IMF Reaches Staff Level Agreement With Jordan On New US$1.2 Billion 4-Year Arrangement Under Extended Fund Facility

International Monetary Fund (IMF) staff and the Jordanian authorities reached a staff-level agreement on a program of economic and structural reforms, supported by a new 4-year Extended Fund Facility (EFF) arrangement, in the amount of about US$ 1.2 billion.

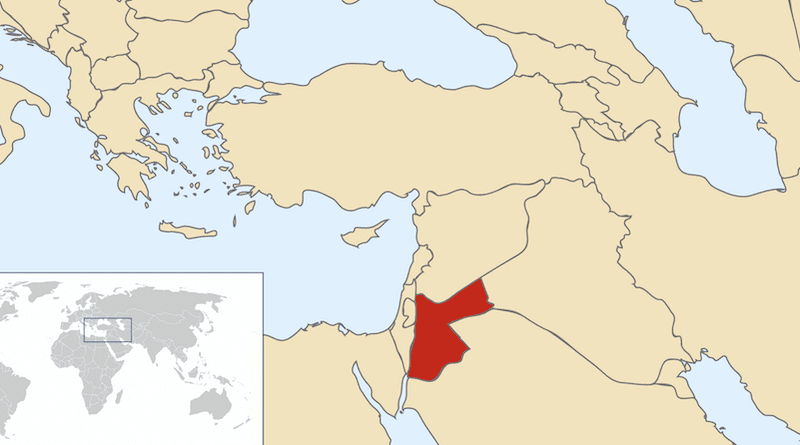

A staff team from the IMF, led by Ron van Rooden, visited Amman during October 30 – November 9, 2023, to discuss a new program of reforms supported by the IMF’s Extended Fund Facility (EFF). Jordan expressed interest in a new program in June 2023. Discussions on the new program were launched during the authorities’ visit to Washington DC in July this year.

Over the past years, the Jordanian authorities’ performance under the existing EFF arrangement was consistently strong, the IMF said. As a result, Jordan has maintained macro-economic stability in the face of successive external shocks, reduced fiscal and external imbalances, and preserved market access, while strengthening social safety nets. Progress was also made in advancing structural reforms to boost inclusive growth.

According to the IMF, the new program will continue to support Jordan as it weathers new shocks, with focus on continuing with fiscal consolidation to place public debt on a steady downward path, safeguarding monetary and financial stability, and accelerating structural reforms to support growth and enhance job creation.

The agreement is subject to IMF management approval and consideration by the Executive Board, which are expected in early January 2024. Upon Board approval, Jordan would have immediate access to SDR 144.102 million (about US$ 190 million).

“Jordan’s economy is still expected to grow by 2.6 percent in 2023, with strong performance across all sectors in the first three quarters. The higher interest rate environment has contributed to a low rate of inflation, reflecting CBJ’s commitment to safeguard the exchange rate peg. Inflation declined to just over 1 percent in September 2023. The current account deficit is expected to improve in 2023, to just over 7 percent of GDP and international reserves are strong,” said Ron van Rooden, adding, “Growth is projected to be held back by the impact of the conflict, not exceeding 2.6 percent in 2024, while the current account is expected to narrow less than expected earlier, to 6.5 percent of GDP. With sound economic policies and strong international support, reserves are projected to remain strong. The outlook would worsen in the event of an intensification of the conflict.”

Van Rooden said fiscal policy under the new program will be anchored by the goal to place public debt on steady downward path, bringing public debt to below 80 percent of GDP by 2028.