Tailoring Government Support – Analysis

By Vitor Gaspar, W. Raphael Lam, Paolo Mauro and Mehdi Raissi

The race to vaccinate against COVID-19 continues, but the pace of inoculation varies widely across countries, with access unavailable to many. Global cooperation must be stepped up to produce and distribute vaccines to all countries at affordable costs. The sooner vaccinations curb the pandemic, the faster economies can return to normal.

If the global pandemic is controlled via vaccination, the resulting stronger economic growth would yield more than $1 trillion in additional tax revenues in advanced economies by 2025—and save more in fiscal support measures. The COVID-19 vaccination will thus more than pay for itself, according to the April 2021 Fiscal Monitor, providing excellent value for the public money invested in it.

Varying degrees of fiscal support

In the first year of COVID-19, fiscal policy has reacted quickly and forcefully to the health emergency. Lifelines have saved lives and protected livelihoods. Fiscal support has also prevented more severe economic contractions and job losses than the world would otherwise have seen, including by easing financial stress when monetary and fiscal policies acted together.

Countries’ ability to scale up fiscal support has varied, depending on their capacity to access low-cost borrowing. In the meantime, economic recoveries are diverging, with China and the United States pulling ahead while other countries lag behind or stagnate.

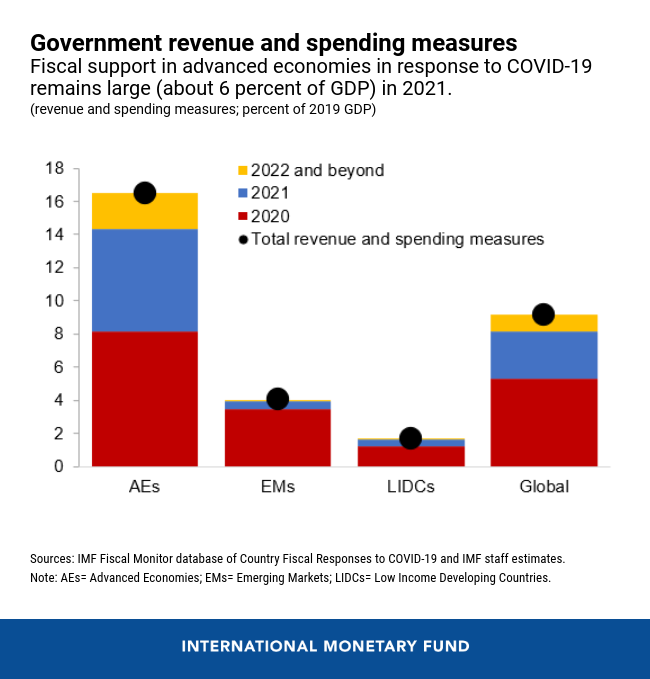

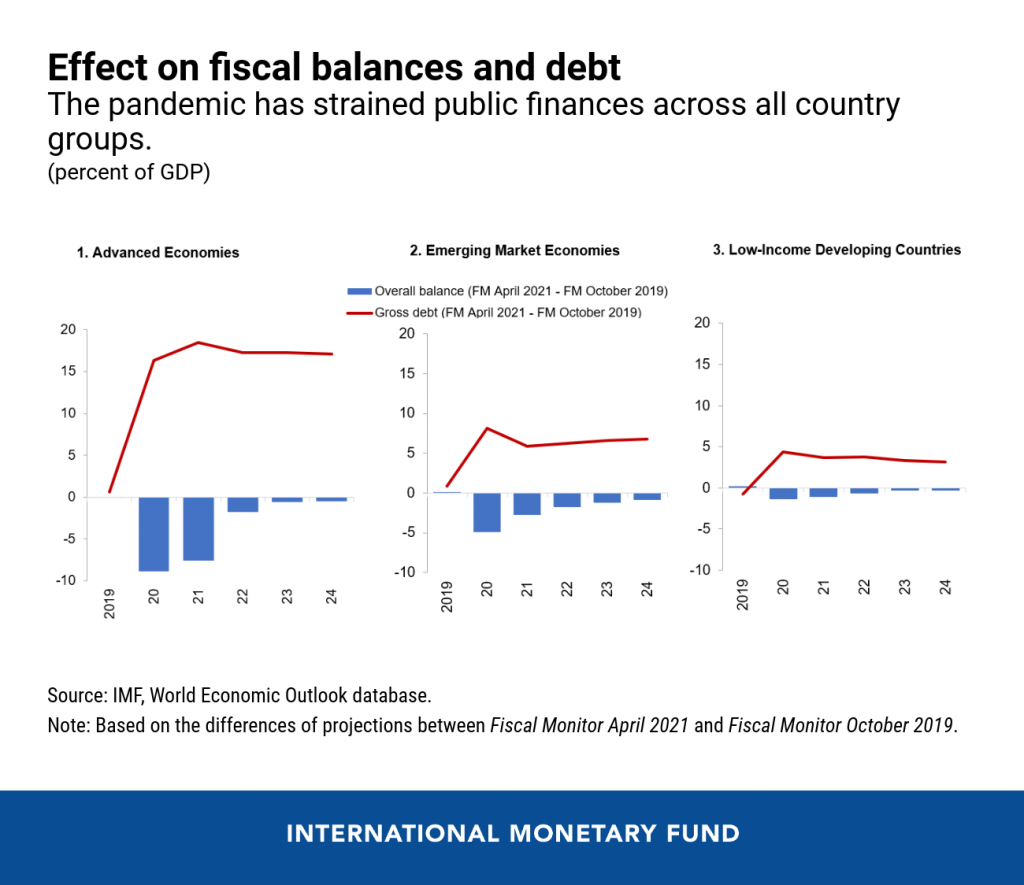

In advanced economies, fiscal actions have been sizable and cover several years (6 percent of GDP in 2021), such as those recently approved in the United States and featured in the 2021 budget of the United Kingdom. Among emerging markets and developing countries, fiscal support has been more limited owing to financing constraints, but the rise in deficits is still notable as tax receipts have fallen. Average overall fiscal deficits as a share of GDP in 2020 reached 11.7 percent for advanced economies, 9.8 percent for emerging market economies, and 5.5 percent for low-income developing countries.

As a result, average public debt worldwide approached 97 percent of GDP at the end of 2020 and is expected to stay just below 100 percent of GDP over the medium term. Unemployment and extreme poverty have also increased significantly. The pandemic thus risks leaving a deep scar.

Until the pandemic is brought under control, however, fiscal policy will have to remain flexible and supportive. The need and scope for such support varies across sectors and economies, with responses tailored to country circumstances. However, governments should prioritize the following:

- More targeted support to vulnerable households. The pandemic has had a disproportionately negative effect on poor people, youth, women, minorities, and workers in low-paying jobs and the informal sector. Policymakers should ensure that social protection is available and spending is sustainable over the duration of the crisis by expanding the coverage of social safety nets in a cost-effective way (for example, by limiting the leakage of benefits to unintended beneficiaries).

- More focused support to viable firms. If the pandemic persists, widespread corporate insolvencies could result, destroying millions of jobs, particularly in contact-intensive service sectors and small and medium enterprises. At the same time, governments would do well to prevent resource misallocations and limit the rise of nonviable firms. Governments could gradually roll back blanket loans and guarantees, and limit public support to circumstances in which there is a clear need for intervention. Partnering with the private sector to assess the viability of firms before providing support can improve targeting and reduce administrative costs.

