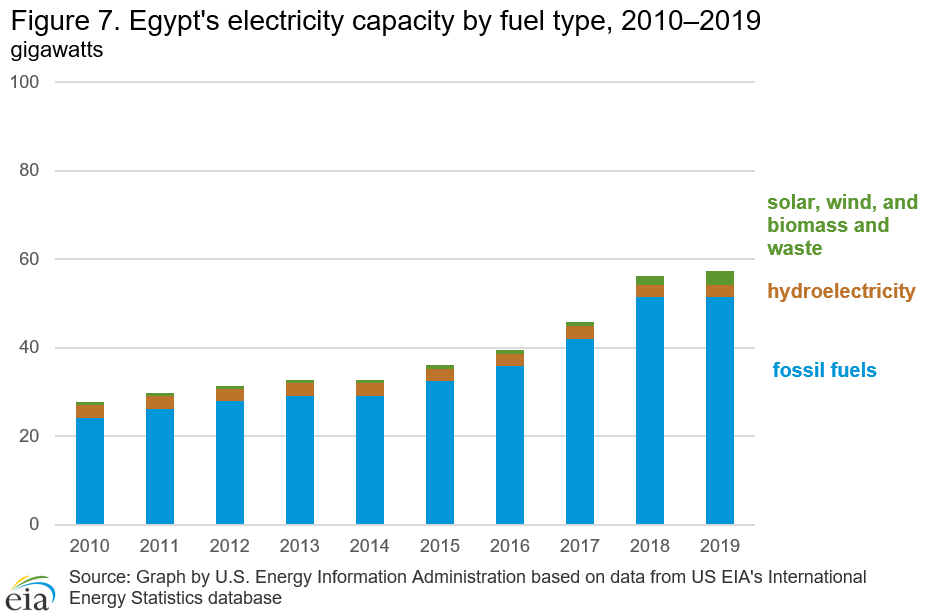

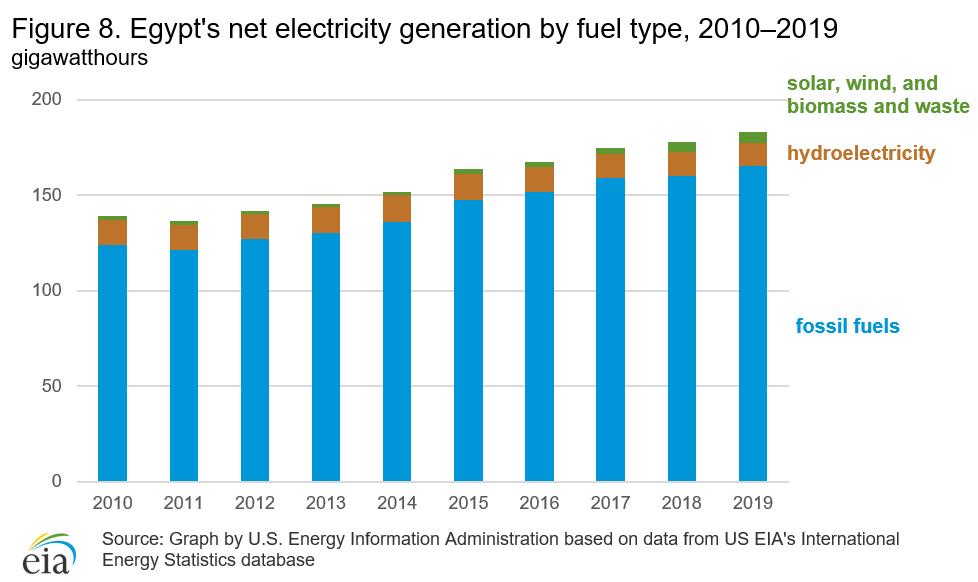

Power generation and capacity

Egypt has a total installed capacity of 57 gigawatts (GW) and generated about 183 gigawatthours (GWh) in 2019. Fossil fuel-derived sources accounted for approximately 90% of total power generation capacity in Egypt, and hydropower and renewable sources made up the remainder, at about 5% each of total capacity. Egypt does not use any coal for power generation. (Figure 7 and Figure 8).36

