Philippines: Examining DFA’s Economic Security Strategy And Elusiveness Of Stable Job Creation – Analysis

By FSI

“While the country’s supply and quality of labor are not major issues, what is imperative is improving the investment climate. The government must streamline procedures and check regulatory measures for consistency to ensure ease of doing business. As for foreign aid, the DFA can mobilize technology transfer and technical assistance for priority areas. ODA-financed projects focused on human resource development, particularly in education and health, can reinforce productivity gains.”

By Rowell G. Casaclang*

A perennial policy challenge facing the Philippines is job generation. Despite the recent trend of economic expansion, the economy has fallen short of creating more and better jobs. For its part, the Department of Foreign Affairs (DFA) has crafted its strategic plans to include job generation in line with the economic security pillar.

Back in 2002, former Foreign Affairs Secretary Blas Ople had high hopes that the DFA will be an “effective instrument” to help reduce unemployment from 4 million to 1.5 million by 2013. However a decade later 2.8 million Filipinos remained unemployed. That “target” stays unreached by the end of 2016 as 2.4 million Filipinos are still jobless; thus begging the following questions: Why is stable job creation so difficult to achieve? Where does the DFA’s economic security strategy figure in the country’s development framework?

DFA’s economic security strategies went through many changes as the Department strove to produce favorable outcomes concerning job creation as well as poverty reduction.

In the DFA Strategic Plan 2003-2013, searching new markets for the country’s local goods and services and using official development assistance (ODA) were identified as key strategies. These strategies were part of DFA’s mandate as the main actor in promoting development diplomacy, which entails designing and harnessing foreign relations in the active pursuit of rapid and sustained long-term growth of the Philippine economy.

As in its precursor, the DFA Strategic Plan 2017-2022 also commits to assist the national government in attaining sustained growth and economic development.

However, creating more jobs are expected to come from improving Philippine participation in higher value global value chain, enhancing the country’s competitive edge in services, and promoting tourism and outbound investments. Notably, despite observed uptrends in recent years, ODA and foreign direct investment (FDI) were seemingly given less emphasis on the new plan.

The potentials and pitfalls of aid

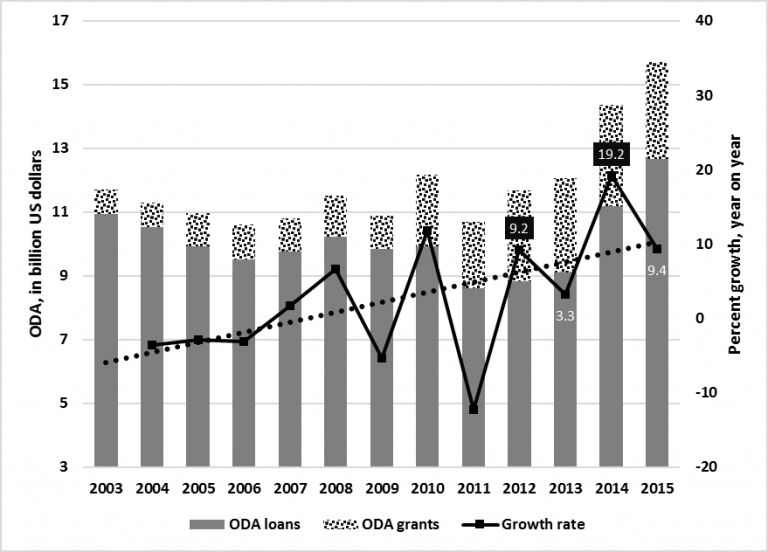

Why was ODA omitted in the latest strategic plan? Past experience indicates some explanation. Amid the increase in ODA pledges over the years, projects became rife with implementation issues, one of which is underutilization. From 2003 to 2015 (See Figure 1), the Philippines received ODA worth USD 154.5 billion, of which USD 131 billion are loans and USD 23.4 billion are grants.1

While total ODA grew steadily at an annual average rate of 2.8 percent between 2003 and 2015, absorptive capacity2 remains a challenge. Some ODA-funded projects have also been marred with issues of corruption, mismanagement, and overvaluation. In 2008, the Philippine Center for Investigative Journalism (PCIJ) reported that at least seven in 10 completed projects funded by the Philippines’ biggest lenders3 posted failed or lower actual returns versus estimated returns. These poorly implemented projects failed to generate expected revenues, which could ultimately lead the national government to pass the burden to taxpayers, especially since ODA loans comprise the largest portion of the country’s debt burden.

