The Empire Of Deficit And Future For The US Debt Ceiling – OpEd

By Dee Woo

With little time to spare, Congress and President Obama passed legislation raising the debt ceiling on Aug. 2, 2011. The markets and sovereign states around the world now breathe a much-delayed and much-needed relief.

Nobody knows how to react to the mooted American default. The US has been the cornerstone of free market economies for decades. So the contagious fear,however stoked by the frenzy of media and political theatrics, is not unfounded.

People are worried that the default will trigger a collapse of the US dollar and treasure bills (T-bills) and then the collapse of the world economy. Nevertheless, their fears are over-stretched. The global dominance of the US dollar and T-bills is not underwritten by those politicians’ scheming towards the moral high-ground of an election. This dominance is deeply entangled in the decades-long building of one of the most profound global empires in the human history: The American Empire.

First, sustaining the global dominance of the US dollar and treasure bills is the absolute prerequisite for sovereign states to subscribe to the US imperialistic issuance and alliance against many Geo-political risks and economic and diplomatic debacles. (see in the pie-chart below) According to a detective-like analysis on the cunning report from Budget of the United States Government,in 2009 military spending accounts for 54% of the total outlays of the federal funds.”current military” includes Dept. of Defense ($653 billion), the military portion from other departments ($150 billion), and an additional $162 billion to supplement the Budget’s misleading and vast underestimate of only $38 billion for the “war on terror.”

First, sustaining the global dominance of the US dollar and treasure bills is the absolute prerequisite for sovereign states to subscribe to the US imperialistic issuance and alliance against many Geo-political risks and economic and diplomatic debacles. (see in the pie-chart below) According to a detective-like analysis on the cunning report from Budget of the United States Government,in 2009 military spending accounts for 54% of the total outlays of the federal funds.”current military” includes Dept. of Defense ($653 billion), the military portion from other departments ($150 billion), and an additional $162 billion to supplement the Budget’s misleading and vast underestimate of only $38 billion for the “war on terror.”

“Past military” represents veterans’ benefits plus 80% of the interest on the debt. In 2010, $80 billion was allotted to the US intelligence agencies’ worldwide operations. In 2011, $54.6 billion was requested for U.S. diplomacy and development efforts, after accounting for programs outside State and USAID, such as the Peace Corps, the Broadcasting Board of Governors, and the Millennium Challenge Corporation. The colossal stakes here are not just for the US’s sake. It is also necessary for the US to effectively manage the threatening global volatility on military and economic levels for its diplomatic allies and trading partners. For example, In the South China Sea, Japan, Philippine, Vietnam and Taiwan are increasingly demanding the US to enhance the buffer between them and the more assertive China. In the middle east, Saudi Arabia, Israel and other allies have long been agitated by Iran’s nuclear ambition and the regional instability imposed by Arab Spring.

To elicit the US’s cooperation on economic and diplomatic issues, Frenemy such as China has always applied the trickery of accelerating T-bills buying to show friendly gesture when the relationship with the US turns sour. It is no coincidence the more screwed up the world, the higher the demand for the T-bills.

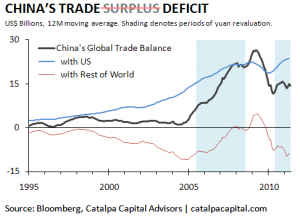

Second, all the major economies’ performances are heavily collateralized against the US deficit. Failure to finance that deficit will render these economies’ production over-capacity so severe that the blow will be lethal. In 2010, the gap between US imports from China and what it sold to the country rose to$273.1bn , the largest trade imbalance the US has ever recorded with a single country. When all the math is done, without the US, China is running a trade deficit with the rest of the world (the red line). In the meantime, the US accounts for 15.4% of all Japanese exports and 9.7% of all Japanese imports.

The US accounts for approximately 10% of all German exports and 10% of all German imports. That year the US trade deficit with the rest of the world hit $497.8bn,up 32.8% on the year before, the biggest annual percentage gain since 2000. No other nation came close to the U.S. deficit in that year while the US major trading partners all posted strong export growth. By shouldering a decisive chunk of the global imbalance, the US greatly helps many countries’ economic recovery. (Japan’s trade surplus was more than 2.5 times higher than the previous year at $82 billion. Germany had €140.3bn trade surplus. China’s 2010 trade surplus hit $183.1 billion.) The trade war didn’t beak out under such a grievous global imbalance, mainly because the US didn’t initiate an all-out trade war against China. Or we will all live behind the iron curtains of tariff retaliation.

The US accounts for approximately 10% of all German exports and 10% of all German imports. That year the US trade deficit with the rest of the world hit $497.8bn,up 32.8% on the year before, the biggest annual percentage gain since 2000. No other nation came close to the U.S. deficit in that year while the US major trading partners all posted strong export growth. By shouldering a decisive chunk of the global imbalance, the US greatly helps many countries’ economic recovery. (Japan’s trade surplus was more than 2.5 times higher than the previous year at $82 billion. Germany had €140.3bn trade surplus. China’s 2010 trade surplus hit $183.1 billion.) The trade war didn’t beak out under such a grievous global imbalance, mainly because the US didn’t initiate an all-out trade war against China. Or we will all live behind the iron curtains of tariff retaliation.

If these trade surplus countries fail to prop up the T-bills, the dollar will collapse as well. That will send the value of their own currencies through the roof, which will derail their export-led economies and precipitate a serious cost-push inflation to squash the profit margin of their export industries.

Third, the liquidity and shock absorber of the global financial system are most heavily leveraged on the treasure bills. The melt-down of T-bills will precipitate the collapse of many profitable arbitrage opportunities. The post-crisis capital requirements for banks enhance the importance of money market. T-bills are the most marketable money market security and the most important collateral. The fire sale of T-bills will paralyze the repo market, drive up the sweeping borrowing costs, suck dry the liquidity and close up the spread in the carry trade. The ensuing panic will be contagious. Many financial institutions will fall, even including some gigantic sovereign funds.

Finally, there is no other sizable asset pool other than T-bills able to absorb the chunk of the $10 trillion worth foreign-exchange reserves piled in trade surplus nations. At $9.3 trillion outstanding, the U.S. Treasury market is second in size to Japan’s government bond market, whose $9.7 trillion makes it the world’s biggest. While Japanese bonds are mainly(90%) sold to domestic investors, the US sells around half of its bond to outsiders.

its bond to outsiders.

It’s unrealistic to say to convert the foreign reserve to German bunds, British gilts, or even gold. Because these markets are puny compared to the mammoth portfolios hoarded by countries such as China and Japan.

As long as the US stays as a global empire, shoulders much of the global imbalance, and export-oriented economies refuse to alleviate the global imbalance and continue to swallow up gargantuan trade surplus, the US dollar and T-bills will perch on the top of the world. Who said the whole world can’t roll over as much as T-bills to entertain the American politicians’ thirst for political theater and flirtation with a temporary default?

It’s not a sucker punch. Take it however it comes. No need to panic and ignore the rating agencies.See the chart below, there were countries doing rather well after losing triple A.

More good news is China is bluffing when it says it will reduce t-bills holding. Under the radar, China is gobbling up t-bills through proxy agents all over the world.