Egypt’s electricity grid connects to transmission grids in Libya, Jordan, and Syria under the Eight Countries Electric Interconnection Project. This project is still under development, and on completion, will connect the remaining partner countries involved in the project—Iraq, Lebanon, Palestine, and Turkey.37

The government also seeks to develop additional cross-border transmission interconnections to electricity grids to enable Egypt to become a regional hub for electricity. The governments of Egypt and Jordan signed an agreement to double the current interconnection capacity of 500 MW to enable Egypt to begin supplying electricity to Iraq through its connection with Jordan. Egypt and Saudi Arabia are also planning to construct a 3 GW electricity cable between the two countries and awarded contracts to build out some of the infrastructure in October 2021. The first phase of the Egypt-Saudi Arabia interconnector cable is expected to be completed by 2024 and to reach full capacity in 2025.38

Hydropower

Hydropower is Egypt’s third-largest energy source after fossil fuel-derived sources. Most of the country’s hydroelectricity comes from the Aswan High Dam and the Aswan Reservoir Dams across the Nile River. The Egyptian government plans to replace some of the turbines at the Aswan High Dam and Aswan Low Dam to rehabilitate the infrastructure and to improve efficiency at the facility.39

Ethiopia’s plans to build the 5.2 GW Grand Ethiopian Renaissance Dam (GERD) on the Blue Nile River have prompted concerns about water shortages to Egypt’s Aswan High Dam and the effects on industries that depend on the Nile River as a water source in Egypt. GERD can hold up to 2.6 trillion cubic feet of water, and once completed and operational, GERD will be the largest hydropower plant in Africa. Interstate dialogue between Ethiopia and downstream nations Egypt and Sudan has failed to resolve the issues surrounding the construction of GERD and the resulting economic and environmental impact the dam will have once it becomes fully operational.40

Solar and Wind

According to the International Trade Administration, Egypt has developed a series of large-scale wind farms in the past two decades, with a total capacity of 1.2 GW, and plans to develop additional wind power projects in the Gulf of Suez and Nile Banks area, allocating approximately 4,900 square miles to construct wind farms. In August 2020, the government awarded a contract to Vestas Wind Systems to construct a 250 MW wind farm located in the Gulf of Suez. Hitachi Energy, which is building the infrastructure to integrate the wind farm into the national power grid, expects this project to be completed by 2023.41

Egypt’s solar park in Benban in the Western Desert region was completed in 2019, and it has a total capacity of about 1.7 GW. A consortium led by the International Finance Corporation provided initial financing of $653 million for the construction of the initial 13 solar power plants in October 2017, and the European Bank for Reconstruction and Development has provided additional financing for the construction of more solar power plants at the Benban solar park.42

Nuclear

Egypt maintains a nuclear research program and operates two research nuclear reactors although the nuclear research reactor at Inshas is shut down.43

Egypt has no commercial nuclear power but seeks to add nuclear power to its energy mix. The Egyptian government has signed a preliminary agreement with Russia’s state nuclear corporation, Rosatom, to build and operate Egypt’s first commercial nuclear power plant in El-Dabaa. However, construction of the 4.8 GW plant has been delayed, and it is unlikely that the plant will be operational in the near or medium term.44

- Data presented in the text are the most recent available as of April 4, 2022.

- Data are EIA estimates unless otherwise noted.

- “Organizational Structure of the Petroleum Sector,” Arab Republic of Egypt, Ministry of Petroleum, accessed January 24, 2022.

- “About the Commission,” the Egyptian General Authority for Mineral Resources, accessed January 24, 2022, http://www.petroleum.gov.eg/en/AboutMinistry/Pages/Heirarchy.aspx. Egyptian Petrochemicals Holding Company, accessed January 24, 2022.

- About Us,” South Valley Egyptian Petroleum Holding Company (Ganope), accessed January 24, 2022. “About EGPC,” Egyptian General Petroleum Corporation, accessed January 24, 2022.

