Strong US Job Growth In February, But Hours Drop, And Wage Growth Slows – Analysis

By Dean Baker

The February employment report gave a very mixed picture of the labor market. The job growth was again surprisingly strong, with the establishment survey showing a gain of 311,000 jobs. However, the index of aggregate hours actually fell by 0.1 percent, as the length of the average workweek fell back by 0.1 hour. Wage growth also slowed, with the annual rate over the last three months being just 3.6 percent, a pace that would be consistent with the Fed’s 2.0 percent inflation target.

The household survey showed a modest uptick in the unemployment rate to 3.6 percent. While these data are erratic, there were rises in unemployment of 0.3 percentage points for Blacks, 0.6 percentage points for Asian Americans, and 0.8 percent for Hispanics. At 5.3 percent, the unemployment rate for Hispanics is now 1.3 percentage points above the 4.0 percent low hit in November. The unemployment rate for Asian Americans is 1.2 percentage points above the 2.4 percent low hit in December.

Job Growth Remains Strong

The February job growth number means that the striking growth reported in January was not a fluke. The restaurants, retail, and health sectors together accounted for more than half of the February job growth, adding 69.9k, 50.1k, and 44.2k jobs, respectively. In spite of interest rate hikes and the sharp drop in housing starts, construction continues to add jobs. Construction as a whole added 24,000 jobs, with residential construction adding 12,400 jobs.

There were notable job losses in some sectors. Manufacturing lost 4,000 jobs in February. Trucking lost 8,500 jobs in February. The categories “nondepository credit intermediation” and “activities related to credit intermediation,” both of which are largely tied to mortgage issuance, lost 6,800 and 3,000 jobs respectively.

These diverging patterns are reflected in the employment diffusion index, which shows the percent of industries added jobs. The one-month diffusion index fell to 56.0, the lowest reading since April 2020. The one-month manufacturing index was down to 47.2, the lowest since July of 2020.

Hours Drop in February

While the job growth reported in January was surprising, the hours growth was even more striking. A reported increase in the length of the average workweek, coupled with the strong job growth, led to a 1.2 percent rise in the index of aggregate hours, the equivalent of more than 1.8 million jobs with unchanged hours. In this report, the January rise was revised down, and February’s data showed a decline in the index of aggregate hours of 0.1 percent, as the average workweek fell to 34.5 hours.

The drop for production and non-supervisory workers was even sharper, with the overall index of aggregate hours falling 0.4 percent in February, although it is still up 0.8 percent from December. For production and non-supervisory workers in the leisure and hospitality sector, the drop was 1.4 percent, in spite of the large rise in employment.

The hours data are erratic, and subject to large revisions, but the February data paint a very different picture on the state of labor demand than the jobs numbers.

Annual Rate of Wage Growth Slows to 3.6 Percent Over Last Three Months

The Fed’s stated concerns on inflation have focused on the pace of wage growth being inconsistent with its 2.0 percent inflation target. With a downward revision to January’s data and slower growth in February, the annualized rate of wage growth over the last three months is slightly under 3.6 percent, a pace often seen prior to the pandemic when inflation was below the Fed’s target.

We continue to see evidence of wage compression, with faster wage growth for lower paid workers. The annual rate of wage growth for production and non-supervisory workers in retail over the last three months was 6.1 percent, while it was 4.0 percent in the leisure and hospitality sector.

Share of Unemployment Due to Voluntary Quits Falls Back to 14.8 Percent

Unemployment due to people voluntarily quitting their jobs is a sign of labor market strength, since it indicates workers are confident enough in their job prospects to quit a job before they have a new job lined up. The February level of 14.8 percent is high, but below pre-pandemic peaks.

Duration Measures of Unemployment All Fall

The average and median length of unemployment spells both fell in February, as did the share of long-term unemployment (more than 26 weeks). The average duration fell to 19.3 weeks, the lowest since July of 2020, while the median duration fell to 8.3 weeks. The share of long-term unemployed fell to 17.6 weeks, a low for the recovery.

While the fact that fewer workers are experiencing long spells of unemployment is good news, the 343,000 rise in the number of short-term unemployed (less than 5 weeks) is grounds for concern, even though the February figure remains quite low.

Prime Age Labor Force Participation Rate for Women Exceeds Pre-Pandemic Peak

The labor force participation rate (LFPR) for prime age women (ages 25 to 54) is now 0.2 percentage points above pre-pandemic peak. For men, it is still down by 0.5 percentage points. The overall rate of 83.1 percent is equal to the peak hit in January of 2020. The sharpest decline for men is in the 35 to 44 age group with a LFPR that is 1.6 percentage points below its pre-pandemic peak, although, if we go back to the late 1990s peaks, the sharpest drop is a 4.5 percentage points decline among the 25 to 34 age group.

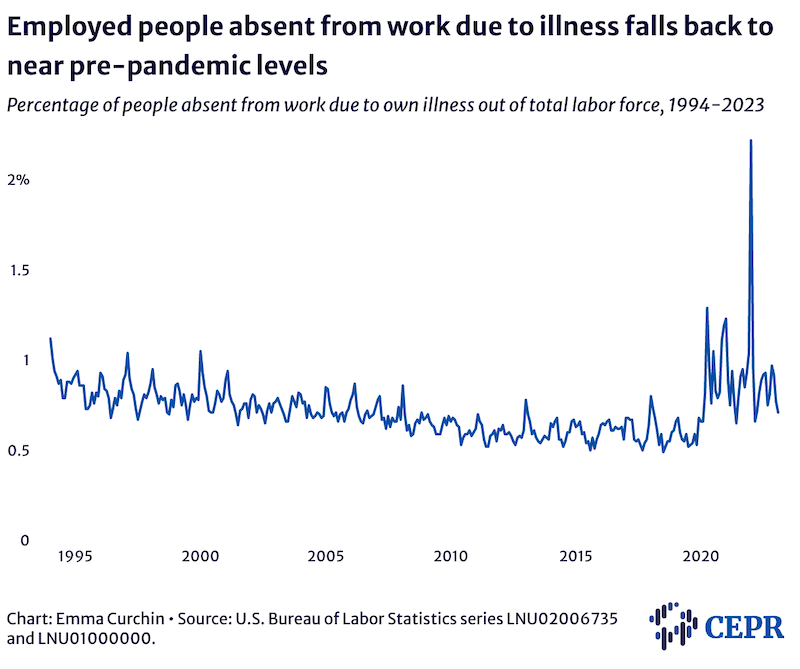

The number of workers reporting missing days due to their own illness is also largely back to pre-pandemic levels. The February figure was 1,172,000, a figure often hit in months prior to the pandemic.

Labor Market Remains Strong, but Wage Growth Slows to Non-Inflationary Pace

This is a difficult report to read. The 311,000 jobs number, following the huge January increase, indicates a rate of jobs growth that cannot be sustained in a labor market that is near full employment. At the same time, the drop in hours reported in February, as well as some evidence of weakness reported in the household survey, indicate that the labor market could be weakening.

Perhaps most important from the Fed’s perspective is the slowdown in wage growth. The 3.6 percent annual rate over the last three months can hardly be seen as posing a serious threat of inflation. This slowing in the average hourly wage, coupled with the 4.0 percent rate reported in the fourth quarter Employment Cost Index, should provide solid evidence that wage growth has slowed sharply.