EIA Short Term Energy Outlook: Lower Global Oil Production Forecast – Analysis

By EIA

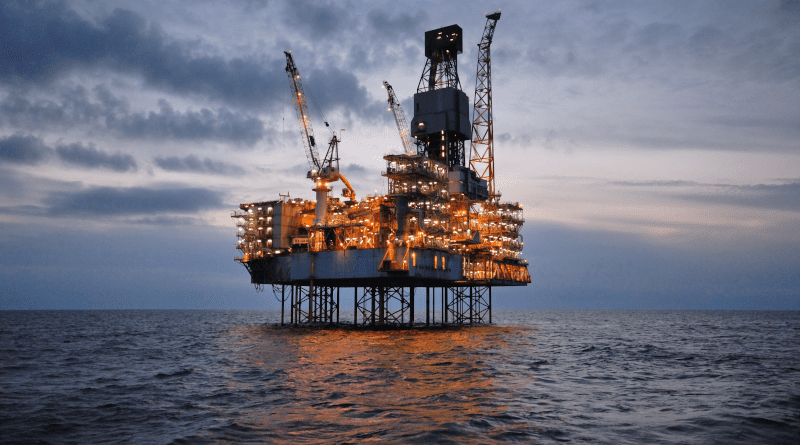

Global oil markets. As a result of OPEC+ extending crude oil production cuts, we have reduced our forecast for global oil production growth in 2024. The lower growth contributes to significant global oil inventory declines in our forecast for the second quarter of 2024 (2Q24). Because of falling inventories, we now expect the Brent crude oil spot price will average $88 per barrel (b) in 2Q24, up $4/b from our February STEO, and we expect the Brent price will average $87/b this year.

U.S. retail gasoline prices. We forecast the U.S. average retail gasoline price will average about $3.50 per gallon (gal) this year, almost 20 cents/gal higher on an annual average basis in 2024 compared with the February STEO, driven by higher crude oil prices. Although still lower than 2023 over the course of the year, we expect nominal gasoline prices from May through July will exceed prices for those same months in 2023.

Natural gas prices. We expect the Henry Hub spot price to remain below $2.00 per million British thermal units (MMBtu) in 2Q24 as the winter heating season ends with natural gas inventories 37% above the five-year average. The Henry Hub spot price averaged $1.72/MMBtu in February (30% lower than in our February STEO), a record low adjusted for inflation. Low prices were partially driven by reduced natural gas consumption in the residential and commercial sectors this winter (November—March).

Natural gas production. We forecast that U.S. dry natural gas production will remain unchanged in March from February at just under 104 billion cubic feet per day (Bcf/d). We expect lower natural gas prices to cause slight declines in natural gas production the remainder of the year, and we do not expect that natural gas production will return to its December 2023 record of 106 Bcf/d during the forecast period. Forecast U.S. dry natural gas production averages 103 Bcf/d in 2024, down slightly from 2023. Production increases to 104 Bcf/d in 2025, driven by expected growth in associated natural gas production in the Permian Basin and growth in LNG export demand.

Electricity generation. We expect utility-scale solar generation to provide 6% of U.S. electricity generation in 2024, up from 4% in 2023 and supported by a 36-gigawatt increase in solar generating capacity. By contrast, we expect coal to provide 15% of generation this year, down from 17% in 2023.

Macroeconomics. Following the release of the Bureau of Economic Analysis’s end-of-2023 advance estimate of GDP and based on updates to the S&P Global macroeconomic model, we have raised our forecast of U.S. GDP growth from our February STEO to 2.6% in 2024 and 1.7% in 2025.