- Vision and Mission,” Egyptian Natural Gas Holding Company, accessed January 24, 2022. “About EGPC,” Egyptian General Petroleum Corporation, accessed January 24, 2022. Girgis Abd El-Shahid and Asmaa Badawy, “The Oil and Gas Law Review: Egypt,” The Law Reviews, November 3, 2021, accessed February 28, 2022. Olfat Kamel, Mostafa El Shazly, “The Egyptian upstream petroleum sector: legal analysis of joint operating companies,” Egypt Oil & Gas, November 6, 2016.

- Analysis based on data taken from Rystad Energy UCube Browser, accessed January 28, 2022.

- “Supermajors take the lead in Egyptian Red Sea,” Rystad Energy, December 30, 2019.

- “Egypt Oil & Gas Report, Q4 2021,” Fitch Solutions Country Risk & Industry Research, November 2021. “Regional Trends Report: North Africa,” Rystad Energy, November 2021. Nermina Kulovic, “Egypt launches new licensing round to keep up medium-term gas output,” Rystad Energy, February 23, 2021. “Eni scoops up bulk of acreage in Egypt’s first online licensing round,” Rystad Energy, January 13, 2022. “Exploration Trends Report: February 2022,” Rystad Energy, February 2022.

- BP 2020 Statistical Review of World Energy, accessed 9/25/2020. Sarah Matthews and Amanda Flint, “Egypt 2019 thermal coal imports rise 31% on cement sector demand,” S&P Global Platts, January 16, 2020.

- Oil &Gas Journal, “Worldwide Look At Reserves and Production,” [Table], December 7, 2020.

- “Light Crude vs. Heavy Crude: A Continuously Narrowing Gap,” Egypt Oil & Gas Group, September 9, 2018. Crude blend qualities are defined as sweet or sour, and as light, medium, or heavy based on their API gravity and sulfur content utilizing our criteria on crude oil blend characteristics; see Corrina Ricker, et al. “Changing quality mix is affecting crude oil price differentials and refining decisions,” Today in Energy, September 21, 2017.

- U.S. Energy Information Administration. International Energy Statistics database, accessed 6/10/2020.

- “Egypt Oil & Gas Report, Q4 2021,” Fitch Solutions Country Risk & Industry Research, November 2021. “Egypt Oil Output Plumbs New 40-Year Low For August,” Middle East Economic Survey, October 15, 2021.

- “World Oil Transit Chokepoints,” U.S. Energy Information Administration, July 25, 2017. Lejla Villar and Mason Hamilton, “Three important oil trade chokepoints are located around the Arabian Peninsula,” Today in Energy, U.S. Energy Information Administration, August 4, 2017.

- “Egypt Oil & Gas Report, Q4 2021,” Fitch Solutions Country Risk & Industry Research, November 2021.

- “Refineries,” Egyptian General Petroleum Corporation, accessed January 24, 2022.

- “Middle East Refinery Expansion,” NS Energy Business, accessed January 25, 2022. “TechnipFMC awarded major contract for MIDOR refinery project,” Hydrocarbon Processing, November 1, 2018. “Middle East Oil Refinery (Midor), Alexandria,” Hydrocarbons Technology, accessed January 25, 2022. “Egypt’s MIDOR refinery expansion will open in Q1 2022: Petroleum Minister,” Daily News Egypt, March 22, 2021.

- “Assiut Oil Refinery Upgrade Project,” NS Energy Business, accessed January 25, 2022. “Egypt firms to build atmospheric distillation facility at Assiut Refinery,” Offshore Technology, October 13, 2021.

- “Project Overview,” Egyptian Refining Company, accessed January 24, 2022. “ERC Mostorod Refinery,” NS Energy Business, accessed January 24, 2022. “Al-Sisi Inaugurates New Mostorod Project Worth $4.3 B,” Egypt Oil & Gas Group, September 28, 2020. “Egyptian Refining Company Delays Production to 2018Q2,” Egypt Oil & Gas Group, March 2, 2017.

