Rate Hike A No-Go For Federal Reserve – OpEd

By Andrew Moran

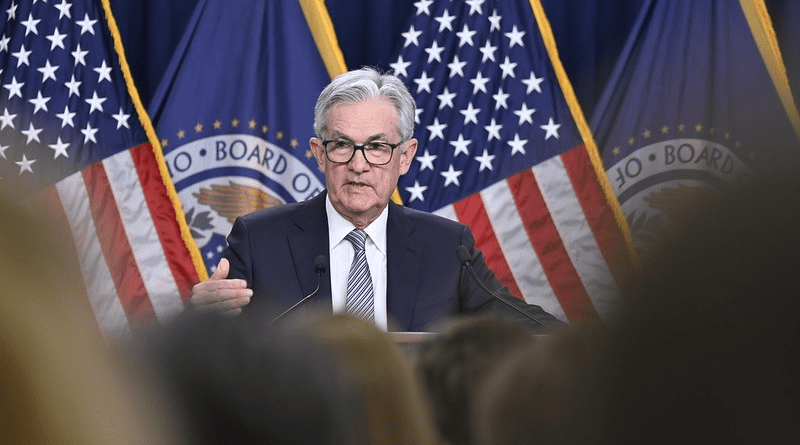

The Federal Reserve concluded its widely anticipated May Federal Open Market Committee (FOMC) policy meeting on May 1. Financial markets were unsurprised to see that the US central bank left its benchmark rate unchanged at a 23-year high of 5.25% to 5.5%. But while the decision everyone waited for was the day’s main event, the FOMC statement and Chair Jerome Powell’s post-meeting press conference were the critical attractions for Wall Street, Main Street, and the White House.

Federal Reserve Shrugs Off Inflation

Stocks were little changed when the Fed issued its final decision. Markets even shrugged off the Eccles Building’s move to slow the pace of its balance sheet runoff campaign (more on that later). However, minutes into Powell’s press conference, equities soared higher than a SpaceX rocket. Why? There was one statement that traders were waiting for him to utter: “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.”

When reporters asked Powell what he and his team would need to see to entertain the idea of a rate increase, he responded: “I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.”

At the same time, the Fed chief admitted that the central bank is not gaining “greater confidence” that inflation is progressing this year, meaning that it will likely “take longer than previously expected” to bring inflation back down the entity’s 2% target rate. The Fed, Powell noted, is ready to keep policy restrictive “for as long as appropriate.”

Because he insisted that no rate hikes were coming and that the peak in the tightening cycle had been reached, the leading benchmark indexes soared as much as 1.4% before paring most of these gains. Still, it was a testament to how powerful the Fed is and how a few words can ignite a rally or trigger a crash. It was a stunning moment to observe in real-time.

A second wave of inflation appears to be crashing into America’s shores. In the first three months of 2024, various inflation readings, from the consumer price index (CPI) to the employment cost index (ECI), have topped estimates. Could the CPI exceed 4% or 5% this year? While the US government does not think so, some private-sector economists suggest that it is in the realm of possibility. Regardless, the central bank is uninterested in a rate hike. Who can blame them? An election is happening in November!

Got Politics?

The Wall Street Journal published an article full of unnamed sources and a supposed “top secret” memo that suggested former President Donald Trump intends to transform the Federal Reserve System by eliminating its so-called independence. The newspaper asserted that Trump would essentially install himself on the Fed board and coordinate monetary policy with the central bank. Trump’s top economic advisors dismissed this reporting.

That said, Powell was asked about the Fed’s decision-making process in an election year. He dismissed political events and noted that the 2024 election “just isn’t part of our thinking,” adding that “it’s not what we’re hired to do.” Ultimately, the central bank will guide policy based on what is best for the economy, not politics.

“It’s hard enough to get the economics right here,” Powell said. “These are difficult things, and if we were to take on a whole other set of factors and use that as a new filter, it would reduce the likelihood we’d actually get the economics right.”

Of course, the Federal Reserve maintains a long history of working with the White House, from Marriner Eccles and FDR to Arthur Burns and Richard Nixon to Alan Greenspan and Bill Clinton. Even Powell fell victim to Trump’s demands for rate cuts in 2019 when it was not warranted. And yet, the mainstream media and central bankers carry on with this charade of autonomy.

Balance Sheet Blues

Were the monetary authorities bracing the financial markets for shifts in the balance sheet? In recent weeks, a chorus of officials, whether Dallas Fed President Lorie Logan or Fed Gov. Christopher Waller, had hinted that it would be time to slow the pace of quantitative tightening, also known to the cool kids of finance as QT.

Since March 2022, the central bank has been offloading $95 billion monthly in holdings – $60 billion in Treasurys and $35 billion in agency debt and mortgage-backed securities. The two-year effort effectively lowered the balance sheet by approximately $1.5 trillion, from $8.9 trillion to $7.4 trillion. But now the FOMC wants to decelerate, assess market conditions, and ensure it is not disrupting the money markets. As of June 1, the Fed will be tapering QT by reducing the monthly Treasury declines by $35 billion to $25 billion (mortgage-backed securities will remain the same).

Here is the full statement:

“The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage‑backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities. The Committee is strongly committed to returning inflation to its 2 percent objective.”

The real reason, of course, is that the Fed is uncomfortable with government bond yields flirting with 5%. So far, the move was insufficient to pressure Treasury yields. While there was a sea of red ink across the US bond market, they turned positive toward the May 1 closing bell. The benchmark ten-year yield picked up a few basis points to 4.62%, while the two-year added 1.5 basis points to 4.954%.

Washington is ostensibly relieved because it could result in less funding needed in the third quarter, meaning the Treasury might not issue as many short-term debt securities (officials recently estimated they would sell about $850 billion in bonds during the FY 2024 third quarter). Does this mean the Fed is ready to bail out the Treasury again? Time will tell. But the real story might be how quick everyone has been to forget the history of the balance sheet.

At the start of the global financial crisis, the balance sheet was below $1 trillion. The Fed bailed everyone out, even years following the Great Recession. Then-Fed Chair Ben Bernanke insisted to lawmakers that the balance sheet would eventually be lower than where it was prior to the economic collapse. The coronavirus pandemic occurred, and the balance sheet popped to nearly $9 trillion. Today, Powell and Co. suggested this will never happen.

I Can’t Get No Stagflation

Stagflation – a combination of stagnating growth, high unemployment, and rising inflation – is not on the mind of Jerome Powell. In fact, he delivered a quip that had the business media in the room laughing. “I don’t really understand where that’s coming from,” Powell said. “I don’t see the ‘stag’ or the ‘-flation.’” Of course, the Fed did not see the inflation bomb exploding in America, going as far as calling it transitory. In December, Powell gave investors an early Christmas present out of nowhere by shapeshifting from hawk to dove and declaring that rate cuts were coming. Essentially, there was no inflation threat. A few months later, the US is on the brink of an inflation revival, a plethora of statistics suggest the economy is slowing, and consumers are struggling from a toxic mix of higher prices and soaring borrowing costs. If the Fed is dismissive of stagflation, then maybe the concern is justified.

- About the author: Economics Editor at LibertyNation.com. Andrew has written extensively on economics, business, and political subjects for the last decade. He also writes about economics at The Epoch Times and financial markets at FX Daily Report. He is the author of “The War on Cash.” You can learn more at AndrewMoran.net.

- Source: This article was published by Liberty Nation