Changing Tides: The Imminent Shift Of Japan’s Monetary Policy – Analysis

By Anbound

By Wei Hongxu

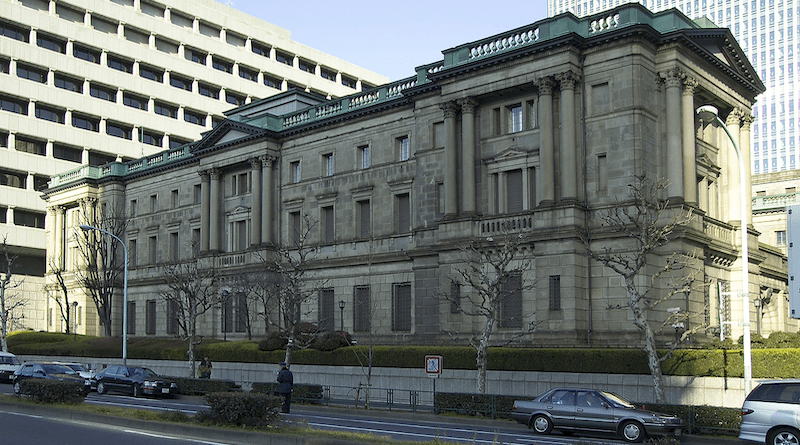

On April 9, Haruhiko Kuroda stepped down as the Bank of Japan (BOJ) governor after serving for a decade, and the newly appointed governor Kazuo Ueda officially took office. While both have emphasized the stability of BOJ’s monetary policy, there is a growing concern regarding a potential change in the direction of Japanese monetary policy.

Market investors widely acknowledge that the era of quantitative easing policy initiated during Shinzo Abe’s time is becoming unsustainable. As a result, there is an expectation among market institutions that Japan will undergo a shift in its monetary policy after the new governor takes office. ANBOUND researchers have previously highlighted the prevailing trend of Japan ending quantitative easing policy and aligning with the tightening policy direction of major central banks in Europe and the United States to promote monetary policy normalization.

Kuroda acknowledged the positive impact of large-scale quantitative easing policies on Japan’s economy and prices, with no sustained price declines and the possibility of wage increases. However, he expressed regrets for not being able to stabilize the inflation rate at the target of 2% and achieve matching wage growth before leaving office. Despite reaching an inflation level of 2.3% in 2022, surpassing the policy target, Japan’s economic growth remained sluggish at only 1% in the same year, raising questions about the effectiveness of the policy. Furthermore, the BOJ is facing increasing external pressure to push for further depreciation of the yen due to the accelerated tightening policies of central banks in Europe and the United States, potentially leading to increased imported inflation and posing additional challenges for Japan’s economy. Adding to the concerns, the country has experienced 19 consecutive months of trade deficits as of February this year, indicating that the prolonged monetary easing has weakened its effectiveness on the economy. These challenges highlight the need for a reassessment of the sustainability and effectiveness of the BOJ’s quantitative easing policy in the current economic environment.

On the flip side, the yield curve control (YCC) policy introduced by Kuroda in 2016 is facing an impending end due to widening policy gaps. Market investors are increasingly concerned about the sustainability of the YCC policy, prompting them to sell Japanese government bonds, which in turn is pressuring the BOJ to intervene. On April 7, the BOJ released data revealing that its holdings of Japanese government bonds reached a record high of JPY 582 trillion in March, marking a year-on-year increase of 10.6%. Not only has the scale of bond purchases escalated rapidly, but the proportion of government bonds held by the central bank has also reached a new pinnacle. According to the BOJ’s capital cycle statistics for the fourth quarter of last year, the government bonds held by the end of December accounted for 52.02% of the total issued balance based on market value, setting a new record. Although the long-term YCC policy has suppressed market interest rates, it has also distorted market prices over an extended period, making the Japanese central bank the dominant buyer in the market and resulting in decreased liquidity in the Japanese government bond market.

Given the circumstances, the Bank of Japan (BOJ) is compelled to make adjustments to its policy. The new governor, Ueda, has indirectly acknowledged the possibility of a shift in monetary policy. He has previously stated that the BOJ’s easing policy has helped create a non-deflationary price environment, but achieving the 2% inflation target will take time, and once it is close to being reached, the normalization of the ultra-loose monetary policy will be implemented gradually. In relation to the YCC policy, Ueda candidly acknowledged that the various side effects of the policy cannot be denied. However, he noted that the BOJ has taken measures to alleviate these side effects since December of the previous year, and he believes that it is now the stage to monitor the effects of these measures. With the price outlook gradually improving, he suggests that the BOJ can re-evaluate the YCC policy and consider the normalization of the yield curve policy. Therefore, while Ueda may not immediately implement policy adjustments, it is clear that policy changes are imminent.

However, the shift in Japan’s monetary policy is not simply a matter of timing. After over a decade of quantitative easing, there remains uncertainty as to whether Japanese banks and businesses can effectively adapt to higher interest rates if changes occur. The possibility of a banking crisis, similar to what Europe and the United States are currently facing, looms over Japan as well. Additionally, international investors who have traditionally seen Japan as a haven market may also adjust their strategies, potentially triggering panic and impacting financial stability. Last year, Japan’s attempt to raise the upper limit of the YCC policy resulted in significant market turbulence, placing the BOJ in a challenging situation as it seeks to change policy without causing shocks and policy risks. The market’s scrutiny and hedging make even minor actions by the Japanese central bank capable of triggering large-scale market adjustments. The bank is expected to make adjustments and shifts in three main directions, i.e., relaxing the upper limit of the YCC, reducing the scale of easing, and adjusting the negative interest rate policy. However, these adjustments cannot be achieved unilaterally, as any single change will impact other factors. Hence, the biggest challenge for Ueda and his team will be determining when and how to shift Japan’s monetary policy.

Final analysis conclusion:

After serving as the governor of the Bank of Japan for a decade, Haruhiko Kuroda recently stepped down, and his successor Kazuo Ueda has assumed office. This leadership change comes at a crucial time as Japan’s long-standing loose monetary policy requires adjustments in light of changing domestic and international circumstances. The new governor faces the formidable challenge of orchestrating a seamless transition that minimizes potential disruptions to the economy and safeguards financial stability.

Wei Hongxu is a researcher at ANBOUND