Setting the stage for an economic transition

Policymakers will have to strike a balance between providing fiscal support now, on the one hand, and keeping debt at a manageable level on the other. Some countries may need to start rebuilding fiscal buffers to lessen the impact of future shocks. Developing credible multiyear frameworks for revenue and spending will therefore be vital, especially where debt is high and financing tight.

Many low-income countries, even after doing their part, face challenges in dealing with the pandemic in the near term and for development over time, as indicated in recent IMF research. They will need additional assistance, including through grants, concessional financing, the extension of the Debt Service Suspension Initiative, or, in some cases, debt treatment under the Common Framework.

Done properly, fiscal policy will enable a green, digital, and inclusive transformation of the post-pandemic economy. To make this a reality, governments should prioritize:

- Investing in health systems (including expanded vaccinations), education, and infrastructure. A coordinated green public investment push by economies that can afford it can foster global growth. Projects—ideally with the participation of the private sector—would aim at mitigating the effects of climate change and facilitating digitalization.

- Helping people get back to work and change jobs, if needed, through hiring subsidies, enhanced training, and job search programs.

- Strengthening social protection systems to help counter inequality and poverty, and reinvigorating efforts to achieve the Sustainable Development Goals.

- Reforming domestic and international tax systems to promote greater fairness and protect the environment. To help meet pandemic-related needs, a temporary COVID-19 recovery contribution levied on high incomes is an option. Over the medium term, revenue collection should be bolstered, especially in in low-income developing countries, which could help finance development needs.

- Cutting wasteful spending, strengthening the transparency of spending initiatives, and improving governance practices to reap the full benefits of fiscal support.

In sum, governments have gone to exceptional lengths to shore up their economies, but further work is needed to get ahead of the COVID-19 pandemic, provide flexible yet targeted support now, adjust when a recovery is firmly in place, and set the stage for a greener, fairer, and more durable recovery.

*About the authors:

- Vitor Gaspar, a Portuguese national, is Director of the IMF’s Fiscal Affairs Department.

- W. Raphael Lam is a Senior Economist in the Fiscal Affairs Department. His research currently focuses on fiscal issues related to inequality, intergovernmental relations, and fiscal rules.

- Paolo Mauro is Deputy Director in the IMF’s Fiscal Affairs Department. Previously, he held various managerial positions in the IMF’s African, Fiscal Affairs, and Research departments.

- Mehdi Raissi is a senior economist in the Fiscal Affairs Department of the IMF. He joined the Fund in 2010 and worked on several multilateral surveillance issues and a range of countries, including Italy, India, and Mexico.

Source: This article was published by IMF Blog