- “Egypt to build $7.5bn petrochemical complex in Ain Sokhna industrial zone,” NS Energy Business, April 29, 2021. Robert Brelsford, “Egypt advances plan for new refining, petrochemicals complex,” Oil & Gas Journal, May 5, 2021. Sam Hashmi, “Egypt signs deal to build $7.5bn petrochemical complex,” Argus Global Media, April 29, 2021.

- Our analysis based on International Energy Statistics database and trade data provided by Global Trade Tracker, accessed February 10, 2022. Jasmine Shaheen, “Egypt Oil Imports Increase by 135.2% in February 2020,” Egypt Oil & Gas, May 10, 2020. Egypt Country Profile, Middle East Economic Survey, accessed February 14, 2022.

- Oil &Gas Journal, “Worldwide Look At Reserves and Production,” [Table], December 7, 2020.

- U.S. Energy Information Administration, International Energy Statistics database, accessed January 27, 2022.

- “Zohr Gas Field,” Offshore Technology, accessed January 27, 2022. “Egyptian gas sector poised for growth,” Newbase, Afroil Issue 721, Week 1, January 9, 2018. “Eni strikes Zohr sale deal,” Newbase, Afroil Issue 730, Week 10, March 13, 2018. “BP begins production from Egypt’s Atoll gas field seven months ahead of schedule,” BP press release, February 12, 2018, accessed January 27, 2022. “BP announces start of production from West Nile Delta development achieving first gas eight months ahead of schedule and production 20 percent above plan,” BP press release, May 10, 2017, accessed January 27, 2022.

- “Egypt’s Zohr Struggles with Water Breakthrough,” Middle East Economic Survey, June 11, 2021. “Egypt: Condensate Output Record as Gas Slumps,” Middle East Economic Survey, June 11, 2021.“BP’s Raven: Delayed Start Hikes Egypt Gas To New Highs,” Middle East Economic Survey, April 30, 2021.”Raven Gas Field: Egypt,” Offshore Technology, May 10, 2021.

- “Eni expands Egypt’s Great Nooros area with Bashrush discovery,” Rystad Energy, July 2, 2020. “Eni successfully tests Egypt’s Bashrush discovery in North El Hammad concession in Mediterranean Sea,” Oil & Gas Middle East, July 30, 2020. ”Eni: Bashrush discovery, in North El Hammad concession in Mediterranean Sea of Egypt, tested with success,” Eni press release, July 28, 2020.

- Jennifer Gnana, “Explainer: what is the Arab Gas Pipeline and why it matters,” The National News, September 8, 2021. “Repairs to Arab Gas pipeline should be completed by end-Feb, Lebanese minister says,” Reuters, December 29, 2021.

- “Arish-Ashkelon Pipeline,” Global Energy Monitor, accessed February 9, 2022. “Israel begins exporting natural gas to Egypt,” Al-Jazeera Media Network, January 15, 2020. “Israel, Egypt plan new gas pipe that could boost Europe supplies: Israeli ministry,” Al-Arabiya News, October 22, 2021.

- “Damietta Segas LNG Terminal,” Global Energy Monitor, accessed February 10, 2022. “SEGAS Liquefied Natural Gas Complex, Damietta,” Hydrocarbons Technology, accessed February 10, 2022. “Eni closes agreement with partners for restart of Damietta liquefied natural gas plant in Egypt and amicable settlement of Union Fenosa Gas disputes,” Eni press release, March 10, 2021.

- “Egyptian LNG Terminal,” Global Energy Monitor, accessed February 10, 2022. “Egyptian LNG Project: Idku,” NS Energy Business, accessed February 10, 2022.

- “Egypt: BW Singapore FSRU moves to port in Sumed,” Offshore Energy Business, June 7, 2017. “Hoegh Gallant LNG carrier leaves Egypt, sets U.S. destination,” Reuters, October 18, 2017.