Just seven months into his term, President Duterte has obtained USD 33 billion (or PHP 1.69 trillion) in aid and investment pledges from China and Japan by January 2017.4 These pledges are primarily intended to fund projects to serve areas outside the Greater Manila Area as part of Duterte’s promise to create more jobs to uplift the living conditions of Filipinos. Chinese ODA in particular is eyed for the Agus River project and irrigation projects in the Autonomous Region of Muslim Mindanao (ARMM).

To improve the performance of agencies utilizing ODA, NEDA established an alert mechanism in December 2009 that identifies priority projects for monitoring and facilitation. The breakout of the NBN-ZTE scandal in 2007 led to the restoration and strict observance of the 15 percent economic internal rate of return requirement, which provides a measure of profitability for prospective investments. Moreover, the Commission on Audit (COA) in February 2017, acting on congressional orders, conducted a special review of at least 20 ODA-funded government projects over suspicions that these projects have yet to be executed or failed to meet project specifications.

Where to invest?

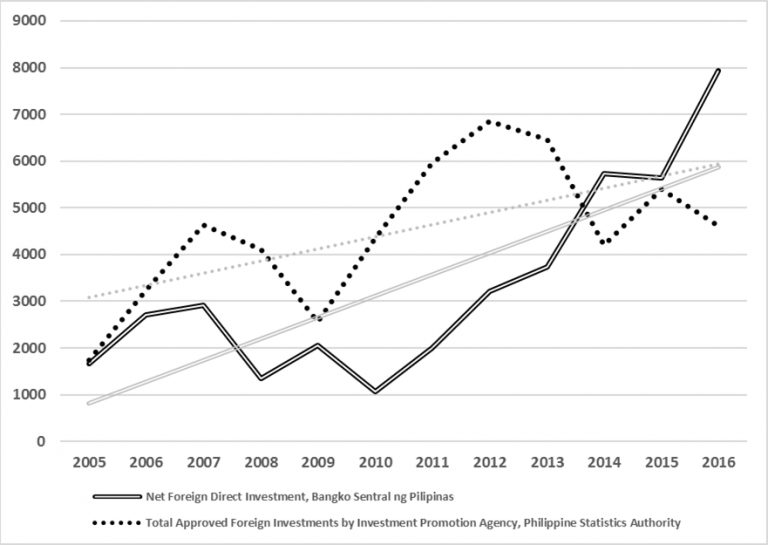

The United Nations Conference on Trade and Development (UNCTAD) noted that the latest revision of the foreign investment negative list in 2015 has improved the country’s investment climate. Last year, the Philippines received USD 7.9 billion in actual FDI and (albeit a comparatively smaller) USD 4.6 billion (PHP 219 billion) in foreign investment pledges. FDI inflows and pledges show no signs of slowing down (See Figure 2) and in step with the Duterte administration’s promise to make the country “a top FDI magnet” in Southeast Asia by 2022. The Philippines has also been identified as one of top prospective investment destinations of multinational enterprises.

