China: The Expanding Footprint Of The Digital Yuan – Analysis

By Observer Research Foundation

By Sauradeep Bag

The Shanghai Petroleum and Natural Gas Exchange (SHPGX) has announced utilising the digital yuan, China’s central bank digital currency (CBDC), e-CNY, for the first time to settle an oil transaction. On 19 October, PetroChina International purchased 1 million barrels of crude using the digital yuan. This transaction followed a directive from the Shanghai Municipal Party Committee and Municipal Government promotingthe use of e-CNY in international trade.

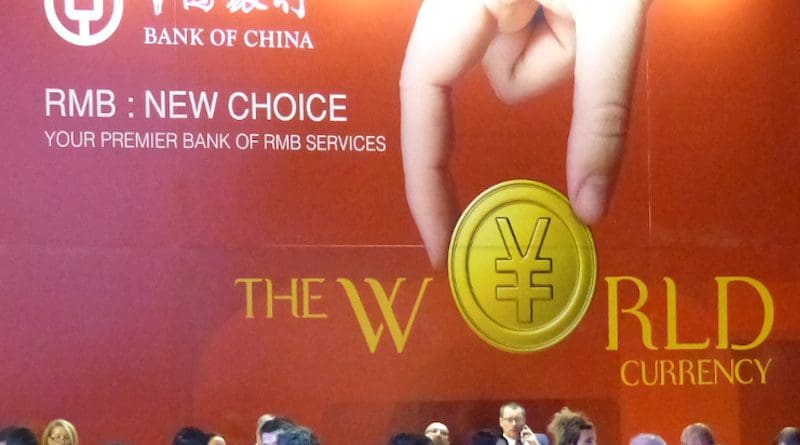

While the SHPGX did not disclose the details of the seller and the transaction price, this milestone marks a substantial step toward reducing dependency on the US dollar and increasing the global adoption of the yuan.

The move is a significant milestone in the digital yuan’s growth. China has been actively working on the development and adoption of its digital currency for several years, and this recent transaction reflects the ongoing progress of this initiative.

Digital Yuan on the rise

China has put forth the framework for its 14th Five-Year Plan for National Economic and Social Development. Within this blueprint, the nation has made a resolute commitment to construct a robust and contemporary financial system characterised by adaptability, fierce competitiveness, and universal applicability. A key cornerstone of this undertaking is the digital currency, poised to occupy a prominent role in this transformative endeavour.

The yuan made its debut in the liquefied natural gas (LNG) market in March when French energy company TotalEnergies agreed to sell LNG to the China National Offshore Oil Corporation (CNOOC). Another LNG deal in yuan took place last week, involving CNOOC and the French company Engie. It’s important to note that these transactions did not utilise the digital yuan.

Additionally, on 19 October, First Abu Dhabi Bank disclosed its digital currency agreement with the state-owned commercial bank, the Bank of China. This announcement came during the third Belt and Road Forum for International Cooperation. China and the United Arab Emirates are both actively involved in the mBridge platform aimed at facilitating cross-border transactions with CBDCs. MBridge has plans to launch as a minimum viable product in the coming year.

Accelerated Adoption

In January 2022, the People’s Bank of China reported that 261 million people had digital yuan wallets. However, this represents only a 28.89 percent uptake rate compared to the 903.6 million people using mobile payments in China. Additionally, merely having a wallet doesn’t guarantee active use. Many likely created digital yuan wallets with the hope of winning free cash. In 2022, pilot cities held digital yuan lotteries with a total prize pool of 340 million RMB.

To promote the use of the digital yuan, Chinese banks have begun actively integrating CBDCs for large commercial transactions. For instance, China Construction Bank embraced digital yuan for wealth management product purchases. Agricultural Commerce Bank marked a significant milestone by issuing the first digital yuan loan of 500,000 RMB. These banks possess the potential to influence millions of individuals and numerous domestic and international businesses, playing a pivotal role in advancing widespread digital yuan adoption.

Local governments across China are also increasingly incorporating the digital yuan into their public programmes. For instance, as of April 2022, residents in Zhejiang province utilised digital yuan for payments for taxes, stamps, and social security. The digital yuan found application as a payment method for public bus rides on ten routes in Guangzhou and for public subway rides at 125 stations in Ningbo. This strategy aligns with the aim of making the digital yuan China’s top payment method.

Chinese authorities are actively promoting the cross-border adoption of the e-CNY through multiple strategies. Chinese subsidiaries of international banks like DBS Bankand BNP Paribas are collaborating with the People’s Bank of China to facilitate their overseas clients in China to use the digital yuan. The People’s Bank of China (PBOC) is part of the aforementioned collaborative experiment named Project mBridge.This project aims to establish a cross-border infrastructure for efficient and real-time transaction settlement. In 2022, the project achieved success by conducting 164 transactions in partnership with 20 banks across four countries, resulting in a total settlement of US $22 million.

This innovative approach eliminates the reliance on correspondent banking networks, allowing banks to directly connect with their foreign counterparts for conducting various financial operations, including payments, foreign exchange settlements, redemptions, and issuance. Remarkably, nearly half of all these transactions involved e-CNY, totalling approximately US$1,705,453 in issuance, US$3,410,906 used in payments and foreign exchange settlements, and US$6,811,812 redeemed. The preference for e-CNY transactions can be attributed to the seamless integration of the retail e-CNY system and the significant role of the RMB in regional trade settlements.

Monitoring digital progress

In September 2022, Hong Kong joined the list of digital yuan pilot regions for cross-border payment experiments. This move is strategically significant as Hong Kong is China’s special administrative region under Beijing’s control. Success in this endeavour can further bolster the global prominence of the renminbi. Notably, by the end of 2022, the RMB had risen to become the world’s third-largest asset in official foreign exchange reserves.

The Belt and Road Initiative (BRI) offers a chance to boost the international use of the renminbi. China could require the use of the digital yuan in BRI projects, encouraging adoption for infrastructure development. This shift could benefit countries in the Global South with limited dollar-based transaction capabilities. While promoting the digital yuan under the BRI’s Digital Silk Road might reduce reliance on the dollar, the PBOC President stated in October 2021 that there are no current plans to promote the digital yuan for BRI projects.

The rise of China’s digital yuan through the introduction of CBDCs signifies a pivotal shift in the global financial landscape. With the dollar’s dominance being increasingly challenged by emerging powers like China, it becomes imperative to closely monitor the development of the digital yuan. China’s efforts to challenge the dollar’s hegemony and internationalise its currency require the creation of new payment infrastructure and incentives for other nations to adopt its digital currency. As China continues to bolster its influence on the world stage through foreign policy and technological advancements, the launch of the digital yuan becomes a crucial component in its journey. Keeping a vigilant eye on the evolution of the digital yuan is essential, as it may usher in a period of transformative change in the global financial system.

About the author: Sauradeep Bag is an Associate Fellow at Observer Research Foundation

Source: This article was published by Observer Research Foundation