- U.S. Energy Information Administration. International Energy Statistics database, accessed February 11, 2022. Eric Han, “Offshore discoveries in the Mediterranean could increase Egypt’s natural gas production,” Today in Energy, U.S. Energy Information Administration, August 14, 2018. “Egypt officially became a net exporter of LNG, bringing our gas hub ambitions ever closer,” Enterprise, February 16, 2020. Ahmed Fouad, “Egypt’s future in the LNG market,” Middle East Institute, September 21, 2021.

- BP 2021 Statistical Review of World Energy, accessed January 27, 2022.

- Egypt Power Report: Q4 2021, Fitch Solutions Country Risk & Industry Research, August 2021. “Affiliated Companies,” Ministry of Electricity and Renewable Energy government website, accessed January 31, 2022. International Renewable Energy Agency, Renewable Energy Outlook: Egypt, October 2018.

- Mariam Fahmy and Nada Hussein, “Electricity Regulation in Egypt,” Thomson Reuters Practical Law, November 1, 2020, accessed February 2, 2022.

- International Trade Administration, “Egypt Country Commercial Guide: Renewable Energy,” September 15, 2020, accessed February 2, 2022. “El-Molla: Egypt to Stay Focused on Gas Despite Transition,” Energy Intelligence Group, November 24, 2021.

- U.S. Energy Information Administration, International Energy Statistics database, accessed January 27, 2022.

- International Renewable Energy Agency, Renewable Energy Outlook: Egypt, October 2018.”Egypt Power Report: Q1 2022,” Fitch Solutions Country Risk & Industry Research, November 2021. “Electricity,” Arab Fund for Economic & Social Development, accessed February 1, 2022. “Electricity Interconnection Projects,” National Electrical Power Company (Jordan), accessed February 1, 2022.

- “Saudi-Egypt interconnection awards confirmed,” Power Technology, October 15, 2021. “Egypt, Saudi Arabia sign contracts for $1.8B electrical interconnection project,” Egypt Today, October 5, 2021. “Egypt and Jordan to double capacity of interconnection,” Energy & Utlities, November 29, 2021.

- Mohamed Sabry, “Egypt to overhaul hydropower plants amid Nile dam crisis,” Al-Monitor, September 22, 2021. “Aswan High Dam, River Nile, Sudan, Egypt,” Water Technology, accessed February 3, 2022.

- Sonal Patel, “”Ethiopian GERD Mega-Dam Readying to Test Power Production,” Power Magazine, January 6, 2022.”Grand Ethiopian Renaissance Dam Project, Benishangul-Gumuz,” Water Technology, accessed February 3, 2022. “Ethiopia’s massive Nile dam explained,” Al-Jazeera, July 8, 2021. John Mukum Mbaku, “The controversy over the Grand Ethiopian Renaissance Dam,” The Brookings Institution, Africa in Focus, August 5, 2020.

- U.S. International Trade Administration, “Egypt Country Commercial Guide: Electricity and Renewable Energy,” September 5, 2021, accessed February 2, 2022. “Egypt Power Report, Q1 2022,” Fitch Solutions Country Risk & Industry Research, November 2021. “Gulf of Suez 1 wind farm project timeline and latest news,” Construction Review Online, January 20, 2022, accessed February 2, 2022.

- International Trade Administration, “Egypt Country Commercial Guide: Electricity and Renewable Energy,” September 5, 2021, accessed February 2, 2022. Andrew Raven, “A New Solar Park Shines a Light on Egypt’s Energy Potential,” International Finance Corporation, October 2017. “Benban Solar Park,” NS Energy Business, accessed February 3, 2022. Al-Masry Al-Youm, “Ten facts on Egypt’s Benban Solar Park, the largest solar power plant in the world,” Egypt Independent, December 27, 2021.

- World Nuclear Association, “Nuclear Power in Egypt,” World Nuclear Association Country Profiles, updated January 2022, accessed on February 1, 2022.

- World Nuclear Association, “Nuclear Power in Egypt,” World Nuclear Association Country Profiles, updated January 2022, accessed on February 1, 2022.