Sri Lanka To Gain From Intensified Big Power Rivalry Over Colombo Port – Analysis

With USIDFC joining the Adanis in the WCT project, there will be heightened competition with the Chinese CICT, and the resultant increase in the income of the Colombo port will benefit Sri Lanka.

Sri Lanka is set to gain from the intensified Big Power rivalry over Colombo port.

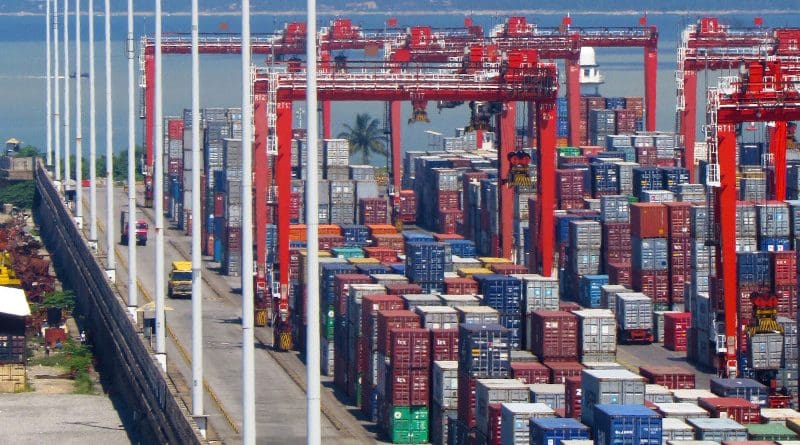

With the US and the Adani group now collaborating in building the West Container Terminal (WCT), and China already in through the Colombo International Container Terminal (CICT), Colombo port is now in the vortex of Big Power rivalry.

But the heightened competition between the geopolitical rivals to outperform each other, will result in higher incomes for Colombo port that, in turn, will help Sri Lanka come out of the economic crisis.

On Wednesday, the US International Development Finance Corporation (USIDFC) joined India’s Adani Ports & Special Economic Zones Limited (APSEZ), the Sri Lankan company John Keells Holdings Ltd., and the Sri Lanka Ports Authority (SLPA), to constructing the deep water West Container Terminal (WCT) at Colombo port.

The Adanis and John Keells had already secured the US$ 650 million contract to Build Operate and Transfer (BOT) the WCT in 2021. But implementation was slow because of the pandemic and the Sri Lankan economic crisis that followed.

The current deal gives the Indo-US alliance a foothold in a major South Asian port where there is already a significant Chinese presence in the form of the Colombo International Container Terminal (CICT) run by the China Merchants Port Group (CMPort).

The Indian hold on the port will be further strengthened if the Sri Lankan government implements an Indian proposal that the two countries build a “lank link” between India and the Colombo port. That proposal was made by India when Sri Lankan President Ranil Wickremesinghe visited New Delhi in July this year.

According to Rohan Maskarola, Chief Executive Officer of the Shippers’ Academy in Colombo, the West Container Terminal project, beefed up by the infusion of US$ 553 million from the USAIDFC, will be able to put up its first berth by the third quarter of 2024.

“USIDFC will be meeting two-thirds of the funds required for the WCT, and this will be a great help,” he said. Asked about the progress of the WCT so far, he said that land reclamation has been done and that progress has been “satisfactory”.

The entire terminal is expected to be completed by 2025.

In June 2022, the website Maritime Gateway reported that the Sri Lankan partner in WCT, John Keells Holdings (JKH), borrowed US$ 75 million from a Canadian financial institution Fairfax Financial Holdings Limited through privately placed debentures. Out of this, US$ 70 million will be invested in the WCT.

The US$ 650 million WCT project is 70/30 debt to equity-funded. The Adanis hold a 51% stake, the Sri Lanka Ports Authority, the landlord, holds a 15% stake and John Keells 34%.

Largest Terminal

With a planned quay of 1450 metres, WCT will be the largest terminal in Colombo port, Maskarola pointed out. In contrast, the China Merchant Port Group (CMPort) built and operated Colombo International Container Terminal (CICT) has a quay of 1250 meters.

The WCT will cater to the growing economies in the Bay of Bengal, taking advantage of Sri Lanka’s prime position on major shipping routes and its proximity to these expanding markets, US Ambassador Julie Chung said on Wednesday.

USIDFC Chief Executive Officer (CEO) Scott Nathan said that Sri Lanka is one of the world’s key transit hubs, with half of all container ships transiting through its waters.

The Port of Colombo is the largest and busiest trans-shipment port in the Indian Ocean. It has been operating at more than 90% utilization since 2021, signalling its need for additional capacity.

The Port of Colombo is ranked No. 3 among ports in the Indian Ocean Rim and No. 22 among 370 seaports worldwide.

The World Bank Group and S&P Global Market Intelligence ranked the Port as No. 1 in South Asia.

As on date, Colombo port has four functioning terminals – Jaya Container Terminal (JCT); Unity Container Terminal (UCT); South Asia Gateway Terminal (SAGT) and Colombo International Container Terminal (CICT). The West Container Terminal and the Eastern Container Terminal are being built.

Chinese-run Terminal

The Chinese-built and run CICT was the recipient of the Most Efficient Terminal Award at the Global Ports Forum Awards 2022. It is ranked No. 1 in South Asia.

Managed by the China Merchants Port Group (CMPort), CICT is the first deep-water container terminal in Sri Lanka and is also the only terminal in the South Asian region capable of handling 22,000+ TEU vessels.

According to the Chief Executive Officer of CICT, Jack Huang, CICT has invested in state-of-the-art equipment and infrastructure. Presently, CICT operates 14 quay cranes (two of which are capable of handling 22,000+ TEU vessels), 46 rubber-tyred gantry (RTG) cranes and 105 trucks during its normal operations.

CICT is capable of handling volumes larger than 13,500 TEUs, with a Gross Crane Rate (GCR) of 29 moves per hour whilst the global GCR is only 23.8 moves per hour.

This article was published in Counterpoint.lk