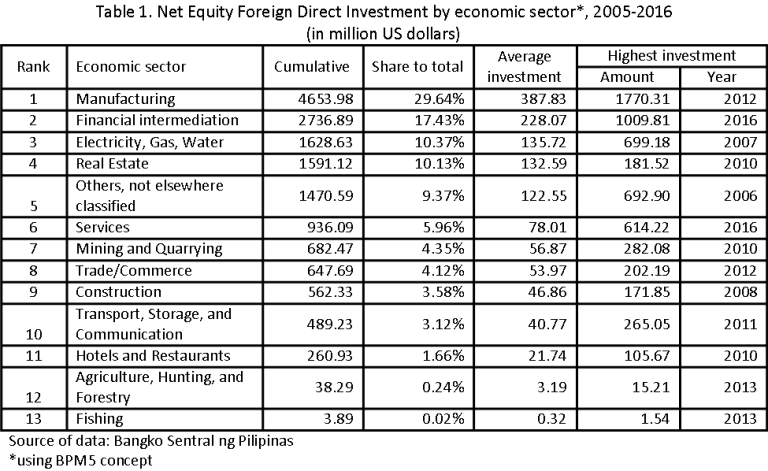

Sectors that take the biggest share of FDI every year are also worth examining. About two-thirds of equity FDI approved between 2005 and 2016 went to manufacturing, finance, utilities, and real estate (See Table 2). In February, President Duterte approved the 2017 Investment Priority Plan to incentivize investment activities in agriculture and other priority areas. Particularly, agriculture’s share was barely 0.25 percent, indicating that this sector has been neglected over the years. Agriculture still employs roughly 30 percent of the population in the past 12 years but suffer from low productivity levels; thus explaining its shrinking GDP contribution.

(in million US dollars)

Corrective measures

Capital is key in making the basic sectors of the economy more productive. The Philippines is still burdened with insufficient domestic capital, hence the Department of Budget and Management (DBM) deciding a debt-to-GDP uptick in the next five years. Arguably, the government appears to have sufficient funds to support its projects. As shown above, external sources such as ODA and FDI increased in recent years and inflows are likely to continue in the future. Implementation bottlenecks and other perennial challenges and corresponding remedies are already identified. Nevertheless, the question remains whether these projects can produce outcomes such as job generation.

Moving forward, the Philippine government should intensify its management and supervision of the use of ODA to improve disbursement rate–fluctuating in recent quarters–and absorptive capacity, as well as mitigate the effects of implementation bottlenecks. The DFA in particular should attract new investors in priority areas such as infrastructure, manufacturing, agriculture, fishery, and forestry, especially in underprivileged regions outside the nation’s capital. Investments in these areas will not only create new employment opportunities, but also improve efficiency in producing outputs. While the country’s supply and quality of labor are not major issues, what is imperative is improving the investment climate. The government must streamline procedures and check regulatory measures for consistency to ensure ease of doing business. As for foreign aid, the DFA can mobilize technology transfer and technical assistance for priority areas. ODA-financed projects focused on human resource development, particularly in education and health, can reinforce productivity gains. Additionally, the DFA can also support relevant agencies like NEDA in enabling speedier implementation and monitoring of ODA-implemented projects, such as assisting in the immediate resolution of issues concerning project scope and design with the development partners.

About the author:

*Rowell G. Casaclang is a Foreign Affairs Research Specialist with the Center for International Relations and Strategic Studies of the Foreign Service Institute. Mr. Casaclang can be reached at [email protected].

The views expressed in this publication are of the authors alone and do not reflect the official position of the Foreign Service Institute, the Department of Foreign Affairs and the Government of the Philippines.

Source:

This article was published by FSI. CIRSS Commentaries is a regular short publication of the Center for International Relations and Strategic Studies (CIRSS) of the Foreign Service Institute (FSI) focusing on the latest regional and global developments and issues.

Endnotes:

1 Loans are low-interest, long-term, and concessional funds offered to countries to fund their development projects, while grants are financial assistance with no obligation for repayment.

2 Absorptive capacity refers to recipient’s capacity to use aid for projects with acceptable returns. The Monitoring and Evaluation Staff of the National Economic and Development Authority (NEDA) identifies bidding failures, and delays in procurement and funding as key implementation issues.

3 These lenders were Japan International Cooperation Agency, World Bank, and Asian Development Bank.

4 Both Japan and China promised the Philippines USD 9 billion and USD 24 billion, respectively. Japan’s pledge will be spread over five years. Meanwhile, China’s pledge comprises USD 9 billion for about 40 proposed government-to-government projects and USD 15 billion for 27 proposed business-to-business or projects.